Introduction:

In the realm of financial trading, Forex (foreign exchange) stands as a lucrative yet challenging arena. For those seeking to maximize their profitability, a deep understanding of market dynamics and astute trading strategies is paramount. This article delves into the intricate world of Forex trading, unraveling the secrets to unlocking exceptional profits.

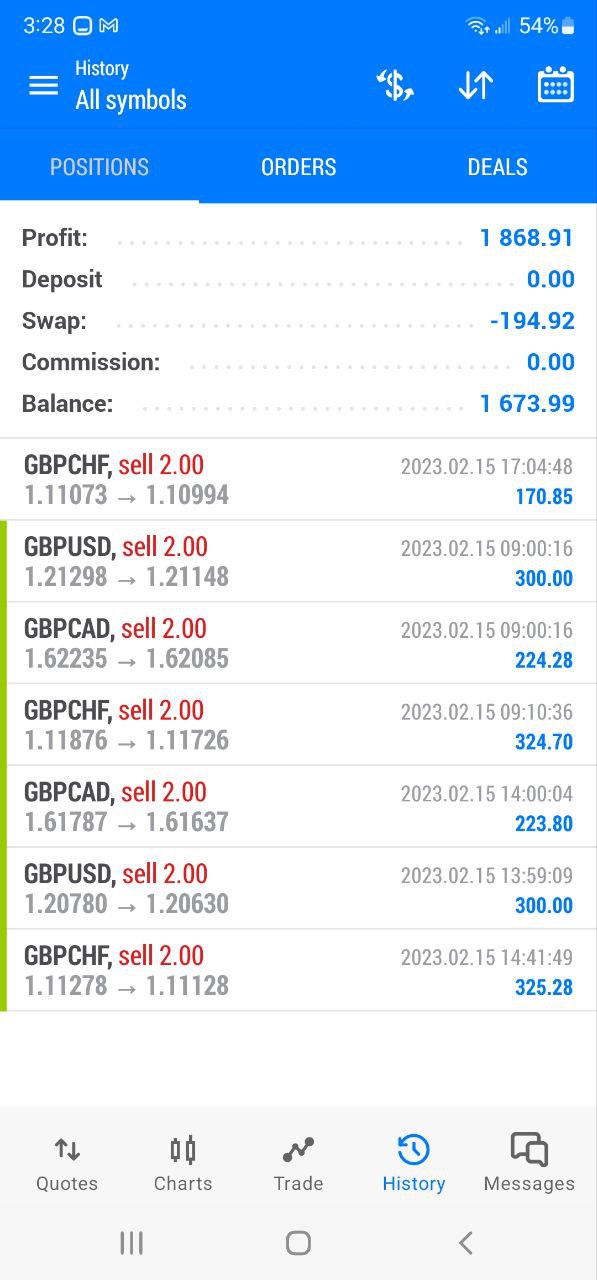

Image: www.mql5.com

The Essence of Forex Trading:

Forex trading revolves around the exchange of currencies between two parties. Unlike traditional investment markets, Forex operates 24 hours a day, 5 days a week, offering continuous trading opportunities. The allure of Forex lies in its exceptional liquidity, driven by the involvement of central banks, financial institutions, and individual traders worldwide.

Strategies for Profit Maximization:

To maximize profits in Forex trading, a multifaceted approach is required, encompassing fundamental analysis, technical analysis, and risk management techniques.

1. Fundamental Analysis:

Fundamental analysis explores macroeconomic factors that influence currency values. This includes economic growth, interest rates, inflation, political stability, and global news events. By understanding these fundamentals, traders can predict future currency movements and make informed trading decisions.

Image: www.litefinance.org

2. Technical Analysis:

Technical analysis involves studying historical price charts to identify patterns and trends. Traders use indicators, such as moving averages, support and resistance levels, and candlestick patterns, to anticipate market direction and determine optimal entry and exit points.

3. Risk Management:

Risk management is vital to preserve capital and mitigate losses. This includes setting appropriate stop-loss orders, limiting position sizes, and maintaining a diversified portfolio. Effective risk management allows traders to navigate market volatility without jeopardizing their overall profitability.

Advanced Techniques for Enhanced Returns:

Beyond the fundamental principles, advanced techniques can further enhance profit potential in Forex trading. These include:

1. Scalping:

Scalping involves making numerous small trades within a short timeframe, aiming to capture quick profits from small price fluctuations. Scalpers rely on rapid market analysis and lightning-fast execution.

2. Hedging:

Hedging strategies involve opening multiple positions with correlated currency pairs to offset potential losses. By balancing positions across different markets, traders can minimize risk while capitalizing on market trends.

3. Automated Trading:

Automated trading systems, known as expert advisors or trading robots, execute trades based on pre-defined parameters. While not a substitute for human judgment, automated trading can provide advantages such as 24/7 operation and reduced emotional bias.

Essential Qualities of a Successful Forex Trader:

To thrive in Forex trading, aspiring traders should cultivate specific traits and attributes, including:

1. Discipline:

Adhering to trading plans, managing risk rigorously, and avoiding impulsive decisions are essential for long-term success. Traders must remain disciplined even during periods of market volatility or emotion-evoking events.

2. Patience:

Patience is both a virtue and a necessity in Forex trading. It involves waiting for the right trading opportunities, allowing profits to accumulate, and avoiding the temptation to chase every market move.

3. Adaptability:

The Forex market is constantly evolving, requiring traders to be adaptable and responsive to changing conditions. This includes adjusting strategies, adopting new trading techniques, and continually seeking knowledge.

How To Maximize Profit In Forex Trading

Conclusion:

Maximizing profit in Forex trading requires a multifaceted approach that combines fundamental and technical analysis, risk management, and advanced trading techniques. By cultivating essential qualities such as discipline, patience, and adaptability, traders can navigate the complex world of Forex and achieve exceptional financial rewards. Remember, success in Forex trading is an ongoing journey that demands continuous learning, practice, and unwavering dedication.