Pip Pips, What Are They?

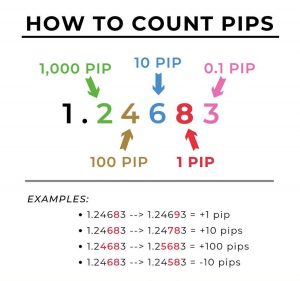

In the realm of foreign exchange (Forex) trading, pips play a pivotal role in gauging the market’s fluctuations. A pip, in its most basic form, represents the smallest increment of change in a currency pair’s exchange rate. Its significance lies in its ability to quantify the movement of currencies against each other, allowing traders to measure potential profits or losses.

Image: ofertalaboral.uct.cl

100 Margin: A Trader’s Leverage

The concept of 100 margin in Forex revolves around the idea of leverage, which is the utilization of borrowed capital to amplify the potential return on an investment. With 100 margin, a trader can control a position worth 100 times the amount of margin they deposit. For instance, with a $1,000 margin account, a trader can control a position worth $100,000.

How Margin Impacts Pip Values

The amount of margin used directly influences the value of a pip. With 100 margin, a one-pip movement in the exchange rate equates to a $10 gain or loss per standard lot (100,000 units of the base currency). This relationship emphasizes the substantial impact that leverage can have on potential profits, as well as the risks involved.

Understanding Pip Values

Calculating the pip value for different currency pairs is crucial for astute Forex trading. The formula is:

Pip Value = (1 / Current Exchange Rate) * Pip Conversion Factor

The Pip Conversion Factor varies depending on the currency pair. For currency pairs involving the U.S. dollar, it is typically 10,000.

Image: forexeastudio.blogspot.com

Leverage and Risk Management

Harnessing the power of 100 margin can significantly enhance profit potential. However, it is imperative to exercise caution, as the use of leverage magnifies both potential gains and losses. Prudent risk management strategies, such as stop-loss orders and appropriate position sizing, are essential to mitigating the risks associated with high leverage.

Expert Tips for Managing 100 Margin

- Start small: Begin with a modest margin amount to gain experience and confidence before venturing into larger positions.

- Set realistic targets: Avoid chasing unrealistic profits. Establish achievable goals based on your risk tolerance and market conditions.

- Monitor positions closely: Dedicate time to monitoring open positions regularly. Prompt adjustments can minimize losses or lock in profits.

- Use stop-loss orders: Implement stop-loss orders to limit potential losses by automatically closing positions at predetermined levels.

- Manage emotions: Stay disciplined and avoid making trades based on fear or greed.

Frequently Asked Questions (FAQs)

-

Q: What is the difference between points and pips?

- A: Points represent a larger unit of change in the exchange rate, typically 100 pips.

-

Q: How do I calculate the profit or loss from a trade?

- A: Multiply the pip value by the number of pips gained or lost.

-

Q: What is a standard lot in Forex?

- A: A standard lot represents 100,000 units of the base currency.

-

Q: Can I lose more than my initial margin?

- A: Yes, with leverage, losses can exceed the initial margin deposited.

100 Margin Means Forex Howmany Pip

https://youtube.com/watch?v=XbcCs4XnFpo

Conclusion

Embracing 100 margin in Forex trading opens up vast opportunities to enhance profit potential. Yet, it is imperative to approach it with a prudent mindset. By understanding pip values, managing leverage responsibly, and implementing sound trading strategies, traders can navigate the dynamics of the Forex market with greater confidence.

Are you eager to delve deeper into the fascinating world of Forex trading? Share your thoughts and inquiries, and let us embark on this journey of knowledge together!