Unlocking the Trading Potential with a Proven Strategy

Within the realm of forex trading, the allure of capturing consistent, high-yield returns has inspired countless traders to seek out the Holy Grail of strategies. Among these, the 50 Pips a Day Forex Strategy has gained prominence as a promising approach to generating substantial profits in the volatile world of currency trading. In this comprehensive review, we will delve into the intricacies of this strategy, its potential benefits, limitations, and key considerations for successful implementation. Whether you’re a seasoned trader or just starting your forex trading journey, this definitive guide will empower you with the knowledge to make informed decisions and navigate the 50 Pips a Day Forex Strategy effectively.

Image: darelocountry.weebly.com

Understanding the Strategy: A Blueprint for Success

At the heart of the 50 Pips a Day Forex Strategy lies a pragmatic trading approach that aims to capture consistent returns by harnessing short-term price movements in the forex market. The strategy revolves around identifying and exploiting short-term market inefficiencies, such as price reversals or trend breakouts. By focusing on capturing a modest number of pips per trade rather than large one-time windfalls, this strategy prioritizes steady accumulation over risky gambles.

Step-by-Step Framework for Execution

Embarking on the 50 Pips a Day Forex Strategy involves a systematic process that blends technical analysis, market observation, and disciplined trade execution. Here’s a breakdown of the key steps:

