Navigating the ever-fluctuating forex market can be a thrilling yet daunting task. Seasoned traders know that deciphering market sentiment is key to making informed decisions that boost profitability. Enter sentiment analysis — an invaluable tool that empowers traders to gauge the collective mood of market participants and anticipate market movements.

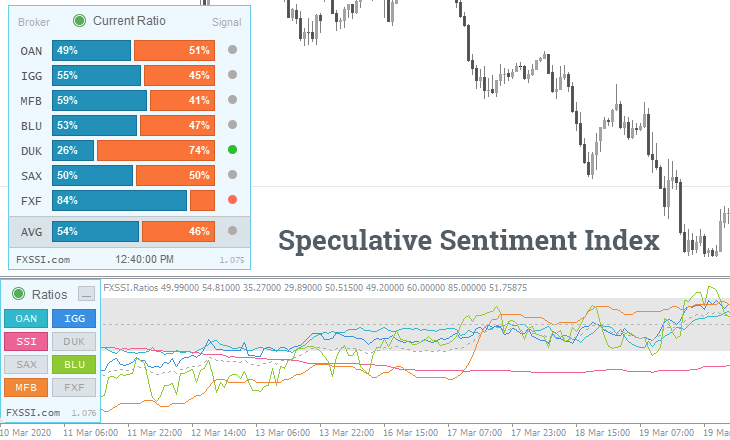

Image: fxssi.com

Understanding Sentiment Analysis

Sentiment analysis is the systematic process of extracting insights from vast volumes of market data, including news articles, social media feeds, and analyst reports. By analyzing the tone and polarity of such data, traders can decipher whether the market is exhibiting positive (bullish) or negative (bearish) sentiment.

Benefits of Sentiment Analysis in Forex Trading

- Predicting Market Trends: Gauge collective market sentiment to anticipate future price movements and identify potential trading opportunities.

- Validating Trading Decisions: Validate your existing trading strategies by confirming if market sentiment aligns with your predictions, reducing the risk of losses.

- Uncovering Market Inefficiencies: Detect discrepancies between market sentiment and actual price movements, uncovering hidden opportunities for profitable trades.

Tips and Expert Advice for Effective Sentiment Analysis

Harnessing sentiment analysis effectively requires a strategic approach. Consider these expert tips:

- Consider Multiple Data Sources: Draw insights from a wide range of market data, encompassing traditional news sources, social media platforms, and forums, to obtain a comprehensive view of market sentiment.

- Analyze Historical Data: Examine past market behavior and compare it to sentiment data to identify recurring patterns and refine your trading strategies over time.

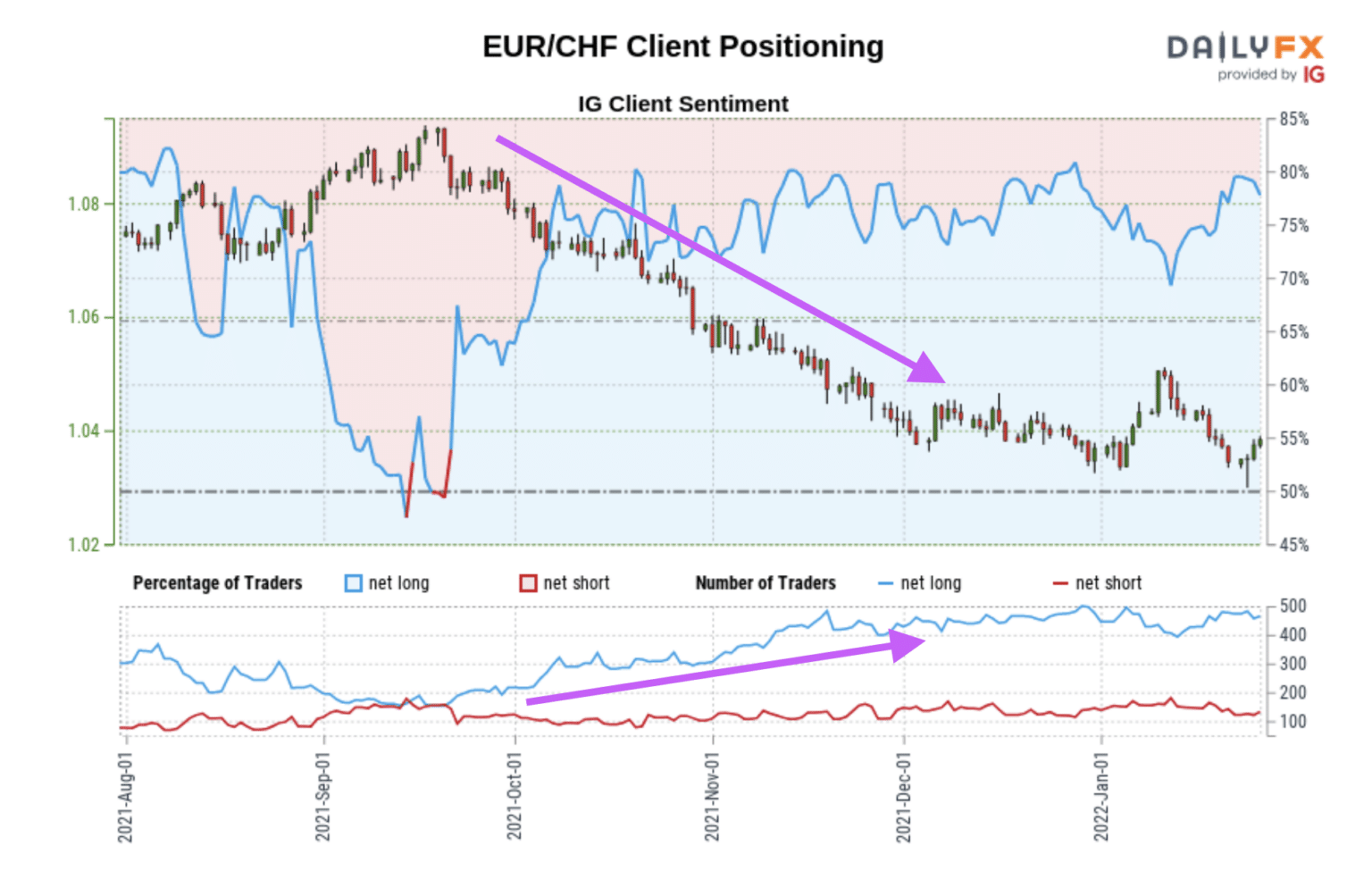

Image: forextraders.guide

FAQs on Sentiment Analysis in Forex Trading

- Q: Is sentiment analysis a foolproof trading method?

A: While sentiment analysis provides valuable insights, it should be used as a complementary tool alongside other technical and fundamental analysis methods. - Q: How do I measure market polarity?

A: Sentiment analysis tools employ algorithms to assign a sentiment score to market data, ranging from negative to positive or from -1 to +1. - Q: Can sentiment analysis be automated?

A: Yes, many platforms offer automated sentiment analysis tools that can streamline the process and enhance efficiency.

Sentiment Analysis In Forex Trading

Conclusion

Incorporating sentiment analysis into your forex trading strategy can significantly enhance your ability to make informed decisions and capitalize on market opportunities. By understanding market sentiment, validating your trading ideas, and uncovering market inefficiencies, you can gain a competitive edge and boost your trading profits.

Are you ready to unlock the power of sentiment analysis and elevate your forex trading game? Embrace this invaluable tool today and join the ranks of successful traders who leverage market sentiment to their advantage!