An Essential Tool for International Transactions

HDFC Bank, India’s leading private sector bank, offers a comprehensive range of forex services to facilitate global financial transactions. Their up-to-date forex rates play a crucial role in cross-border payments, investments, and travel. This article provides a detailed overview of HDFC Bank’s forex rates, guiding you through their significance, access, and interpretation.

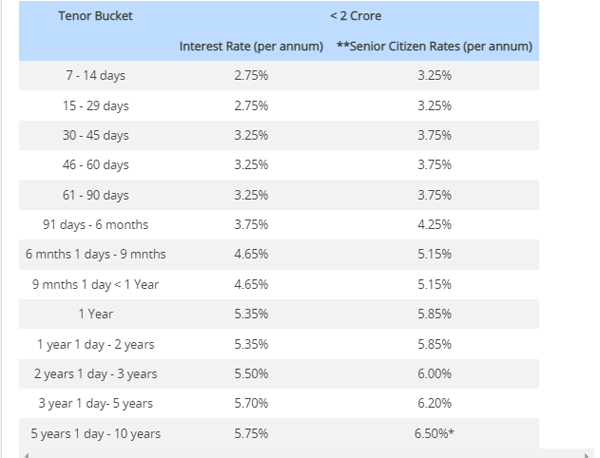

Image: cleartax.in

Accessing HDFC Bank’s Forex Rates Today

HDFC Bank provides convenient access to its forex rates through various channels:

- Online Portal: Visit the HDFC Bank website’s Forex Calculator page to fetch live forex rates for major currencies.

- PDF Download: Download a printable PDF of the day’s forex rates from the provided link for offline reference.

- Branch Network: Visit your nearest HDFC Bank branch to obtain physical copies of the forex rates.

- Mobile Banking: Access real-time forex rates through the HDFC Bank Mobile Banking app under the ‘Forex’ section.

Decoding Currency Quotes

HDFC Bank’s forex rates are presented in a simple and understandable format. Each quote comprises two values:

- Buy Rate: This represents the rate at which HDFC Bank will buy the respective foreign currency.

- Sell Rate: This indicates the rate at which HDFC Bank will sell that currency.

The spread between the buy and sell rates signifies the bank’s margin. A lower spread implies a more competitive currency conversion.

HDFC Bank’s Forex Rates: Factors Influencing Them

HDFC Bank’s forex rates are influenced by various global and domestic factors, including:

- Global Economic Conditions: Overall economic growth, inflation rates, and interest rate levels in different countries impact forex rates.

- Political Events: Political instability or uncertainty in key economies can affect currency valuations.

- Central Bank Policies: Monetary policies such as interest rate adjustments or quantitative easing influence forex market dynamics.

- Supply and Demand: Demand for a particular currency drives up its value, while a surplus supply can lower it.

- Currency Speculation: Currency trading by investors and speculators can create temporary fluctuations in rates.

Image: economictimes.indiatimes.com

Tips for Making Informed Forex Transactions

- Monitor Market Trends: Stay updated on economic news and market movements that could potentially impact forex rates.

- *Compare Exchange Rates:** Before making a transaction, compare forex rates offered by different banks to secure the best deal.

- Consider the Spread: Pay attention to the buy-sell spread offered by banks, as this can significantly impact the final conversion amount.

- *Lock-In Rates:** To protect against currency fluctuations, consider locking-in exchange rates for future transactions.

- *Seek Expert Advice:** Consult with a financial advisor or forex specialist to understand market dynamics and make informed decisions.

FAQ on HDFC Bank Forex Rates

Q: Can I download the HDFC Bank forex rates PDF offline?

A: Yes, you can download the PDF from the provided link on the HDFC Bank website.

Q: What time do the HDFC Bank forex rates update?

A: HDFC Bank’s forex rates are updated daily and are typically available by 9:00 AM IST.

Q: Is the buy rate always lower than the sell rate?

A: No, the buy rate can sometimes be higher than the sell rate, indicating a narrow spread or a potential currency appreciation.

Q: How do I calculate currency conversion using HDFC Bank’s forex rates?

A: Divide the amount you want to convert by the sell rate to determine the equivalent amount in the foreign currency.

Hdfc Bank Forex Rates Today Pdf

https://youtube.com/watch?v=tDu-9PhAZgQ

Conclusion

Understanding and leveraging HDFC Bank’s forex rates today is crucial for seamless international financial transactions. Whether you’re planning a business trip or investing abroad, accessing accurate and timely forex rates empowers you to make informed decisions and optimize your currency exchanges. Stay updated on the latest rates and follow the tips provided in this guide to navigate the forex market confidently.

Are you interested in learning more about HDFC Bank forex rates and their implications? If so, delve deeper into the topic by exploring additional online resources or consulting with financial experts.