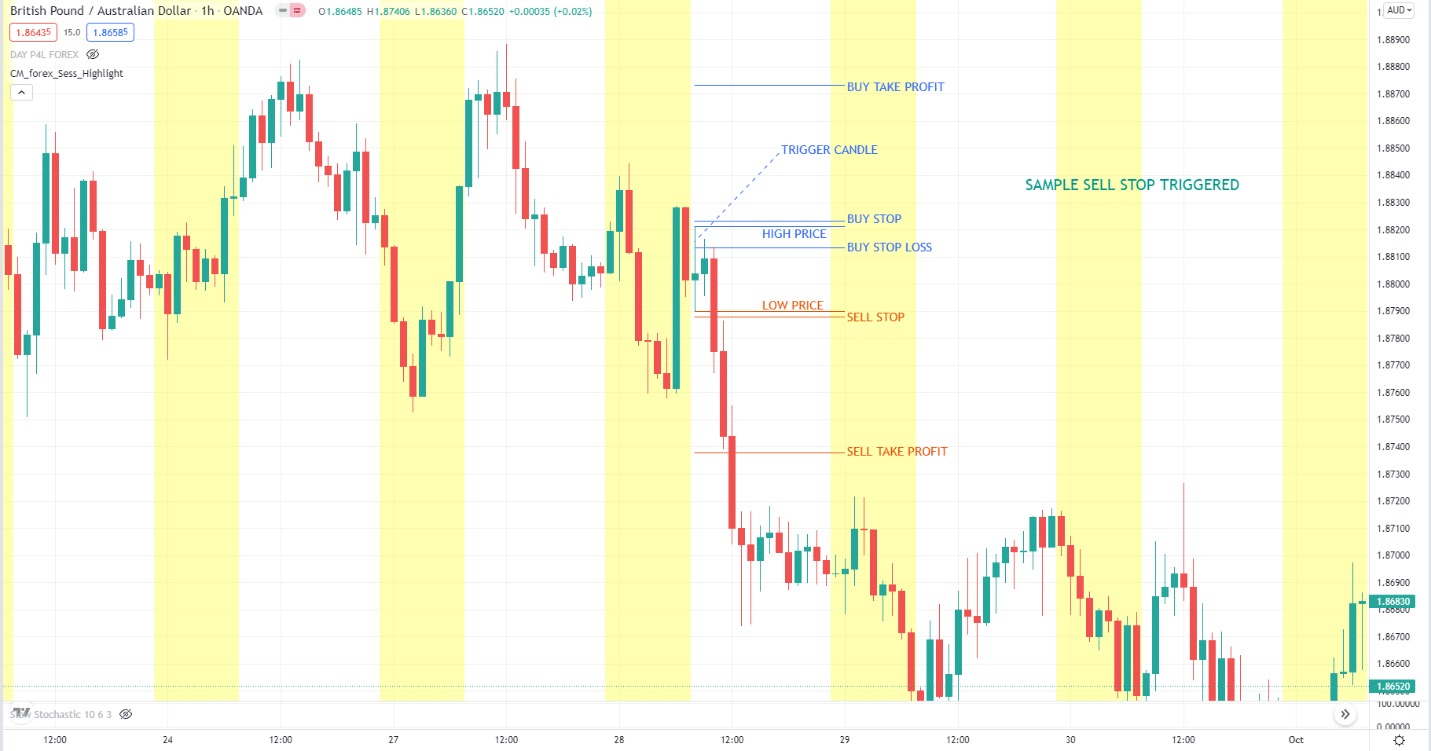

- Market Analysis:Begin by analyzing the currency pair you intend to trade. This involves identifying the overall trend, support and resistance levels, and potential reversal or breakout patterns. Tools like trend lines, moving averages, or candlestick patterns can aid in your analysis.

- Trade Identification:Once the market analysis is complete, you can start scouting for potential trades. Look for price action that aligns with your analysis, such as a bounce from a support level or a breakout from a resistance level. Confirm your trade idea with additional technical indicators or candlestick patterns for increased confidence.

- Position Sizing: Prudent position sizing is crucial for effective risk management. Calculate the appropriate trade size based on your account balance, risk tolerance, and the potential reward-to-risk ratio of the trade.

- Trade Execution: Enter the trade at the predetermined entry point and set a stop loss order below your entry point to limit potential losses. Determine a profit target of 50 pips and place a take profit order accordingly.

- Trade Management:Once the trade is executed, monitor its progress closely. Implement trailing stop orders to lock in profits as the market moves in your favor and protect against sudden reversals.

Advantages of the 50 Pips a Day Strategy: A Journey Towards Consistent Profits

The 50 Pips a Day Forex Strategy offers several advantages that contribute to its enduring popularity among forex traders:

- Realistic Profit Target:The strategy’s modest profit goal of 50 pips per trade encourages a disciplined approach, avoiding the pitfalls of excessive risk-taking or unrealistically high expectations.

- Reduced Drawdowns:By accumulating small, steady gains over time, the strategy can mitigate the impact of drawdowns, which are inevitable in forex trading.

- Scalability:The strategy is scalable, allowing traders to adjust the number of trades they place based on their risk tolerance and account size. This flexibility enables traders to customize the strategy to their individual trading preferences.

- Applicable to Multiple Currency Pairs:The strategy can be applied to various currency pairs, offering traders the opportunity to diversify their portfolio and reduce overall risk.

Image: investgrail.com

Cautions and Considerations: Navigating the Realities of Forex Trading

While the 50 Pips a Day Forex Strategy has its merits, it’s essential to approach it with realistic expectations and an understanding of its limitations:

- Not a Get-Rich-Quick Scheme:Forex trading, including the 50 Pips a Day Strategy, is not a quick or easy path to wealth. Consistent profitability requires patience, discipline, and sound risk management practices.

- Involves Risk:Forex trading carries inherent risks, and no strategy can guarantee success. It’s vital to understand the risks involved and never trade with more than you can afford to lose.

- Market Volatility:Forex markets are subject to periods of high volatility, which can make it challenging to consistently achieve the 50 pips target. Adaptability and a sound understanding of market dynamics are essential.

- Requires Discipline: The strategy’s success hinges on disciplined trade execution and adherence to risk management principles. Lack of discipline can lead to emotional trading decisions and erode potential profits.

50 Pips A Day Forex Strategy Review

Conclusion: Empowering Traders with a Proven Approach

The 50 Pips a Day Forex Strategy offers a pragmatic and potentially rewarding approach to forex trading. By embracing the strategy’s principles of consistent profit accumulation, realistic targets, and disciplined execution, traders can harness the power of short-term price movements to build a portfolio of steady gains. While not without its limitations, this strategy provides a valuable framework for traders seeking to establish a profitable presence in the ever-evolving world of forex trading.