The foreign exchange (forex) market, a vast and dynamic financial realm, operates under the watchful eyes of regulatory bodies across the globe. These entities play a crucial role in protecting traders, promoting market integrity, and upholding fair play within the industry. However, navigating the intricate regulatory landscape can be a daunting task, especially for novice forex traders. To assist you on this journey, we present an in-depth analysis of the top forex regulators, empowering you to make informed decisions and safeguard your financial interests.

Image: www.asiaforexmentor.com

Navigating the Maze of Forex Regulators

Before embarking on your forex trading endeavors, it is essential to understand the paramount importance of selecting a reputable and reliable regulator. Their oversight ensures that brokers adhere to strict ethical guidelines, maintain adequate financial reserves, and implement robust risk management strategies. By trading with a regulated broker, you gain invaluable peace of mind, knowing that your funds are protected and your transactions are conducted in a transparent and compliant manner.

Various countries boast well-established regulatory frameworks for the forex industry. Among the most prominent are the United Kingdom’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the United States’ Commodity Futures Trading Commission (CFTC). Each of these regulators operates under a unique set of laws and regulations, tailor-made to the specific characteristics of their respective markets. It is imperative to note that choosing the “best” regulator depends on your individual trading needs and preferences, as well as the jurisdiction in which you reside or intend to trade.

Pound for Pound: The FCA’s Unwavering Commitment

The FCA, the United Kingdom’s financial watchdog, has earned a stellar reputation for its robust regulatory regime. Brokers operating under the FCA’s watchful eye are required to meet stringent capital adequacy requirements, ensuring they have the financial wherewithal to honor their obligations to clients. Furthermore, the FCA’s rigorous supervision and enforcement actions have contributed to making the UK forex market one of the most trusted and transparent in the world.

Kangaroo-Tough: ASIC’s Uncompromising Approach

Across the vast Australian continent, ASIC stands as a formidable guardian of the forex industry. With its laser-like focus on consumer protection, ASIC has implemented a comprehensive set of regulations that govern the conduct of forex brokers within its jurisdiction. ASIC-regulated brokers must maintain adequate financial reserves, adhere to strict risk management protocols, and provide clear and concise disclosures to potential clients.

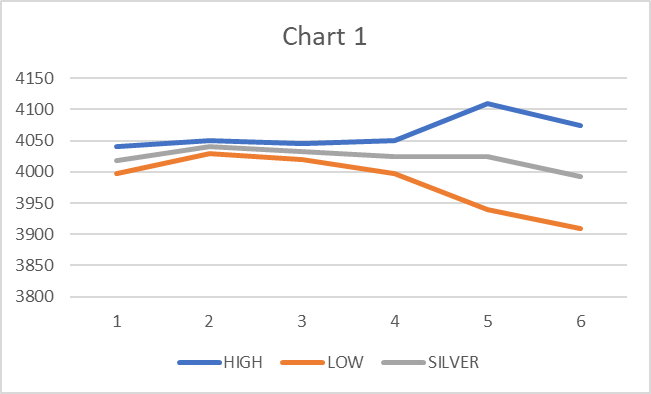

Image: www.mql5.com

CySEC’s Mediterranean Embrace: A Haven for Forex Traders

Nestled on the sun-drenched shores of Cyprus, CySEC has emerged as a leading regulatory hub for forex trading within the European Union. CySEC’s regulatory framework is designed to foster a fair and orderly market, ensuring that traders’ interests are prioritized. Brokers operating under CySEC’s supervision are subject to stringent capital requirements, regular audits, and unwavering oversight to guarantee the safety and security of client funds.

CFTC’s Transatlantic Authority: A Global Force in Forex

The CFTC, the United States’ premier regulator for futures and options markets, casts its wide net over the forex industry. Through its robust regulatory framework, the CFTC seeks to protect market participants, prevent fraudulent activities, and promote market transparency. Brokers operating under the CFTC’s jurisdiction must adhere to strict operational and financial standards, ensuring they conduct their business with the utmost integrity and professionalism.

Step-by-Step Guide to Choosing the Optimal Regulator

Selecting the most suitable regulator for your forex trading endeavors is a task that demands careful consideration. To guide you through this process, we present a step-by-step roadmap:

-

Assess Your Trading Needs: Begin by taking stock of your trading style, risk tolerance, and financial objectives. These factors will influence your choice of regulator, as each one emphasizes specific aspects of market oversight.

-

Research and Compare Regulators: Diligently investigate the regulatory frameworks of various jurisdictions, paying close attention to their capital requirements, risk management protocols, and enforcement track records. Assess which regulator best aligns with your trading needs and priorities.

-

Verify Broker Compliance: Once you have chosen a preferred regulator, ensure that the broker you intend to trade with is duly licensed and regulated by that authority. Check the broker’s website or contact their customer support team to confirm their compliance status.

-

Seek Professional Advice: If you encounter any difficulties during the selection process, do not hesitate to seek guidance from financial advisors or experienced forex traders who can provide valuable insights based on their firsthand experiences.

The Ultimate Yardstick: Ensuring Broker Compliance and Client Protection

Ultimately, the most effective forex regulator is one that ensures the compliance of its regulated brokers and places paramount importance on client protection. By choosing a broker that operates under the watchful eye of a reputable regulatory authority, you gain invaluable recourse in the event of any disputes or irregularities. Moreover, regulated brokers are often required to participate in compensation schemes or insurance programs, providing an additional layer of protection for their clients.

Which Regulator Is Best For Forex

https://youtube.com/watch?v=k3NXLeichEY

Embrace Informed Trading: The Key to Forex Success

In the dynamic and ever-evolving forex market, knowledge is your most potent weapon. Arming yourself with a thorough understanding of the regulatory landscape empowers you to make informed decisions, choose the right regulators and brokers, and protect your financial interests. Remember, investing in the forex market comes with inherent risks, but by wisely navigating the regulatory landscape, you can mitigate these risks and maximize your chances of trading success.