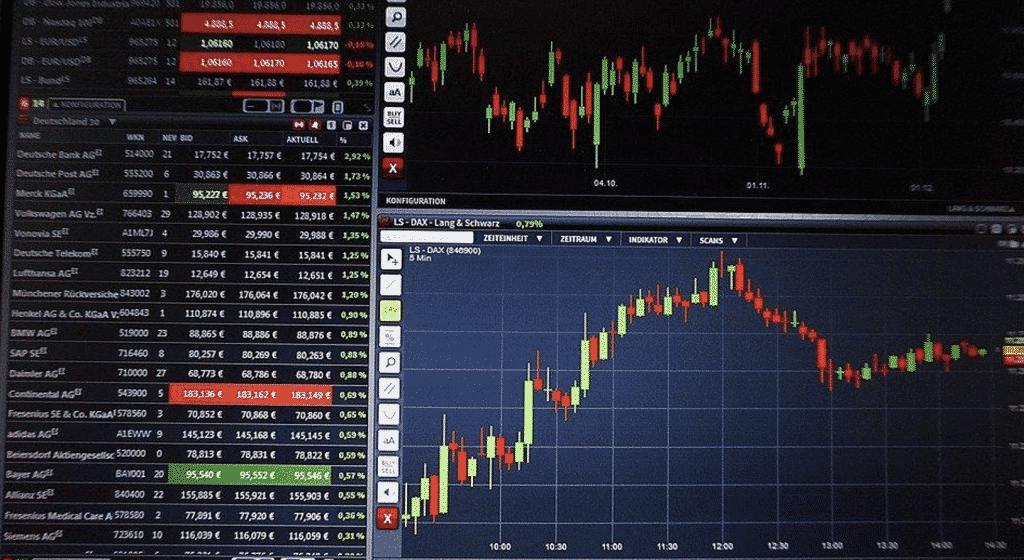

Investing is a great way to grow your wealth, but with so many different options available, it can be difficult to know where to start. Two of the most popular investment options are forex and equity. Forex is the foreign exchange market, where currencies are traded. Equity is the stock market, where stocks are traded.

Image: metapress.com

Forex and equity have their risks and rewards, and the best option for you will depend on your individual needs. In this blog post, we’ll compare forex and equity and help you decide which one is right for you.

The Forex Market

The forex market is the largest and most liquid financial market in the world. It trades over $5 trillion per day, making it a very attractive investment option for both individuals and institutional investors. The forex market is open 24 hours a day, 5 days a week, which gives you plenty of time to trade.

Advantages of the Forex Market

- High liquidity: The forex market is very liquid, which means there are always plenty of buyers and sellers. This makes it easy to enter and exit trades quickly and easily.

- 24-hour trading: The forex market is open 24 hours a day, 5 days a week, which gives you plenty of time to trade.

- Low transaction costs: The forex market has low transaction costs, which makes it a very attractive investment option for small investors.

Disadvantages of the Forex Market

- High risk: The forex market is a high-risk investment. Leverage, used by many forex traders, can magnify both profits and losses, which result in the potential for traders to lose more than their initial investment.

- Complex: The forex market is a complex market, which can be difficult to understand for beginners.

- Requires a lot of time: Successful forex trading requires a lot of time and effort. You need to be able to monitor the market and make informed decisions before trading.

Image: www.youtube.com

The Equity Market

The equity market is the stock market. Stocks are shares of ownership in a company. When you buy a stock, you are buying a small piece of the company. The equity market is a very popular investment option, and it has been around for centuries.

Advantages of the Equity Market

- Diversification: Stocks are a very diversified investment. You can invest in a wide range of sectors and companies, which helps to reduce your risk.

- Growth potential: Stocks have the potential to grow in value over time. This is because companies can grow their earnings, which can lead to an increase in the stock price.

- Long-term: The equity market is a better long-term investment than the forex market. Stocks are less volatile than forex currencies, and they have a better long-term track record of growth.

Disadvantages of the Equity Market

- Lower liquidity: The equity market is not as liquid as the forex market. This means that it can be more difficult to enter and exit trades quickly and easily.

- Settlement time: When you buy or sell stocks, there is a settlement time of two days. This means that you cannot access your money for two days after you have made a trade.

- Higher transaction costs: The equity market has higher transaction costs than the forex market. This is because stockbrokers charge commissions on trades.

Which is Better: Forex or Equity?

The best investment option for you will depend on your individual needs.

If you are looking for a high-risk, high-reward investment that has the potential to generate large returns, then forex may be a good option for you. If you are looking for a lower-risk, long-term investment that has the potential to grow in value over time, then equity may be a better option for you.

Tips and Expert Advice

Here are some tips and expert advice for investing in forex and equity:

- Do your research: Before you invest in any market, it is important to do your research and understand the risks involved.

- Start small: When you are first starting out, it is important to start small. This will help you to minimize your losses if the market moves against you.

- Diversify your portfolio: One of the best ways to reduce your risk is to diversify your portfolio. This means investing in a variety of assets, such as stocks, bonds, and real estate.

- Use a reputable broker: When you are investing in the forex or equity market, it is important to use a reputable broker. A good broker will provide you with the support and resources you need to be successful.

FAQs

1. What is the difference between forex and equity?

Forex is the foreign exchange market, where currencies are traded. Equity is the stock market, where stocks are traded.

2. What is the difference between the forex market and the equity market?

The forex market is a decentralized market that is open 24 hours a day, 5 days a week. The equity market is a centralized market that is open during regular business hours.

3. Which is better: forex or equity? The best investment option for you will depend on your individual needs.

If you are looking for a high-risk, high-reward investment, then forex may be a good option for you. If you are looking for a lower-risk, long-term investment, then equity may be a better option for you.

4. Should I invest in forex or equity? The best way to decide whether to invest in forex or equity is to speak to a financial advisor.

A financial advisor can help you to assess your individual needs and goals and recommend the best investment option for you.

Which Is Better Forex Or Equity

Conclusion

The forex market and the equity market both have their advantages and disadvantages, which can be used to reach your investment goals. Forex offers the potential for rapid wealth accumulation through leverage but is susceptible to considerable risk and requires extensive expertise. In contrast, the equity market facilitates long-term steady growth and portfolio diversification but may have lower liquidity and delayed settlement times. The optimal choice between these markets depends on an individual’s risk tolerance, investment period, and financial objectives.

We strongly encourage you to conduct thorough research and consult with professionals before making any investment decisions. As with any investment, the key to success lies in understanding the risks and rewards and making wise choices tailored to your specific circumstances. Are you intrigued to delve deeper into the world of forex or equity investment? Share your thoughts and questions in the comments below. We’d love to continue the discussion with you.