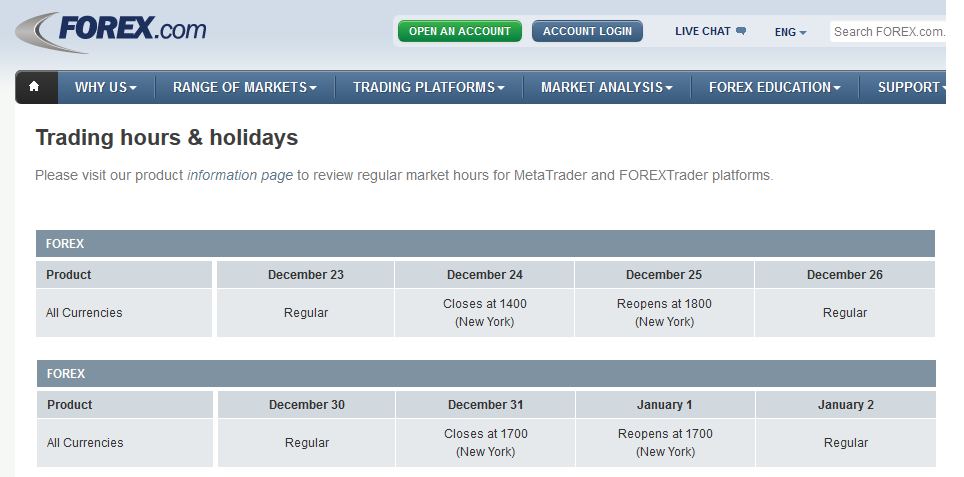

The foreign exchange market, also known as forex or FX, is the largest, most liquid financial market globally, with trading volumes exceeding $6.6 trillion per day. It operates 24 hours a day, five and a half days a week, from Sunday evening to Friday afternoon. However, there are exceptions to this rule, such as during holidays, and Christmas is one of them.

Image: www.tradestocks.com

Christmas Day is a public holiday in most countries, and financial markets are generally closed. This includes the forex market, which will not be operational on Christmas Day. It will also be closed on December 26th, which is generally observed as a holiday in lieu of Christmas Day.

Trading Resumes After Christmas

Forex trading resumes on December 27th. Liquidity may be thinner than usual in the immediate aftermath of the holiday, but it should return to normal levels within a day or two.

Planning Your Trades

If you are a forex trader, it is important to be aware of the market’s holiday schedule and plan accordingly. If you have any open positions on December 24th, you will need to close them before the market closes. You can also use this time to review your trading strategy and make any necessary adjustments.

What is the Forex Market?

The forex market is a decentralized global marketplace where currencies are traded. It is the largest financial market in the world, with a daily trading volume of over $6.6 trillion. The forex market is open 24 hours a day, five and a half days a week, from Sunday evening to Friday afternoon.

The forex market is used by a variety of participants, including banks, hedge funds, corporations, and individual traders. Forex traders use the market to speculate on the value of currencies, hedge against currency risk, or facilitate international trade.

Image: sotoyege.web.fc2.com

How Does the Forex Market Work?

The forex market is a decentralized market, which means that there is no central exchange where all trades are executed. Instead, forex trades are executed over-the-counter (OTC) between two parties. This means that the price of a currency pair can vary depending on the liquidity of the market and the parties involved in the trade.

The forex market is a very liquid market, which means that there is always a ready supply of buyers and sellers for any given currency pair. This liquidity makes it easy for traders to enter and exit the market quickly and efficiently.

What are the Benefits of Trading Forex?

There are a number of benefits to trading forex. These benefits include:

- Liquidity: The forex market is the most liquid financial market in the world, which makes it easy to enter and exit trades quickly and efficiently.

- 24-hour trading: The forex market is open 24 hours a day, five and a half days a week. This means that traders can trade whenever it is convenient for them.

- Leverage: Forex brokers offer leverage, which allows traders to trade with more money than they have in their account. This can increase the potential profits, but it can also increase the risk.

- Low transaction costs: Forex brokers typically charge very low transaction costs, which can save traders money over time.

What are the Risks of Trading Forex?

There are also a number of risks associated with trading forex. These risks include:

- Liquidity: While the forex market is very liquid, there can be times when liquidity is thin. This can make it difficult to enter or exit trades, and it can also lead to sharp price movements.

- 24-hour trading: The forex market is open 24 hours a day, which can make it difficult for traders to manage their risk. It is important for traders to be aware of the risks of trading during extended hours.

- Leverage: Leverage can increase the potential profits, but it can also increase the risk. Traders should be careful not to use too much leverage, as this can lead to large losses.

- Transaction costs: While forex brokers typically charge very low transaction costs, these costs can add up over time. It is important for traders to factor in the cost of transactions when making trading decisions.

Tips for Trading Forex

If you are interested in trading forex, here are a few tips to help you get started:

- Do your research: Before you start trading forex, it is important to do your research and understand the market. This includes learning about the different currency pairs, the factors that affect their prices, and the risks involved.

- Start small: When you start trading forex, it is important to start small. This will help you minimize your risk and learn the ropes before you start trading with larger amounts of money.

- Use a stop-loss order: A stop-loss order is an order to sell a currency pair at a specific price if it falls below a certain level. This can help you limit your losses if the market moves against you.

- Be patient: Forex trading is not a get-rich-quick scheme. It takes time to learn the market and develop a profitable trading strategy.

Frequently Asked Questions about Forex

Here are some of the most frequently asked questions about forex:

- What is the minimum deposit required to trade forex? The minimum deposit required to trade forex varies depending on the broker you choose. However, most brokers will require a minimum deposit of $100-$200.

<li><strong>Can I trade forex with a demo account?</strong> Yes, most brokers offer demo accounts which allow you to trade with virtual money. This is a great way to learn the basics of forex trading without risking any real money.</li>

<li><strong>What is the best time to trade forex?</strong> The best time to trade forex is during the most liquid hours, which are from 7 am to 12 pm EST. However, you can trade forex at any time during the day or night.</li>

<li><strong>How much money can I make trading forex?</strong> The amount of money you can make trading forex depends on a number of factors, including your trading strategy, risk tolerance, and the size of your account. However, it is possible to make a substantial profit trading forex.</li>Christmas is the one time when the Forex Market is not open. Forex, like many other markets, is dictated by the powers that be in each country’s particular banking system. Therefore, when Christmas is celebrated in a specific country, the Forex Market is closed during trading hours. Since the Forex Market operates 24/7, only holidays of particular countries will affect the trading schedule throughout the year.

Is Forex Market Open On Christmas

Are you Interested in Forex

If the answer is yes, I can help you on your journey. There are many different scams out there that deter people from trading. I help educate you with a system that I use and update frequently. If you are interested, please click on the contact me link and send me a message.