For those seeking to venture into the dynamic realm of trading, the choice between forex and stocks poses a pivotal decision that can shape the course of your financial journey. Both avenues offer distinct advantages and intricacies, and understanding their nuances is essential for making an informed choice.

Image: www.thesyedrahman.com

Forex: The Currency Conundrum

The foreign exchange market, commonly known as forex, presents a global marketplace where currencies from different nations are traded. It offers continuous trading around the clock, providing traders with ample opportunities to capitalize on currency fluctuations. However, forex trading carries inherent risks due to the high volatility and leverage involved.

The allure of forex lies in its vast liquidity, which enables traders to enter and exit positions swiftly with minimal slippage. Additionally, the absence of a centralized exchange means that traders can benefit from decentralized pricing, potentially leading to more favorable execution.

Stocks: A Share in the Pie

When it comes to stocks, traders acquire partial ownership in publicly traded companies. Unlike forex, stock markets have specific trading hours and are subject to various regulatory frameworks. While this can limit trading flexibility, it also provides a more stable environment compared to the fast-paced forex market.

Investing in stocks offers the potential for long-term capital gains as companies grow and their underlying value appreciates. Furthermore, shareholders may receive dividends, which provide a passive income stream. However, stock markets can be influenced by economic and political factors, leading to fluctuations in stock prices.

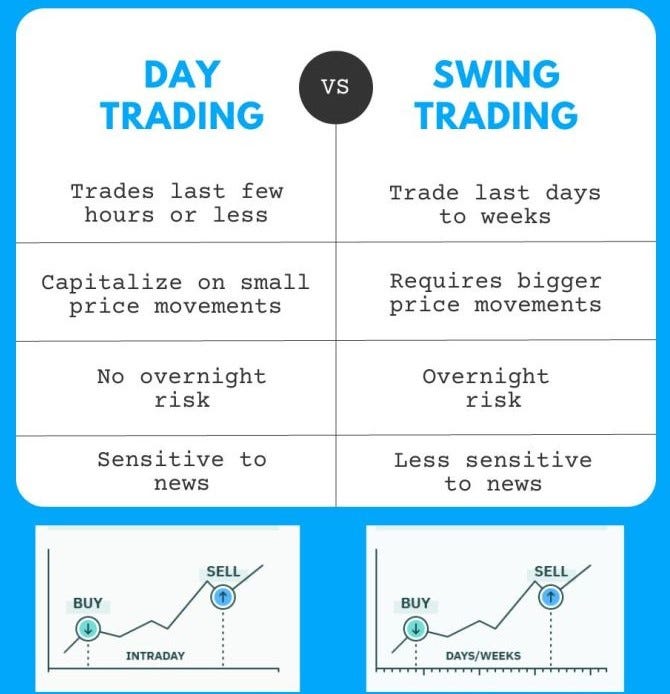

Swing Trading: Unlocking Profits in Short-Term Fluctuations

Swing trading, a technique employed in both forex and stock markets, seeks to capture profits from short-term price fluctuations. Swing traders typically hold positions for a few days or weeks, aiming to ride the wave of price movements while minimizing the impact of short-term noise.

Successful swing trading requires a keen understanding of technical analysis, the study of price charts to identify patterns and forecast potential price movements. Traders rely on indicators and chart patterns to predict future price trends and make informed trading decisions.

Image: medium.com

Comparing Forex vs. Stocks for Swing Trading

When choosing between forex and stocks for swing trading, consider the following factors:

- Volatility: Forex generally experiences higher volatility than stocks, offering greater potential rewards but also increased risks. Stocks, while less volatile, may provide more stable returns over the long term.

- Liquidity: Forex is the most liquid market in the world, while stock liquidity can vary across different companies and exchanges. High liquidity allows for easier entry and exit of positions.

* **Trading Fees:** Trading fees for forex are typically lower than those for stocks, but they can vary depending on the broker and the instruments traded.

- Leverage: Forex trading offers higher leverage than stock trading, allowing traders to control larger positions with smaller capital. However, leverage can amplify both profits and losses.

- Regulation: Forex is less regulated than stock markets, which can introduce additional risks for traders. Stocks are subject to rigorous regulations, providing investors with more protection.

The Emotional Rollercoaster of Swing Trading

Swing trading can be an emotionally charged endeavor. Traders often experience a rollercoaster of emotions as they navigate market fluctuations. Fear, greed, and euphoria can cloud judgment, leading to impulsive decisions.

To succeed in swing trading, it is crucial to maintain emotional discipline. Develop a trading plan and stick to it, avoiding the pitfalls of fear-based selling and greed-fueled overtrading. Remember, emotions are natural, but they should not dictate your trading strategy.

Swing Trading Forex Vs Stocks

https://youtube.com/watch?v=Saq1n_hSnIE