Unlocking the Secrets of Technical Analysis: Embark on a Journey into the Enigmatic World of Candle Patterns

Image: www.dailyfx.com

Introduction

In the realm of financial trading, candle patterns stand as veritable beacons of insight, illuminating the path to market trends and optimal decision-making. For traders seeking to navigate the ever-shifting landscape of price charts, mastering these patterns is akin to possessing a treasure map leading to untapped profits. Within the esteemed trading platform, IQ Option, candle patterns reveal themselves in all their enigmatic glory, offering traders a powerful tool to dissect market dynamics and anticipate future price movements.

In this comprehensive guide, we embark on a voyage into the captivating world of IQ Option candle patterns. Together, we’ll unravel their intricacies, explore their practical applications, and empower you with the knowledge to harness their formidable insights in your trading endeavors. So, fasten your trading belts and prepare to delve into the illuminating universe of candle patterns.

The Essence of Candle Patterns

Candle patterns, the enigmatic formations that adorn price charts, provide a visual representation of price movements over a specified timeframe. These patterns manifest themselves as a series of consecutive candlesticks, each candle encapsulating a particular timeframe’s open, close, high, and low prices. By discerning the distinct characteristics of these patterns, traders can gain valuable insights into market sentiment, potential reversals, and continuation trends.

Unveiling the Building Blocks: Anatomy of a Candlestick

Before embarking on our pattern exploration, it’s essential to dissect the fundamental components of a candlestick. Each candlestick comprises a body and one or two wicks, collectively known as shadows. The body, represented by a filled portion, depicts the range between the open and close prices. Wicks, extending above and below the body, indicate the highest and lowest prices reached within the candle’s timeframe.

Image: www.pinterest.com

Delving into the Diverse Palette of Candle Patterns

The realm of candle patterns encompasses a wide array of formations, each carrying its own unique implications for market behavior. From the bullish engulfing pattern, signaling a potential trend reversal, to the bearish harami, hinting at a possible market pullback, the diversity of these patterns offers traders a comprehensive insight into market dynamics.

Bullish Patterns:

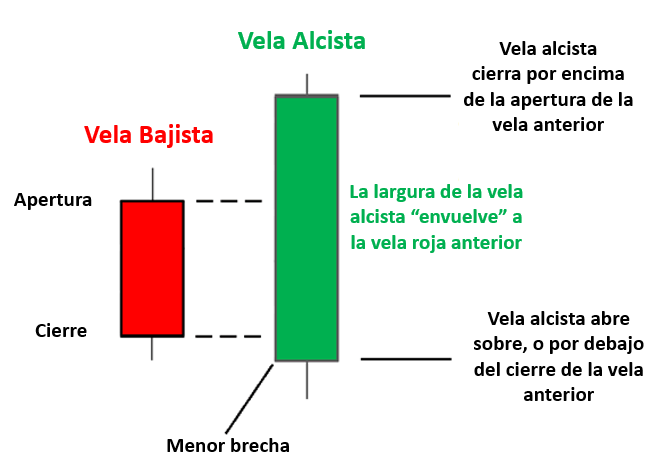

• Engulfing Pattern: A bullish engulfing pattern consists of two candlesticks, with the second candle completely engulfing the first. This pattern signifies a shift in market sentiment towards bullishness and often precedes an upward trend.

• Piercing Line Pattern: This pattern appears as a long red candle followed by a shorter green candle that penetrates more than halfway into the body of the red candle. It indicates a potential reversal of a downtrend.

• Hammer Pattern: A hammer pattern comprises of a small body and a long lower shadow. It forms at the end of a downtrend and suggests a possible trend reversal.

Bearish Patterns:

• Bearish Harami Pattern: This pattern comprises two candlesticks, with the second candle being a small-bodied candle that trades completely within the body of the first candle. It indicates a potential reversal of an uptrend.

• Hanging Man Pattern: The hanging man pattern features a small body and a long lower shadow. It appears at the top of an uptrend and suggests a possible trend reversal.

• Dark Cloud Cover Pattern: This pattern consists of two candlesticks, with the second candle being a black candle that opens higher than the first candle’s close and closes below its open. It indicates a potential reversal of an uptrend.

Practical Applications: Harnessing Candle Patterns for Profitable Trading

The mastery of candle patterns elevates trading from a game of chance to an art of strategic decision-making. By incorporating these patterns into your trading arsenal, you gain the ability to identify potential market turning points, capitalize on emerging trends, and minimize risk exposure.

Identifying Reversal Patterns:

• Bullish Reversal Patterns: Engulfing patterns and hammer patterns often signal potential reversals of downtrends.

• Bearish Reversal Patterns: Bearish harami patterns and hanging man patterns often indicate the potential for trend reversals from uptrends.

Confirming Trend Continuation:

• Continuation Patterns: Piercing line patterns and dark cloud cover patterns provide insights into potential trend continuations.

Gauging Market Sentiment:

Candle patterns offer glimpses into market sentiment, whether bullish or bearish. Bullish patterns indicate a shift towards positive sentiment, while bearish patterns suggest a turn towards negative sentiment.

Patrones De Velas Iq Option

Conclusion

Navigating the tumultuous seas of financial markets requires a sophisticated understanding of market behavior. Candle patterns stand as an invaluable tool, empowering traders with the insights to discern market trends, identify potential reversals, and optimize their trading strategies. By incorporating these patterns into your trading toolkit, you unlock a world of trading possibilities and elevate your chances of achieving success in the fast-paced world of financial markets.