Introduction

As an enthusiastic investor, I’ve often pondered the intricacies of the Forex and stock markets. Embarking on a journey to understand these financial behemoths, I’ve meticulously deciphered their nuances, enabling me to craft a comprehensive guide that unveils the distinctions between these two potent forces. Prepare yourself for an illuminating expedition into the realms of Forex and stocks.

Image: howtotradeonforex.github.io

The Essence of the Forex Market

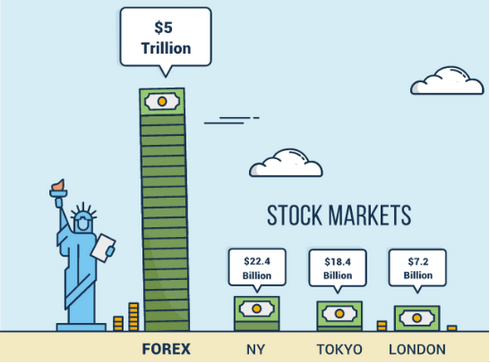

The Forex market, a vast and perpetual tapestry of digital transactions, serves as a global hub for trading currencies. Governments, central banks, multinational corporations, and retail traders congregate in this fluid arena, seeking to exchange their holdings against one another. The Forex market’s unparalleled liquidity, fueled by astronomical trading volumes, grants it unparalleled flexibility and swift execution. Unlike stock markets, Forex trading knows no temporal boundaries, operating incessantly from Monday through Friday, catering to the world’s financial pulse.

Unraveling the Stock Market

The stock market, on the other hand, presents a distinct financial ecosystem. Its foundation rests upon the exchange of company stocks, representing fractional ownership of publicly traded corporations. Investors who venture into the stock market do so with the ardent aspiration of profiting from rising stock prices. Unlike the decentralized Forex market, stock exchanges adhere to standardized operating hours, typically weekdays during specific intervals. This structured environment fosters transparency and calibrated trading.

Key Distinctions: A Comparative Lens

Image: www.forexfreshmen.com

1. Traded Assets

The very essence of Forex and stock markets lies in the disparate assets they trade. Forex markets focus exclusively on currency pairs, facilitating conversions between global currencies. In stark contrast, stock markets provide a platform for the exchange of company stocks, granting investors ownership stakes in various enterprises.

2. Market Hours

Temporality plays a pivotal role in the dynamics of Forex and stock markets. Forex reigns supreme with its perpetual nature, facilitating trades around the clock, five days a week. This unremitting accessibility empowers traders to capitalize on market fluctuations whenever opportunities arise. Conversely, stock markets adhere to prescribed trading hours, typically encompassing weekdays within designated time slots. This structured schedule imparts predictability and facilitates coordinated trading among market participants.

3. Liquidity

Liquidity, a lifeblood of financial markets, refers to the ease with which assets can be bought or sold. The Forex market stands apart with its exceptional liquidity, an attribute stemming from the enormous trading volumes involving multiple currencies. This liquidity empowers traders with the ability to execute transactions swiftly and at competitive prices. Stock markets, while exhibiting varying degrees of liquidity depending on the company and market conditions, generally lag behind the Forex market in this regard.

4. Leverage

Leverage, a double-edged sword in the trading realm, amplifies both potential gains and losses. Forex markets often offer substantial leverage, enabling traders to control larger positions with relatively modest capital outlays. This leverage can augment returns, but it also magnifies risks, demanding prudent management to mitigate potential losses. Stock markets typically provide lower leverage ratios, offering a somewhat safer environment for cautious investors.

5. Volatility

Volatility, an inherent trait of financial markets, measures the extent of price fluctuations. The Forex market, influenced by a myriad of global factors, can exhibit heightened volatility, particularly during periods of economic uncertainty or geopolitical events. Conversely, stock markets tend to display varying degrees of volatility, with some stocks exhibiting more pronounced price swings than others. Understanding volatility patterns is crucial for traders to navigate market conditions effectively.

Emerging Trends and Technological Advancements

The Forex and stock markets are constantly evolving, adapting to technological advancements and evolving market dynamics. The advent of online trading platforms has revolutionized access to these markets, empowering traders with user-friendly interfaces and a wealth of trading tools. Additionally, the proliferation of mobile trading apps has extended market accessibility, allowing traders to monitor and execute trades from the palm of their hands.

Artificial intelligence (AI) and machine learning (ML) are increasingly making their presence felt in these markets. Algorithmic trading, powered by AI and ML, enables traders to automate trading strategies, leveraging data analysis and predictive modeling to make informed decisions. These advancements have enhanced trading efficiency, reduced execution times, and provided traders with sophisticated risk management capabilities.

Tips and Expert Advice

Navigating the intricacies of the Forex and stock markets demands a combination of knowledge, skill, and prudent risk management. Here are some invaluable tips and expert advice to guide your trading journey:

- Educate Yourself Thoroughly: Immerse yourself in the fundamentals of trading, encompassing both theoretical knowledge and practical experience. Stay abreast of market trends, economic events, and geopolitical developments that could impact market behavior.

- Define Your Risk Tolerance: Assess your financial situation and determine your capacity to withstand potential losses. Develop a comprehensive risk management strategy that aligns with your risk tolerance, employing stop-loss orders, position sizing, and proper leverage management.

- Start Small and Gradually Increase: Begin with modest trades and gradually scale up your positions as you gain confidence and experience. This prudent approach mitigates risks and allows you to refine your trading skills while preserving your capital.

- Control Your Emotions: Trading can evoke strong emotions, both positive and negative. Maintain emotional discipline, avoiding impulsive decisions fueled by fear or greed. Ground your trading decisions in sound analysis and a well-defined trading plan.

- Seek Professional Guidance: Consider consulting with a financial advisor or experienced trader who can provide personalized guidance based on your unique needs and risk profile. Leverage their expertise to enhance your trading strategies and risk management practices.

Frequently Asked Questions

- Q: Which market is more accessible for beginners?

- A: Stock markets generally offer a lower barrier to entry, with many online brokers catering to novice investors. Forex markets, while potentially lucrative, require a higher level of knowledge and risk tolerance.

- Q: Can I trade Forex and stocks simultaneously?

- A: Yes, it’s possible to diversify your portfolio by trading in both Forex and stock markets. However, it’s crucial to manage your risk exposure carefully and avoid overleveraging.

- Q: What are the potential risks involved in Forex trading?

- A: Forex trading carries inherent risks, including exchange rate fluctuations, geopolitical events, and market volatility. It’s imperative to implement robust risk management strategies and trade within your means.

- Q: How can I improve my trading skills?

- A: Continuous learning is paramount. Subscribe to industry blogs, attend webinars, and engage with experienced traders to refine your knowledge and trading techniques.

- Q: Is it better to invest in stocks or Forex?

- A: The optimal choice depends on your individual circumstances, risk tolerance, and financial goals. Stocks offer long-term growth potential, while Forex trading provides opportunities for short-term gains. Each market has its unique characteristics and risks.

Forex Market Vs Stock Market

Conclusion

The Forex and stock markets present distinct yet compelling opportunities for investors seeking financial growth. Understanding the key differences between these markets is paramount for making informed trading decisions. Whether you choose to delve into the dynamic world of Forex or the structured realm of stocks, equip yourself with knowledge, prudent risk management strategies, and unwavering determination. The journey to financial empowerment begins with a single step. Embrace the challenge, embrace the learning process, and unlock the transformative power of the financial markets.

Do you find this article on the Forex market vs stock market insightful? Let us know in the comments below!