Introduction

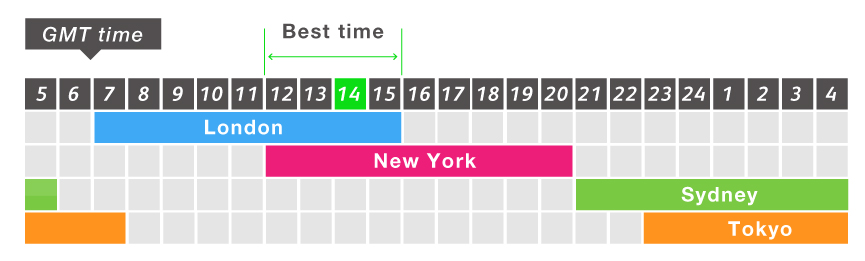

As the financial world awakens from its slumber, the forex market gears up for its daily symphony of currency dance. At the heart of this vibrant marketplace lies a pivotal moment – the London open. Mark your calendars, as 8:00 AM GMT marks the official commencement of the London trading session, signaling a surge of activity that sets the tone for the day’s trading.

The City of London, a global hub for finance and commerce, plays a pivotal role in shaping currency valuations. with major banks and financial institutions headquartered in the heart of the British capital, the London open serves as a melting pot where traders from around the world converge, setting the stage for dynamic price action.

Understanding the Dynamics of Forex Trading

Before delving into the intricacies of the London open, it’s essential to grasp the fundamental principles of forex trading. The term “forex” is a portmanteau of “foreign exchange” which encapsulates the buying and selling of currencies from different countries. These transactions are primarily driven by the ever-evolving global economic landscape, where geopolitical events, economic data releases, and central bank decisions all play a role in influencing currency valuations.

Image: forexillustrated.com

The Significance of the London Open

The London open stands as a pivotal point in the 24-hour forex market cycle, coinciding with the beginning of the European trading session. This convergence of market participants from London, Europe, and beyond creates a surge in trading volume and liquidity, leading to increased volatility and amplified price movements. The heightened activity provides traders with ample opportunities to capitalize on market fluctuations, making the London open a prime time for trading.

Moreover, the London open often sets the trajectory for the rest of the trading day. the initial price movements during this period can provide valuable insights into the market’s sentiment and overall direction, allowing traders to adjust their strategies accordingly.

Trading Strategies for the London Open

Harnessing the potential of the London open demands a well-planned and adaptive trading strategy. Here are some effective approaches to consider:

- News-Based Trading: Economic data releases, such as GDP figures, inflation reports, and central bank announcements, can significantly impact currency values. Staying abreast of upcoming news events and incorporating them into trading decisions can enhance trading outcomes.

- Trend Following: Identifying and aligning with established market trends can be a fruitful approach during the London open. Technical analysis tools such as moving averages, support and resistance levels, and trend indicators can help traders identify these trends and time their entries and exits accordingly.

- Volatility Trading: The London open is characterized by heightened volatility, creating opportunities for traders seeking to profit from rapid price fluctuations. Strategies like scalping, which involves taking small, frequent profits, can be particularly effective in this environment.

- Range Trading: As the London session progresses, currency pairs may settle into well-defined trading ranges. Identifying and trading within these ranges can offer consistent profits, especially for traders employing breakout or range-bound strategies.

Image: www.signalskyline.com

London Open Time Forex Gmt

Conclusion

The London open time, marked at 8:00 AM GMT, stands as a crucial juncture in the global forex market. this period of heightened activity and volatility presents traders with ample opportunities to profit from market movements. Understanding the dynamics of forex trading, implementing strategic trading plans, and capitalizing on the London open’s unique characteristics can empower traders to navigate the complexities of the currency markets successfully.