Forex trading is a global financial market where currencies are traded against each other. Leverage is a powerful tool that allows forex traders to increase their potential profits by amplifying their trading positions. However, it’s essential to understand both the benefits and risks associated with using leverage.

Image: www.pdfprof.com

Let’s dive into the intriguing world of leverage in forex exchange and explore how it can impact your trading strategies.

Leverage: A Double-Edged Sword

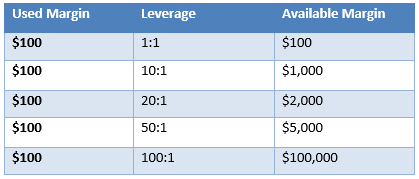

Leverage enables traders to control a larger position in the market with a smaller amount of their own capital. Essentially, it provides the trader with borrowed funds to magnify their trading returns. For instance, with a leverage of 1:100, traders can control a position worth $10,000 by investing only $100 of their own. This can lead to amplified profits, potentially increasing their earnings.

However, leverage acts like a double-edged sword. While it can magnify gains, it also amplifies losses. If the market moves against the trader, the leveraged position can result in significant losses, potentially exceeding the trader’s initial investment. This emphasizes the importance of understanding and managing risk in forex trading.

Types of Leverage in Forex

Forex brokers typically offer different leverage options to their clients. Common leverage ratios include 1:10, 1:50, 1:100, and even higher.

The choice of leverage depends on the trader’s risk tolerance, trading experience, and account size. Higher leverage is suitable for more experienced traders with a higher risk tolerance, while lower leverage is preferred by conservative traders or those with smaller accounts.

Understanding Risk Management

Leverage significantly magnifies both profits and losses in forex trading. Traders must exercise caution and implement robust risk management strategies when using leverage. Some key risk management practices include:

- Determining an appropriate leverage ratio based on individual risk tolerance and trading style

- Setting stop-loss orders to limit potential losses

- Utilizing limit orders to manage risk and maximize returns

- Maintaining a healthy risk-to-reward ratio to ensure that potential rewards outweigh potential losses

Image: samerahaydyn.blogspot.com

Expert Advice and Tips

Seasoned forex traders recommend adopting a cautious approach to leverage and adhering to sound risk management principles. Here are some invaluable tips:

- Start with a low leverage ratio and gradually increase it as you gain experience and confidence.

- Always consider the level of risk involved and never trade with more money than you can afford to lose.

- Use technical analysis and fundamental research to inform your trading decisions.

- Constantly monitor your positions and adjust your strategy as needed.

Frequently Asked Questions

Q: What is the best leverage for forex trading?

A: The optimal leverage ratio depends on individual risk tolerance, trading experience, and account size. A cautious approach is recommended, especially for beginners.

Q: Can I make a living from forex trading with leverage?

A: While leverage can magnify profits, it’s important to have realistic expectations. Consistent profitability in forex trading requires skill, discipline, and proper risk management.

Q: Is leverage dangerous in forex trading?

A: Yes, leverage can be dangerous if not used wisely. It’s vital to fully understand the risks involved and implement robust risk management strategies to mitigate potential losses.

What Is Leverage In Forex Exchange

Conclusion

Leverage is a powerful tool in forex trading that can amplify both profits and losses. While it provides the potential for increased returns, it’s essential to approach leverage with caution and adhere to sound risk management principles.

Remember, successful forex trading isn’t solely about using high leverage. It’s about blending knowledge, skill, and discipline with a well-thought-out trading plan. By embracing these principles, traders can harness the power of leverage to enhance their trading performance.

Are you ready to explore the exciting world of leverage in forex trading? Join the conversation and share your experiences or inquiries in the comments below!