When venturing into the realm of swing trading in forex, selecting the most suitable currency pairs can significantly increase your chances of success. Swing trading involves holding onto positions for several days or even weeks, leveraging market volatility to capture substantial price movements. To maximize profits and minimize risks, identifying the most promising forex pairs is vital. In this comprehensive guide, we will delve into the key considerations and unveil the best forex pairs for swing trading, empowering you with the knowledge to make informed decisions and elevate your trading performance.

Image: topfxmanagers.com

Understanding Forex Pairs for Swing Trading

In the vast forex market, currency pairs represent the exchange rate between two currencies. Swing traders seek pairs exhibiting high liquidity, stable volatility, and predictable trends. Liquidity ensures ease of execution, while volatility provides potential for profit, and predictable trends increase the likelihood of successful trades. Identifying pairs that meet these criteria is crucial for swing trading profitability.

Indicators for Selecting Swing Trading Forex Pairs

Several indicators can assist in identifying the best forex pairs for swing trading. These indicators help traders gauge liquidity, volatility, and trend analysis, providing valuable insights into market behavior.

- Average Daily Range (ADR): ADR measures the average daily price movement of a currency pair, indicating its volatility. Higher ADR usually indicates more trading opportunities.

- Relative Strength Index (RSI): RSI measures overbought and oversold conditions in a currency pair, providing insights into potential trend reversals.

- Moving Averages: Moving averages smooth out price fluctuations, making it easier to spot trends. Traders can use different moving averages to confirm trends and identify potential trading setups.

- Technical Analysis: Technical analysis involves studying historical price data to identify patterns and trends, helping predict future price movements. Swing traders use technical analysis tools to increase their probability of success.

Top Forex Pairs for Swing Trading

Based on the indicators outlined above, the following forex pairs are widely regarded as the best for swing trading, offering a combination of high liquidity, stable volatility, and predictable trends:

