As the sun casts its golden rays upon the globe, the financial world awakens with the rhythmic symphony of currency exchange. The foreign exchange (forex) market, an interconnected web of currencies, hums to the tune of trillions of dollars traded each day. But amidst this global stage, where does the curtain first rise on the trading day?

Image: phantomtradingfx.com

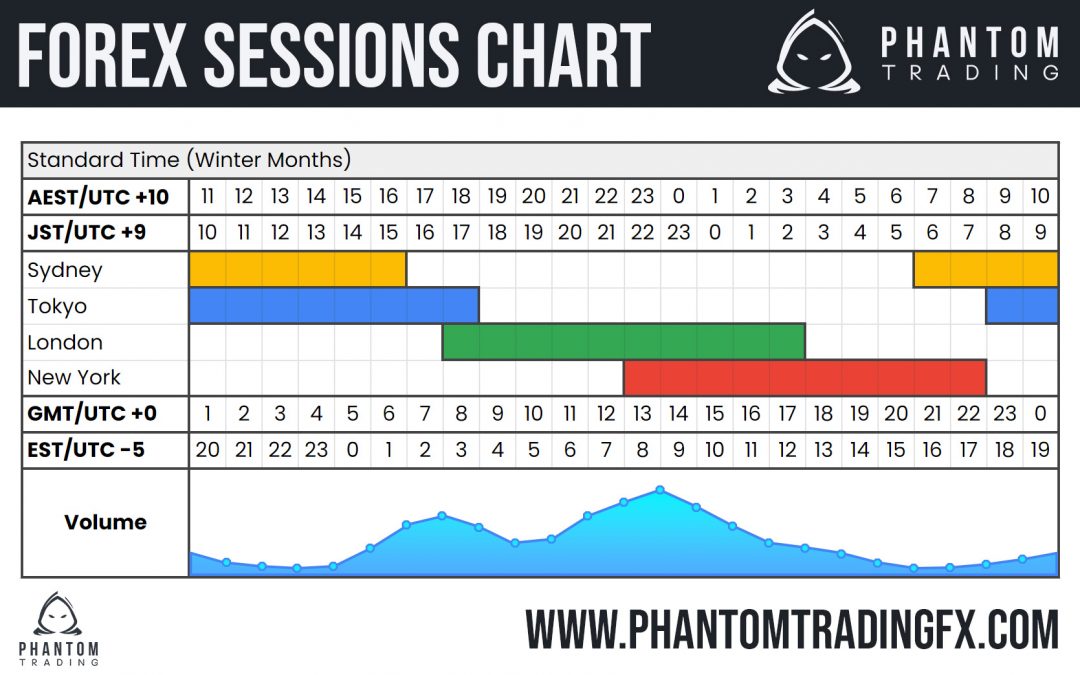

The answer lies in the geographical tapestry of the forex landscape, spanning time zones and continents. As each corner of the world stirs from slumber, different regions take the baton of forex activity. Let’s embark on a time-bending journey to uncover which market has the coveted honor of opening the global forex dance.

The Dawn of Forex: Wellington, New Zealand

As the celestial vault shimmers with the first whispers of dawn, the city of Wellington, nestled at the southwestern tip of New Zealand’s North Island, awakens. Its heartbeat synchronizes with the first trading session of the forex market, ushering in the dawn of a new financial day. Banks, brokerages, and financial institutions in Wellington and its neighboring regions kickstart the global currency exchange, laying the foundation for a day filled with economic ebb and flow.

Tokyo: The Asian Powerhouse

As the morning light washes over the metropolis of Tokyo, the halls of the Tokyo Financial Exchange come alive with the sounds of trading. Japan, the world’s third-largest economy, plays a pivotal role in the global forex market, injecting liquidity and setting the tone for Asia’s currency valuations. Tokyo’s financial institutions, with their vast experience and sophisticated trading strategies, influence currency pairs such as the USD/JPY and EUR/JPY, shaping the direction of forex trading in the Eastern hemisphere.

Hong Kong: The Gateway to China

The vibrant heartbeat of Hong Kong reverberates through the global forex market as its financial hub connects East and West. As the skyscrapers of this metropolitan marvel pierce the sky, traders in Hong Kong commence their day, facilitating currency exchanges involving the Chinese renminbi (RMB). Hong Kong’s unique proximity to mainland China grants it a strategic advantage in forex trading, bridging the gap between the world’s largest economy and the increasingly influential RMB.

Image: www.milesweb.in

London: The Epicenter of Global Trade

London, the financial capital of the United Kingdom, inherits the baton of forex trading as Europe awakens. Its trading floors, reminiscent of a symphony orchestra, hum with activity as traders navigate the bustling currency markets. London’s status as a global financial hub attracts forex traders from around the world, creating a diverse and competitive trading environment. The British pound (GBP) emerges as a major player, dictating currency valuations and influencing global economic trends.

New York: The Wall Street Giant

The stage shifts across the Atlantic Ocean to New York City, home to the iconic Wall Street. As the sun dips below the horizon, casting a golden hue over the city that never sleeps, forex trading reaches its peak in the heart of Manhattan. Traders in towering skyscrapers guide the market’s pulse, orchestrating currency exchanges involving the US dollar (USD), the world’s dominant reserve currency. New York’s financial prowess ensures its place as a pivotal hub in the global forex ecosystem.

Which Forex Market Opens First

Conclusion: A Symphony of Currency Exchange

The global forex market operates seamlessly, its symphony of currency exchange flowing from one financial center to another. Each market opens the day’s trading with its own unique strengths, contributing to the intricate tapestry of global finance. Wellington, Tokyo, Hong Kong, London, and New York, like the movements of a conductor’s baton, set the tempo and orchestrate the ebb and flow of the world’s currencies. As the sun completes its circuit around the globe, the forex market never truly sleeps, connecting diverse economies and empowering traders across every corner of the world.