In the ever-evolving world of finance, understanding currency exchange rates is crucial for informed decision-making. Reuters, a leading provider of financial information, plays a pivotal role in disseminating real-time currency prices and market data. This guide will delve into the intricacies of Reuters NY Forex closing prices, revealing their significance, factors that influence them, and how they impact global markets.

Image: www.forex.academy

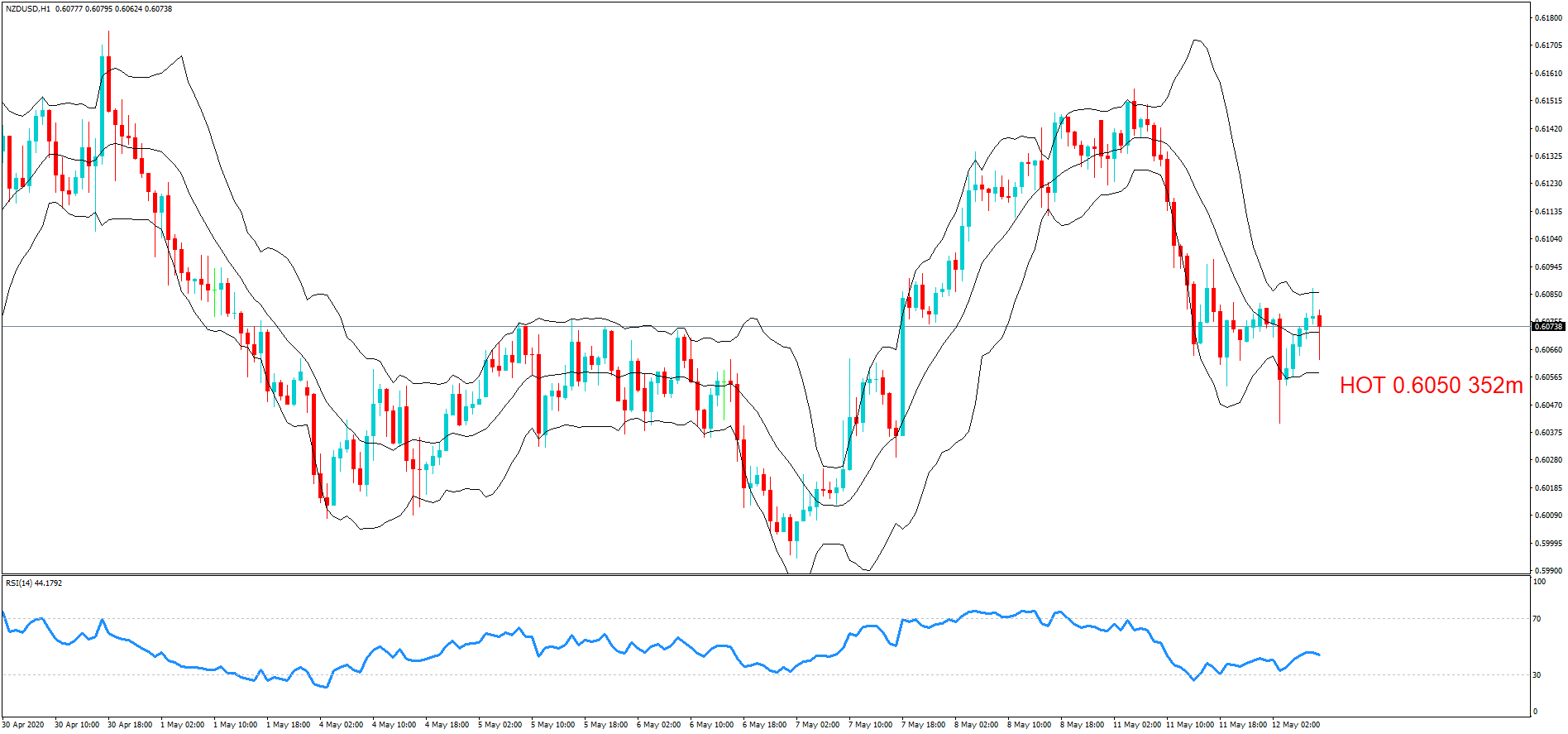

Understanding Reuters NY Forex Closing Prices

Reuters NY Forex closing prices are the exchange rates for major currency pairs as determined by the foreign exchange (forex) market in New York City at the end of a trading day. These prices serve as a benchmark for currency values worldwide and are widely used by traders, investors, and central banks to assess market dynamics and make informed decisions.

Factors Influencing Reuters NY Forex Closing Prices

A myriad of factors can influence Reuters NY Forex closing prices, including:

- Economic data: Economic indicators such as GDP growth, inflation, and unemployment rates provide insights into a country’s economic health and can significantly impact currency demand.

- Interest rate decisions: Changes in interest rates set by central banks can affect the relative attractiveness of different currencies, influencing exchange rates.

- Political events: Political instability, elections, and geopolitical tensions can generate market volatility and impact currency values.

- Supply and demand: The interplay between supply and demand for different currencies also influences their exchange rates.

- News and market sentiment: Breaking news and market sentiment can trigger sudden price movements and influence closing prices.

Significance of Reuters NY Forex Closing Prices

Reuters NY Forex closing prices hold immense significance for several reasons:

- Global benchmark: They are widely recognized as the global benchmark for currency exchange rates.

- Settlement of contracts: Many currency contracts, such as futures and options, are settled based on Reuters NY Forex closing prices.

- Market analysis: Traders and investors use closing prices to analyze market trends, identify trading opportunities, and make informed investment decisions.

- Economic policy: Central banks and governments often monitor closing prices as indicators of economic conditions.

Image: www.pinterest.com

Impact on Global Markets

Reuters NY Forex closing prices can have a profound impact on global markets:

- Trade and investment: Exchange rates influence the cost of imported and exported goods, affecting international trade and investment decisions.

- Tourism and travel: Fluctuating currency prices impact the purchasing power of travelers, affecting tourism industries.

- Economic growth: Stable exchange rates foster economic growth by facilitating international trade and investment.

Reuters N Y Forex Closing Prices

Conclusion

Understanding Reuters NY Forex closing prices is essential for navigating the complex world of currency exchange. They provide a critical benchmark for currency values, influence market analysis and decision-making, and have a significant impact on global trade and economic growth. By delving into the factors that influence these prices and their implications, investors and businesses can gain a competitive advantage in the ever-changing financial landscape.