Unleashing the World of Currency Trading

In the fast-paced world of finance, forex trading has emerged as a compelling opportunity for investors seeking to capitalize on currency fluctuations. For Indian citizens eager to venture into this dynamic arena, opening a forex account is a crucial first step. This comprehensive guide will meticulously guide you through every aspect of this process, empowering you to navigate the intricacies of forex trading with confidence.

Image: motivation.africa

Defining Forex Trading

Forex, an abbreviation of foreign exchange, refers to the global marketplace where currencies are traded. Unlike stock or bond markets, forex operates 24 hours a day, 5 days a week, offering ample trading opportunities. As a currency trader, you speculate on price movements between currency pairs, aiming to profit from exchange rate fluctuations.

Opening a Forex Account in India: A Step-by-Step Guide

-

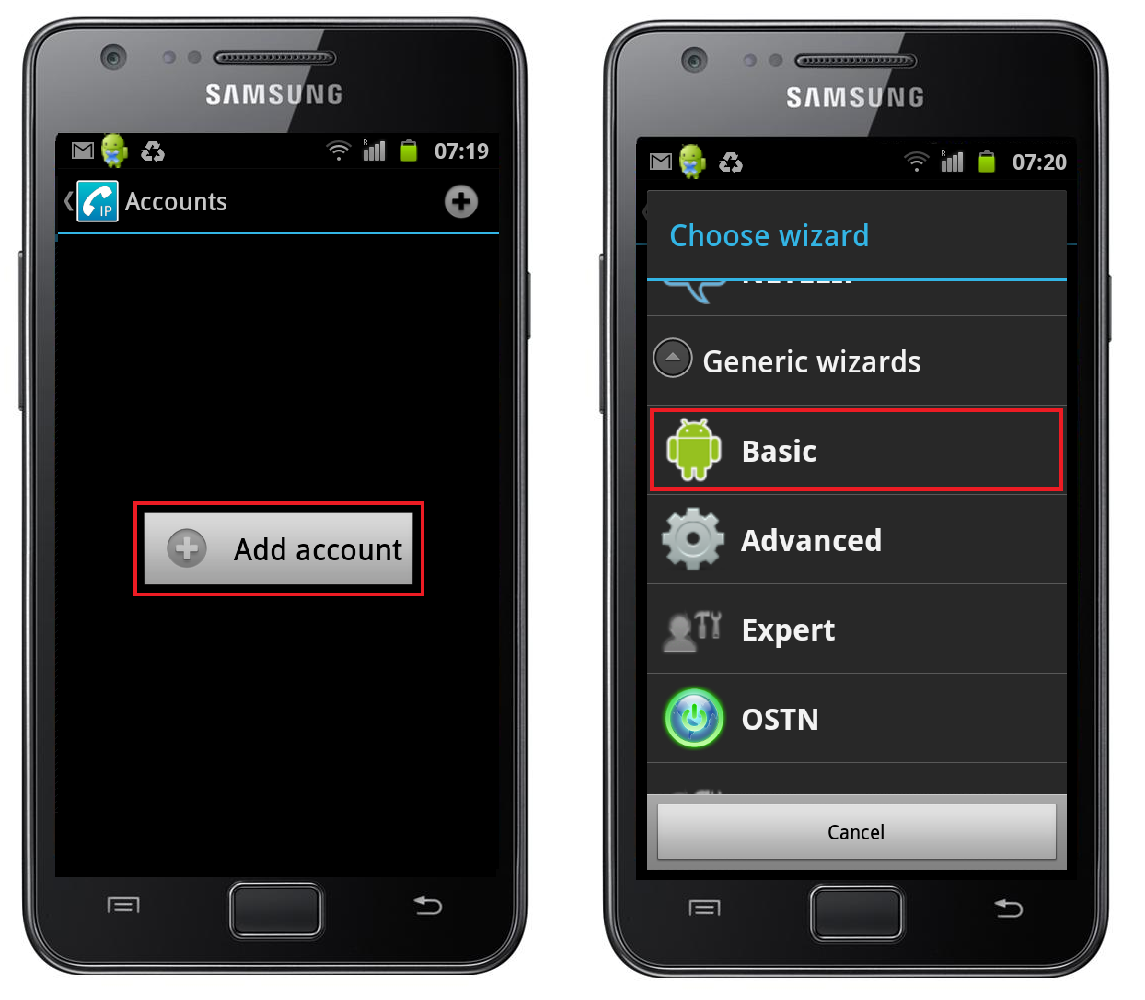

Identify a Reputable Forex Broker:

The first step in opening a forex account in India is selecting a trustworthy broker. Conduct thorough research, read reviews, and consider factors such as regulation, trading platform, fees, and customer support.

