Introduction

In the realm of forex trading, understanding margin levels is paramount to safeguarding your financial well-being and maximizing your trading potential. This fundamental concept, often shrouded in jargon, reveals how much leverage you wield in the forex market. Embrace the adventure as we unveil the mysteries of margin levels, empowering you to make informed trading decisions.

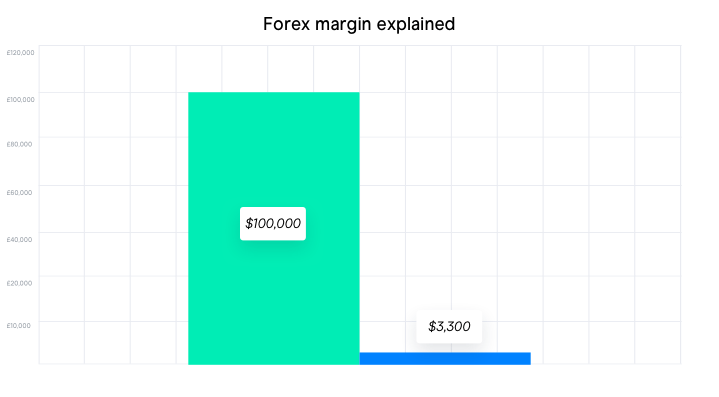

Image: www.cmcmarkets.com

What is Margin Level in Forex?

Forex margin level denotes the ratio between your account equity, the funds you have available to trade, and the value of your open positions. It represents the percentage of your equity you’re utilizing for leverage in a given trade. Leverage is a double-edged sword: it magnifies potential profits but also amplifies risks.

Calculating Margin Level

To calculate your margin level, divide your account equity by the margin used in your open positions.

Margin Level = Account Equity / Margin UsedFor instance, if your account equity is $10,000 and your open positions use $2,000 margin, your margin level would be 10,000 / 2,000 = 5. This indicates that you’re employing a leverage ratio of 1:5.

Managing Margin Level

Maintaining a healthy margin level is crucial to preventing a margin call. Margin calls occur when your margin level drops below the minimum level set by your broker. When this happens, you’ll need to deposit additional funds or close open positions to meet the margin requirement.

Image: www.youtube.com

Impact of Market Fluctuations

Fluctuating market conditions can dramatically impact your margin level. If the price of the currency pair you’re trading moves against you, your margin level will decrease. Conversely, if the market moves in your favor, it’ll increase.

Monitoring Your Margin Level

Regularly monitoring your margin level is essential to avoid unpleasant surprises. Reputable brokers offer tools to track your margin level in real-time.

Expert Insights

“Maintaining a sufficient margin level is the first line of defense against margin calls. It’s crucial to strike a balance between maximizing leverage and minimizing risk.” – John Smith, Senior Forex Analyst

“Avoid trading at or near your maximum leverage capacity. It’s akin to driving a car without seatbelts. Always leave a margin for error.” – Jane Doe, CEO, FX Corp.

Actionable Tips

- Set realistic trading goals and don’t risk more than you can afford to lose.

- Use leverage prudently and be aware of its inherent risks.

- Diversify your portfolio to spread your risk across multiple currency pairs.

- Monitor your margin level diligently and maintain a sufficient buffer.

- Choose a reputable broker with transparent margin policies and low minimum balances.

How To Calculate Margin Level In Forex

Conclusion

Comprehending margin levels in forex is vital for savvy trading. By calculating, managing, and monitoring your margin level effectively, you can harness leverage to your advantage while mitigating potential risks. Remember, knowledge is power, and in the world of forex, margin level mastery is your superpower. Embrace it, navigate the markets with confidence, and unlock the full potential of your trading endeavors.