The world of currency trading revolves around a select group of high-liquidity pairs, known as the major forex pairs. These pairs form the backbone of the foreign exchange market, facilitating trillions of dollars in daily transactions. Understanding these major pairs is essential for anyone keen on stepping into the world of forex trading.

Image: forexoctavesystemreview.blogspot.com

Major Forex Pairs: The Liquidity Powerhouses

Major forex pairs are currency pairs involving the world’s leading economies, such as the United States, Eurozone, Japan, and the United Kingdom. They stand out due to their unmatched liquidity, which ensures seamless execution of trades and keeps spreads (differences between buy and sell prices) razor-thin. Liquidity is the lifeblood of forex trading, and these major pairs provide the necessary liquidity to accommodate the high-volume transactions of institutional investors, hedge funds, and individual traders alike.

The depth and breadth of the market for major forex pairs also contribute to their resilience in the face of economic shocks and market volatility. Even during periods of heightened uncertainty, these pairs maintain their liquidity and stability, making them the cornerstone of the global forex trading ecosystem.

Anatomy of the Major Currency Pairs

Each major currency pair consists of a base currency and a quote currency. The base currency is always listed first, while the quote currency is listed second. For instance, in the EUR/USD pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency.

Other major forex pairs include the USD/JPY (US dollar/Japanese yen), GBP/USD (British pound/US dollar), AUD/USD (Australian dollar/US dollar), and USD/CHF (US dollar/Swiss franc). These pairs represent the world’s most traded currencies, reflecting the economic interconnectedness and trading relationships between different regions.

Importance of Major Forex Pairs

The significance of the major forex pairs extends beyond their market dominance. They offer several advantages for traders, including:

- Low spreads and high liquidity: Major pairs boast narrow spreads, minimizing trading costs and maximizing profit potential.

- Market stability: The high liquidity of these pairs reduces price volatility, providing a more stable trading environment.

- Wide availability: Major pairs are readily available for trading on all major forex platforms and brokers, ensuring accessibility for all.

Understanding the major forex pairs lays the foundation for successful currency trading. Traders can take advantage of the numerous resources available online, such as economic calendars, market news, and technical analysis tools, to make informed trading decisions.

Image: www.cmcmarkets.com

Expert Tips for Trading Major Forex Pairs

Seasoned traders have accumulated valuable knowledge over time. Here are a few expert tips for navigating the major forex pairs:

- Stay informed: Keep abreast of economic news and political events that can impact currency values.

- Use technical analysis: Employ technical analysis techniques to identify trends and trading opportunities.

- Manage risk: Implement appropriate risk management strategies, such as setting stop-loss orders and limiting leverage.

- Practice patience: Avoid impulsivity and let trades play out. Remember, currency fluctuations can take time.

Frequently Asked Questions (FAQs)

- What is the most traded forex pair?

- The EUR/USD pair is considered the most traded forex pair globally, accounting for a significant share of daily trading volume.

- How do I access the major forex pairs?

- Major forex pairs are available through all reputable online forex brokers and platforms.

- Is forex trading profitable?

- Forex trading can be profitable, but it requires extensive knowledge, risk management, and a sound trading strategy.

- How can I learn more about forex trading?

- Numerous online resources, courses, and educational platforms provide comprehensive guidance on forex trading.

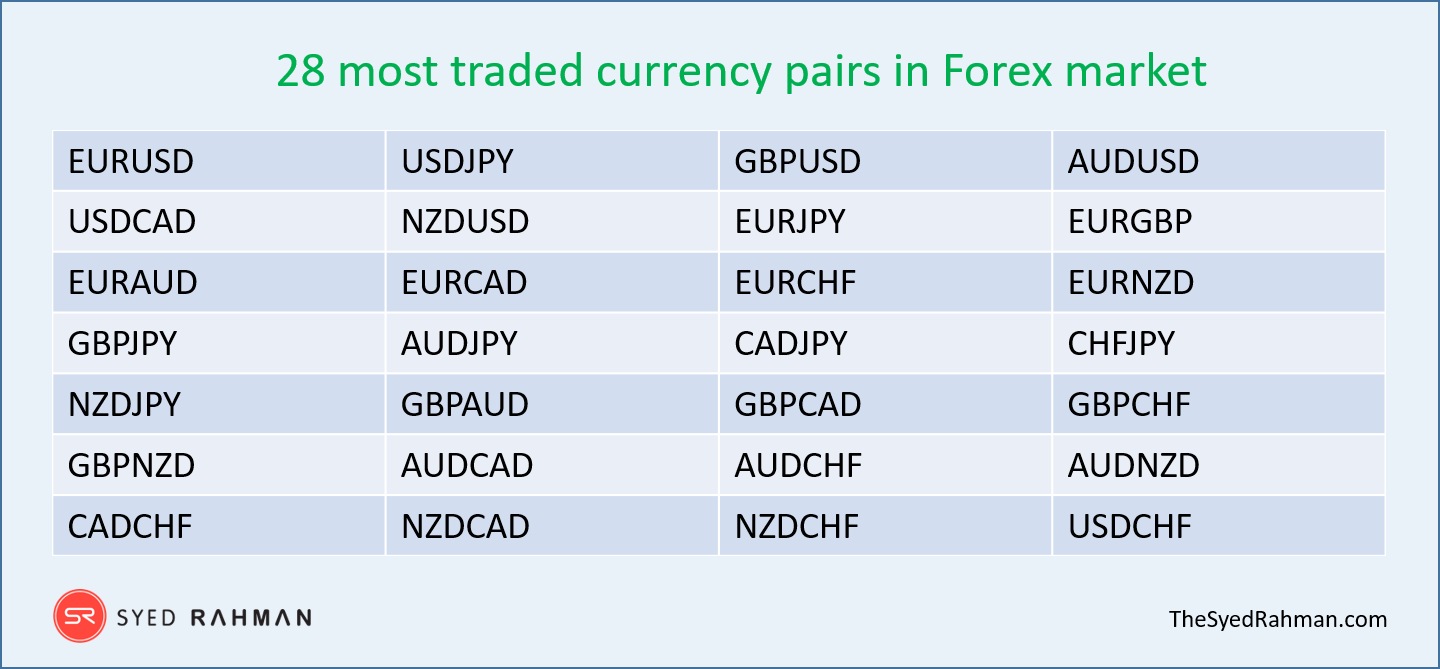

List Of Major Forex Pairs

Conclusion

The major forex pairs represent the cornerstone of global currency trading. Their high liquidity, stability, and accessibility make them the preferred choice for traders of all levels. By understanding the major pairs, traders gain a foundation for informed decision-making and successful navigation of the ever-evolving forex market. If you’re ready to dive into the world of currency trading, start by exploring the major forex pairs and embrace the opportunities they offer.

Are you intrigued by the world of major forex pairs? Connect with experienced traders and delve deeper into the nuances of currency trading to enhance your knowledge and unlock the potential for financial success.