-

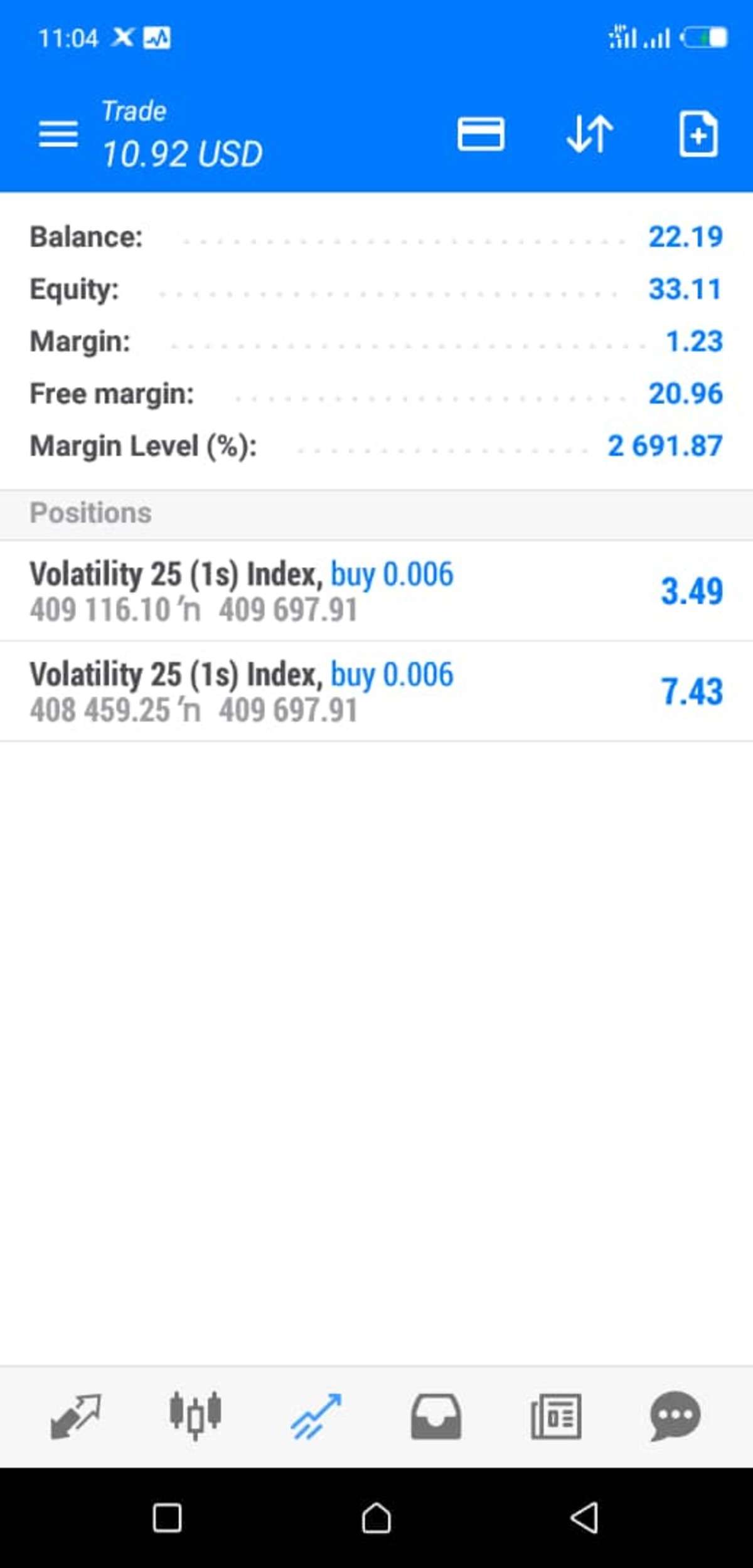

Image: faqogumypoze.web.fc2.comFulfill Account Opening Requirements:

Forex brokers typically require certain documents for KYC (Know Your Customer) regulations. These may include a government-issued ID, proof of address, and a bank statement.

-

Choose Trading Platform:

Brokers offer various trading platforms, ranging from user-friendly web-based interfaces to advanced desktop software. Select a platform that aligns with your knowledge and experience level.

-

Fund Your Account:

Once your account is established, you need to deposit funds to begin trading. Most brokers provide secure funding methods like bank transfers, credit/debit cards, and e-wallets.

-

Leverage Trading Tools:

Forex brokers may offer a range of trading tools, such as charts, analysis tools, and trading signals. These tools can enhance your trading experience and decision-making.

Exploring the Benefits of Forex Trading

-

24/5 Market Availability:

Forex trading offers unparalleled flexibility, allowing you to trade around the clock, even on weekends.

-

Liquidity:

The forex market is incredibly liquid, with high trading volumes, making it easier to enter and exit positions quickly and efficiently.

-

High Leverage:

Forex brokers offer leverage, amplifying your trading potential. However, it’s crucial to use leverage wisely as it can magnify both profits and losses.

-

Global Market Access:

Forex trading connects you to the global currency market, enabling you to capitalize on currency movements worldwide.

Navigating Forex Trading Risks

-

Currency Fluctuations:

Forex trading involves inherent currency fluctuations that can result in both profits and losses.

-

Leverage Risk:

Excessive leverage can magnify losses as well as profits, increasing financial risk.

-

Economic and Political Events:

Economic and political events can significantly impact currency prices, highlighting the importance of staying informed about market news.

-

Technical Proficiency:

Forex trading requires technical proficiency to analyze currency trends and make informed trading decisions.

Empowering Yourself with Expert Insights

-

Mastering Technical Analysis:

Learn technical analysis techniques to identify chart patterns and trends that indicate potential trading opportunities.

-

Understanding Economic Indicators:

Stay informed about economic indicators that influence currency movements, such as GDP, inflation, and interest rates.

-

Risk Management Strategies:

Implement risk management strategies like stop-loss orders and risk-reward ratios to protect your capital.

-

Practice with Demo Account:

Utilize a demo account to practice trading strategies and gain experience before venturing into real-time trading.

How To Open Forex Account In India

https://youtube.com/watch?v=McsNpt105M4

Embracing a Transformative Trading Journey

Opening a forex account in India unlocks a world of opportunities for investors seeking financial freedom. By embracing the insights shared in this guide, you can embark on a transformative trading journey. However, it’s essential to remember that success in forex trading requires dedication, discipline, and a comprehensive understanding of market dynamics. May this guide inspire you to navigate the complexities of forex trading with confidence and achieve your financial aspirations.