Unlocking a World of Financial Convenience

In today’s globalized landscape, having access to financial services that seamlessly transcend borders is indispensable. The Forex Card from Central Bank of India empowers you to navigate international payments with unparalleled ease, opening up a world of opportunities for those embarking on personal or business ventures abroad.

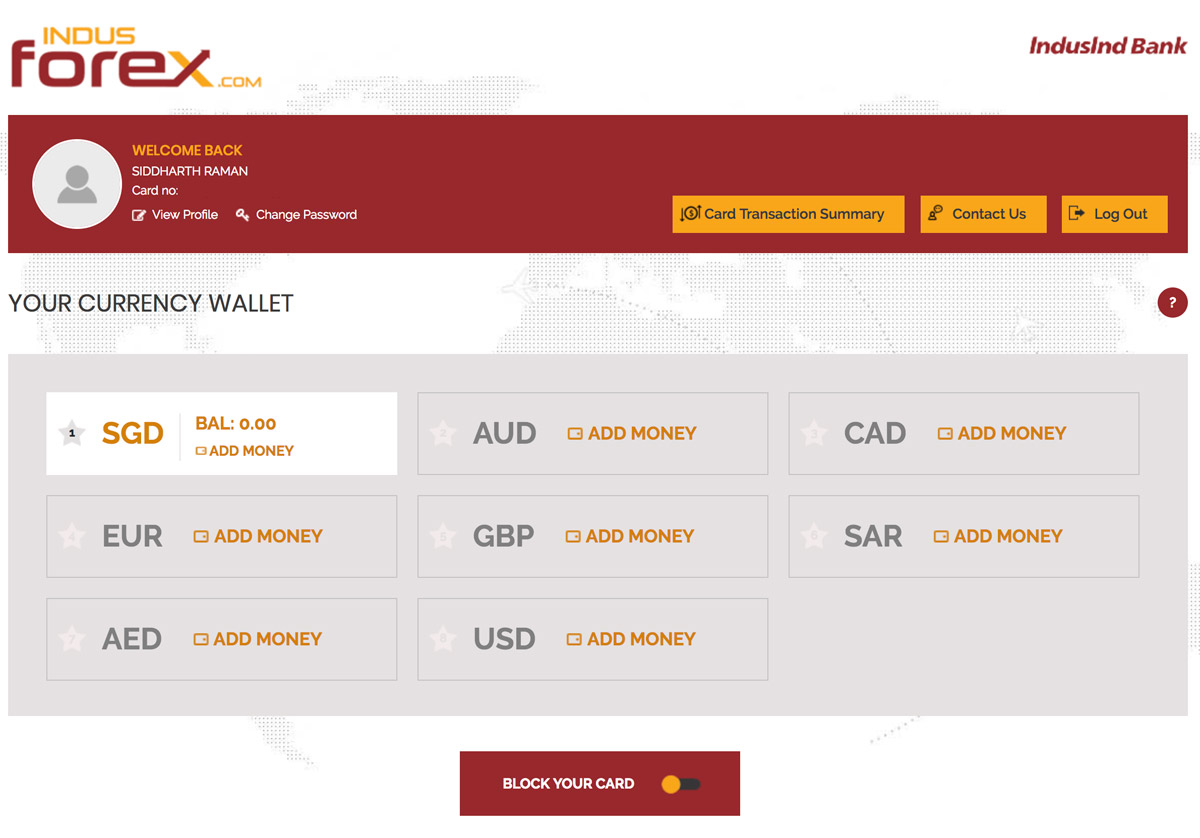

Image: www.cardexpert.in

What is a Forex Card?

A Forex Card, also known as a traveler’s card or prepaid currency card, is a convenient and secure payment solution designed for travelers and individuals conducting international transactions. Unlike traditional credit or debit cards, which are linked to your bank account, a Forex Card is preloaded with a specified amount of foreign currency at a fixed exchange rate. This eliminates the hassle of currency conversion and protects you from fluctuations in exchange rates.

Advantages of Using a Central Bank of India Forex Card

Central Bank of India’s Forex Card offers a host of benefits that make it the ideal choice for globetrotters and business travelers alike:

- Wide Currency Network: The Forex Card is accepted in over 200 countries and regions, giving you the flexibility to make payments in a wide range of currencies.

- Competitive Exchange Rates: The Forex Card offers competitive exchange rates, ensuring that you get the most value for your money.

- Security and Convenience: The Forex Card utilizes chip-and-PIN technology for enhanced security, and it can be used at ATMs worldwide for cash withdrawals and balance inquiries.

- Cashless Transactions: Minimize the need for carrying large amounts of cash, reducing the risk of loss or theft.

- Travel Perks: Enjoy peace of mind with travel-related benefits, such as travel insurance and emergency assistance.

Where to Get Your Forex Card

Acquiring a Central Bank of India Forex Card is a straightforward process. You can apply online or visit your nearest branch. To get started, you will need to provide proof of identity and address and deposit the desired amount of currency into your account. The card will be issued to you within a few days.

Image: invested.in

Using Your Forex Card

Using your Forex Card is as easy as using a regular debit card. Simply present your card at any POS terminal that accepts the Mastercard or Visa network. Your transaction will be automatically converted into the local currency at the pre-determined exchange rate. You can also use your Forex Card to withdraw cash from ATMs worldwide.

Forex Card Central Bank Of India

The Perfect Fit for Your International Needs

Whether you are planning a global adventure or frequently conduct business overseas, Central Bank of India’s Forex Card is the perfect solution to cater to your international financial needs. With its wide currency network, competitive exchange rates, and enhanced security features, it provides a seamless and convenient way to manage your finances while abroad. So, pack your bags, load up your Forex Card, and embark on your global endeavors with peace of mind.