Every trader’s aspiration is to navigate the unpredictable Forex market with finesse and emerge triumphant. The ability to identify and capitalize on resistance and support levels can be the key that unlocks the gates to consistent profitability. Embark on a journey with us as we delve into the world of resistance and support alerts, empowering you with the knowledge to trade with confidence and maximize your returns.

Image: forextk.org

Understanding Resistance and Support: The Foundation of Informed Trading

In the tumultuous Forex market, resistance and support levels act as invisible barriers, shaping price movements and guiding traders’ decisions. Resistance levels mark price ceilings, deterring further upward movement, while support levels act as price floors, preventing further downward movement. By identifying these crucial levels, traders can anticipate market trends and position themselves strategically to capitalize on price reversals.

Resistance and Support Alerts: Your Secret Weapon for Precision Trading

Resistance and support alerts are automated notifications that provide real-time updates when prices approach or breach these critical levels. Armed with these alerts, traders can respond swiftly to market shifts, entering or exiting trades at optimal moments. Whether you’re a seasoned professional or just starting your Forex adventure, these alerts can be your indispensable companion, ensuring you never miss a profitable opportunity.

Empowering You with Actionable Strategies: Unveiling the Experts’ Secrets

Master traders have honed their skills over countless hours of experience, unlocking the secrets of successful Forex trading. By tapping into their wisdom, you can gain invaluable insights that will propel your trading journey forward. Utilize resistance and support alerts in conjunction with trend analysis, pattern recognition, and risk management techniques to build a comprehensive trading strategy that can withstand market volatility and deliver consistent returns.

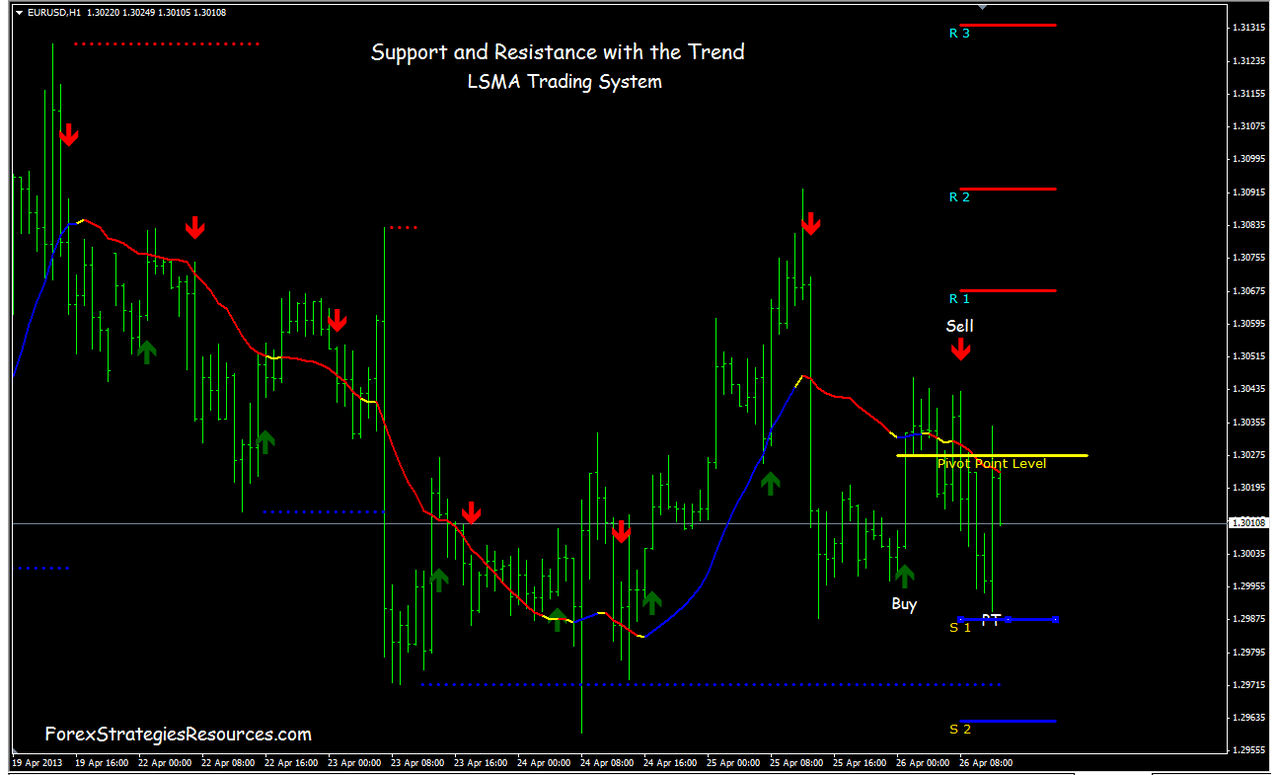

Image: www.forexstrategiesresources.com

Harnessing the Power of Support and Resistance: A Step-by-Step Guide

-

Identify Key Levels: Determine resistance and support levels using historical data, technical indicators, or market analysis tools.

-

Set Up Alerts: Configure resistance and support alerts on your trading platform to receive real-time notifications.

-

Monitor and React: Track price movements closely and respond promptly to alerts. Consider entering trades near support levels for potential buy opportunities and near resistance levels for potential sell opportunities.

-

Manage Risk: Employ stop-loss orders to limit potential losses and protect your profits.

-

Refine Your Strategy: Continuously monitor and adjust your trading strategy based on market conditions and your own trading experience.

Resistance And Support Alert Forex

Conclusion: Your Path to Forex Mastery Begins Here

Remember, Forex trading is a dynamic and ever-evolving arena. By embracing resistance and support alerts as a vital tool in your trading arsenal, you equip yourself with the power to navigate market intricacies with precision and foresight. As you refine your skills and garner experience, you’ll find yourself making informed trading decisions that consistently yield positive results. Join the ranks of successful traders today by harnessing the full potential of resistance and support alerts, and set sail towards a prosperous future in the Forex market.