Understanding the ebb and flow of emotions in the financial markets can be a daunting task, but it holds immense value for savvy traders seeking an edge. Sentiment analysis, an integral aspect of market analysis, has emerged as a beacon of insight, enabling traders to gauge the prevailing mood and predict future price movements. In this comprehensive guide, we embark on a journey through the complexities of sentiment analysis in the forex market, exploring its applications and unlocking the secrets of harnessing market sentiment to enhance your trading strategies.

Image: metatrader4easyforex.blogspot.com

Navigating the Forex Market Landscape: The Power of Sentiment

The financial markets are a tumultuous sea, and the forex market, known for its high volatility and global reach, is no exception. Forex traders grapple with a constant barrage of information, trying to decipher market signals and make informed trading decisions amidst uncertainty. Enter sentiment analysis, a guiding light that sheds clarity on the otherwise opaque market landscape.

Sentiment analysis involves deciphering the collective emotions and attitudes of market participants, providing a valuable glimpse into the underlying forces driving price fluctuations. By studying market commentary, news headlines, social media buzz, and other sources, traders can gauge the prevailing mood, whether it’s optimism, pessimism, fear, or greed. This sentiment analysis empowers traders to align their strategies with the market’s direction, increasing their chances of success.

Harnessing Market Sentiment: A Three-Pronged Approach

Sentiment analysis in the forex market can be approached from three primary angles, each offering unique insights:

-

Fundamental Sentiment: Digging into economic data, political events, and market news reveals the underlying sentiments influencing market direction. Positive news boosts market confidence, while negative news tends to trigger a bearish outlook.

-

Technical Sentiment: Chart patterns, moving averages, and other technical indicators provide an alternative perspective on market sentiment. Overbought or oversold conditions often signal a shift in sentiment and potential trend reversals.

-

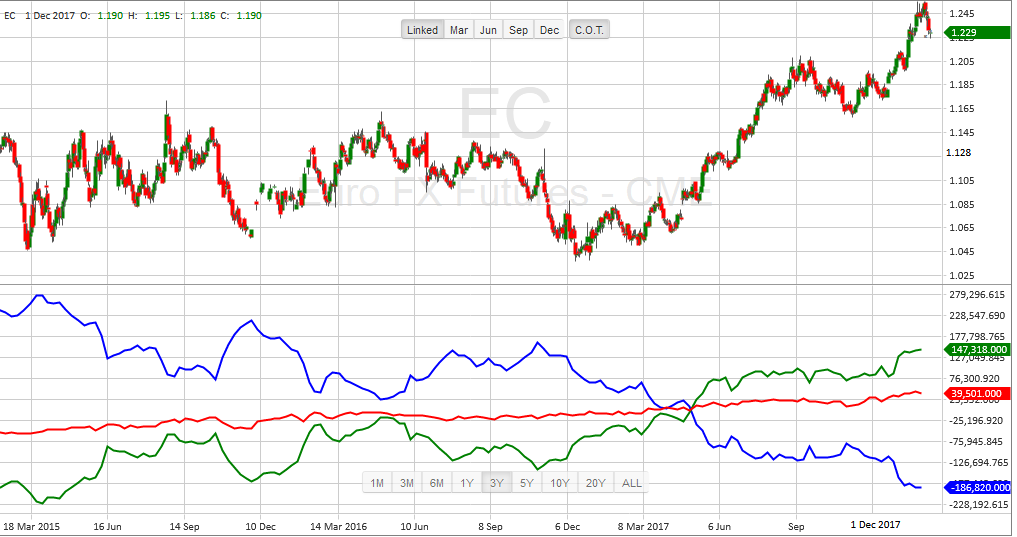

Trader Sentiment: Sentiment data gathered from surveys and proprietary indicators provides a glimpse into the emotional state of actual traders. When a majority of traders are optimistic or pessimistic, it often serves as a contrarian indicator, suggesting an upcoming market correction.

Case Study: Market Buzz Guides Profitable Trades

To illustrate the transformative power of sentiment analysis, consider the recent market frenzy surrounding the US Federal Reserve’s interest rate decision. News headlines hinted at a more aggressive tightening policy, fueling speculation among traders. By harnessing Twitter sentiment analysis, traders gauged the widespread fear and bearish sentiment in the market. Capitalizing on this insight, savvy traders positioned themselves for a potential selloff, anticipating a downturn in risk assets. As the Fed announced its decision, the market plunged, and those who had aligned their positions with the prevailing negative sentiment reaped substantial profits.

![[PoshTrader] Market Sentiment algorithms.types.indicator.name ...](https://poshtrader.com/wp-content/uploads/poshtrader/MarketSentiment_for_cTrader_Described-1000x640.jpg)

Image: ctrader.com

Trend Spotting and Predictive Power: The Holy Grail of Sentiment Analysis

The pinnacle of sentiment analysis lies in its ability to assist traders in identifying market trends and predicting future price movements. When market sentiment aligns with technical indicators, the probability of successful trading decisions increases exponentially. For instance, a confluence of positive fundamental sentiment, bullish chart patterns, and optimistic trader sentiment can serve as a strong signal for an upcoming uptrend. Conversely, a combination of negative sentiment across all three dimensions may foreshadow a market decline.

Sentiment In The Forex M

https://youtube.com/watch?v=6m0GCAt-jM4

Conclusion: Leveraging Sentiment Analysis for Trading Triumph

Mastering sentiment analysis in the forex market empowers traders with a profound understanding of market dynamics and empowers them to make informed trading decisions. By tapping into the collective emotions of market participants, traders can gauge the prevailing mood, anticipate trend reversals, and position themselves favorably for profitable trades. Whether you’re a seasoned veteran or an aspiring forex enthusiast, incorporating sentiment analysis into your trading toolkit can be the catalyst for unlocking your full potential in the ever-evolving forex market landscape.