Introduction

The SBI forex rate INR to AUD represents the value of the Indian Rupee (INR) relative to the Australian Dollar (AUD). This exchange rate is crucial for individuals and businesses involved in cross-border transactions between India and Australia. Understanding the dynamics and implications of this rate is essential for navigating the complexities of international finance. In this article, we will delve into the concepts, factors, and practical considerations surrounding the SBI forex rate INR to AUD, empowering you with the knowledge to make informed currency decisions.

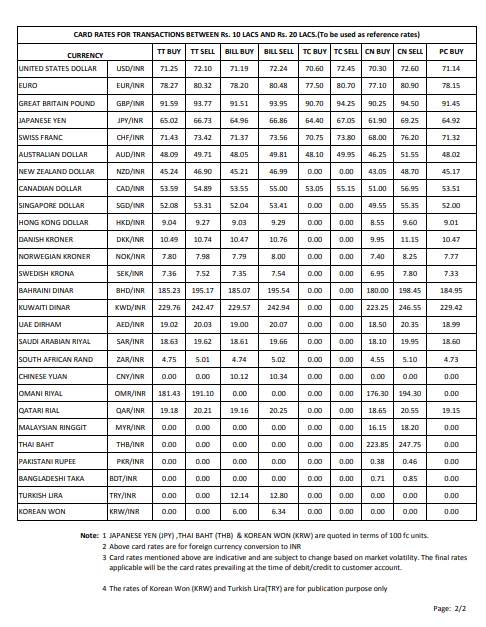

Image: management.ind.in

Understanding the SBI Forex Rate INR to AUD

A forex rate, also known as an exchange rate, signifies the value of one currency in relation to another. In the context of the SBI forex rate INR to AUD, it indicates how many Indian Rupees are required to purchase one Australian Dollar. For instance, if the SBI forex rate INR to AUD is 50, it means that one Australian Dollar can be purchased for 50 Indian Rupees. This rate is indicative of the market value of both currencies at a given point in time.

Factors Influencing the SBI Forex Rate INR to AUD

Numerous factors contribute to the fluctuations of the SBI forex rate INR to AUD. These include:

-

Economic Conditions:

The economic health of both India and Australia plays a significant role in determining the exchange rate. Strong economic growth, low inflation, and a stable financial system in India tend to strengthen the INR against the AUD. Conversely, economic challenges in Australia can weaken the AUD.

-

Image: forexsteroideafreedownload.blogspot.comInterest Rates:

Interest rates set by central banks in India (Reserve Bank of India) and Australia (Reserve Bank of Australia) can influence the forex rate. Higher interest rates in India make it more attractive for investors to hold INR, leading to a stronger INR against the AUD.

-

Political Events:

Political stability and economic policies implemented by the governments of India and Australia can impact investor confidence and, consequently, the forex rate. Significant political events or policy changes can trigger volatility in the currency markets.

-

Global Economic Conditions:

The global economy also exerts influence on the SBI forex rate INR to AUD. Economic growth, inflation, and currency movements in major economies worldwide can affect the demand for both the INR and the AUD.

-

Supply and Demand:

The supply and demand of INR and AUD in the foreign exchange market directly influence the exchange rate. Increased demand for AUD from Indian importers or decreased demand for INR from Australian exporters can result in a weaker INR against the AUD.

Impact of the SBI Forex Rate INR to AUD

The SBI forex rate INR to AUD has significant implications for individuals and businesses involved in cross-border transactions. It affects:

-

Trade:

The exchange rate influences the cost of goods and services traded between India and Australia. Importers and exporters need to consider exchange rate fluctuations to plan their purchases and sales effectively.

-

Investment:

Investors seeking to diversify their portfolios across international markets must take into account the forex rate when evaluating the value of investments denominated in farklı currencies.

-

Travel and Tourism:

Tourists traveling between India and Australia are impacted by the exchange rate, as it affects the purchasing power of their currency in the destination country.

-

Remittances:

Individuals sending or receiving remittances between India and Australia need to be aware of the prevailing exchange rate to optimize the value of their transactions.

Sbi Forex Rate Inr To Aud

Conclusion

The SBI forex rate INR to AUD is a crucial factor in international finance, impacting trade, investment, travel, and remittance activities. Understanding the dynamics of this exchange rate and the factors influencing it empowers individuals and businesses to make informed decisions in the global currency markets. By staying updated with the latest economic developments and market trends, you can navigate the complexities of currency exchange and optimize your financial outcomes.