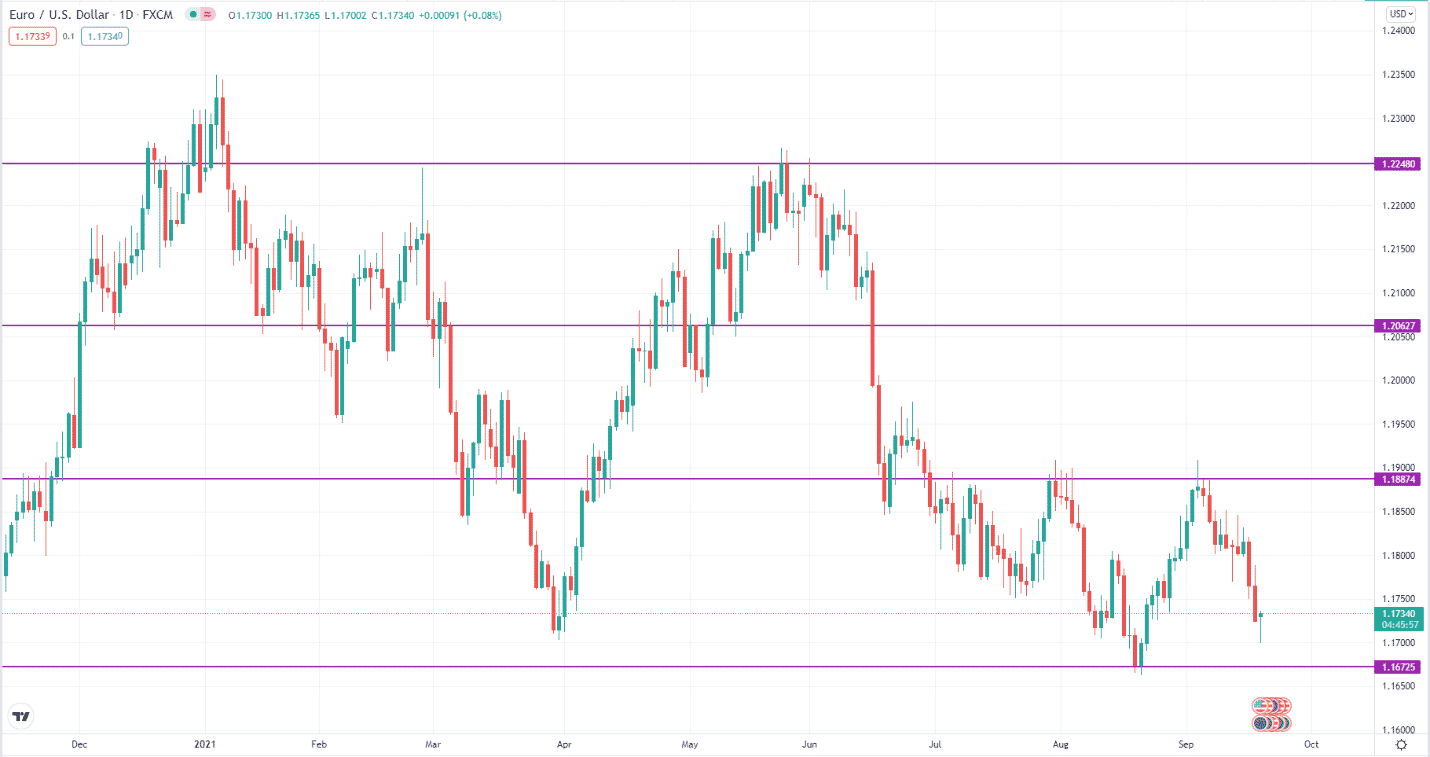

- EUR/USD: The Euro versus US Dollar pair is the most traded currency pair in the world, providing exceptional liquidity and stability. Its high liquidity ensures ease of execution, while its steady volatility offers ample trading opportunities.

- USD/JPY: The US Dollar versus Japanese Yen pair is another highly liquid and widely traded pair. The pair exhibits relatively low volatility compared to other major pairs, making it suitable for swing traders seeking smoother trends.

- GBP/USD: The British Pound versus US Dollar pair offers moderate liquidity and volatility, attracting both novice and experienced swing traders. Its responsiveness to economic and political events creates potential trading opportunities.

- AUD/USD: The Australian Dollar versus US Dollar pair has gained popularity among swing traders due to its stable volatility and high liquidity. Its correlation with the commodity markets provides additional trading opportunities.

- NZD/USD: The New Zealand Dollar versus US Dollar pair exhibits moderate liquidity and volatility, making it suitable for traders seeking a balance between risk and reward. The pair’s response to global dairy prices can provide trading insights.

Image: www.fondazionealdorossi.org

Matching Pairs to Trading Style

Selecting the best forex pairs for swing trading also involves matching them to your trading style. Consider your risk appetite, time horizon, and preferred trading strategies when making your choices.

- Aggressive Traders: Pairs with high liquidity and volatility, such as EUR/USD and GBP/USD, provide more trading opportunities and potential for higher profits, but also carry greater risks.

- Conservative Traders: Pairs with lower volatility, such as USD/JPY and AUD/USD, offer a more stable trading environment with fewer sharp price movements.

- Technical Analysts: Pairs that exhibit clear technical setups, such as GBP/USD and EUR/USD, are ideal for traders relying on technical analysis for trading decisions.

Best Forex Pairs To Swing Trade

Conclusion

Swing trading in forex requires a carefully considered approach, and selecting the best currency pairs is a crucial aspect. By understanding the indicators and considerations involved, you can identify the pairs that suit your trading style and maximize your profit potential. The pairs discussed in this guide, such as EUR/USD, USD/JPY, GBP/USD, AUD/USD, and NZD/USD, have proven to be reliable choices for swing traders, providing liquidity, stability, and ample trading opportunities. Remember, thorough research and ongoing market analysis are key to successful swing trading in forex.