In an era defined by globalized trade and interconnected financial markets, comprehending the adjustment of forex gain/loss in cash flow has become paramount. The complexities of currency exchange often result in fluctuations in the value of receivables and payables, presenting unique challenges in cash flow management. By unraveling this intricate subject, businesses can gain a competitive edge, optimize cash flow visibility, and make informed financial decisions.

Image: www.wallstreetprep.com

Defining Forex Gain/Loss Adjustment: The Interplay of Currency and Cash Flow

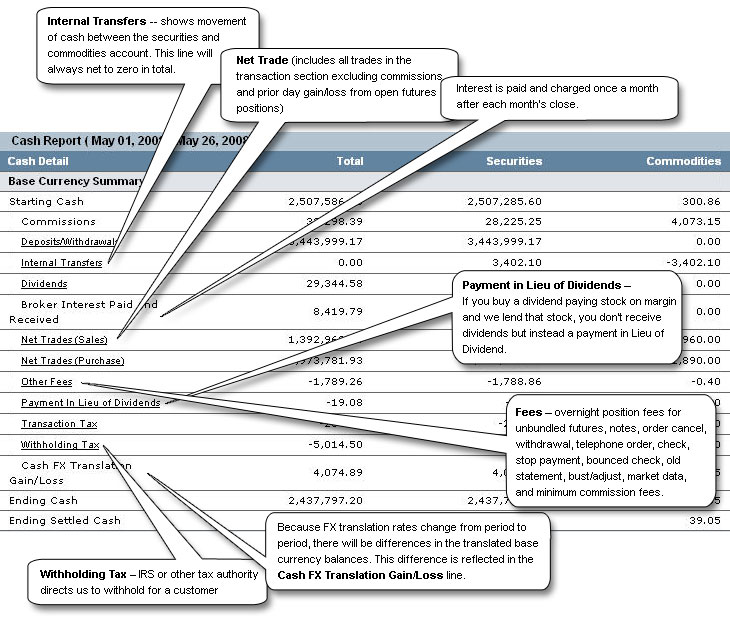

Simply put, forex gain/loss adjustment refers to the accounting entries made to reconcile differences arising from changes in currency exchange rates. When a company conducts transactions in foreign currencies, the value of these transactions in the home currency can fluctuate, resulting in either a gain or a loss. To accurately reflect these changes, the company must adjust its cash flow statement to account for the impact of forex fluctuations.

Navigating the Adjustment Process: Step-by-Step Guidance

Adjusting forex gain/loss in cash flow involves a meticulous process:

-

Identify Eligible Transactions: Determine all transactions denominated in foreign currencies that have not yet been settled.

-

Calculate Currency Exchange Adjustments: Determine the difference between the original transaction exchange rate and the current rate. Multiply this difference by the outstanding amount in foreign currency to calculate the gain or loss.

-

Record Accounting Entries: Record the gain/loss on the income statement and adjust the related asset or liability accounts on the balance sheet.

-

Reflect in Cash Flow Statement: Adjust the cash flow statement to include the net impact of forex gain/loss.

Real-World Applications: Unlocking Financial Clarity

The adjustment of forex gain/loss plays a critical role in various scenarios:

Image: forexbiblesystemv3.blogspot.com

Cash Flow Forecasting: Enhanced Accuracy and Reliability

By incorporating forex fluctuations, businesses can improve the accuracy of their cash flow forecasts, reducing the likelihood of unexpected shortfalls or surpluses.

Optimized Cash Management: Informed Decision-Making

Understanding the impact of currency exchange rates allows businesses to optimize their cash management strategies, such as hedging against potential losses or capitalizing on favorable exchange rates.

Financial Risk Mitigation: Safeguarding Value

Adjusting forex gain/loss helps mitigate financial risks by ensuring that the carrying value of assets and liabilities accurately reflects their current market value.

Adjustment Of Forex Gain Loss In Cash Flow

Efficient Financial Reporting: Enhanced Transparency

Proper forex gain/loss adjustment ensures adherence to accounting standards, resulting in transparent and reliable financial reporting, vital for stakeholders’ trust and decision-making.

In conclusion, the adjustment of forex gain/loss in cash flow is an indispensable aspect of cash flow management in today’s dynamic global economy. By mastering this process, businesses gain a comprehensive view of their cash flows, enabling strategic financial decision-making, optimizing cash management, and ensuring accurate financial reporting. Embracing this understanding empowers organizations to navigate the complexities of currency exchange and achieve sustainable financial success.