In the ever-evolving world of finance, understanding currency exchange rates is crucial for businesses and individuals alike. When it comes to the Indian Rupee (INR) and the US Dollar (USD), the relationship between these two currencies has a significant impact on trade, investment, and personal finances. In this comprehensive guide, we delve into the intricacies of the forex USD to INR forecast, providing you with valuable insights and empowering you to make informed decisions.

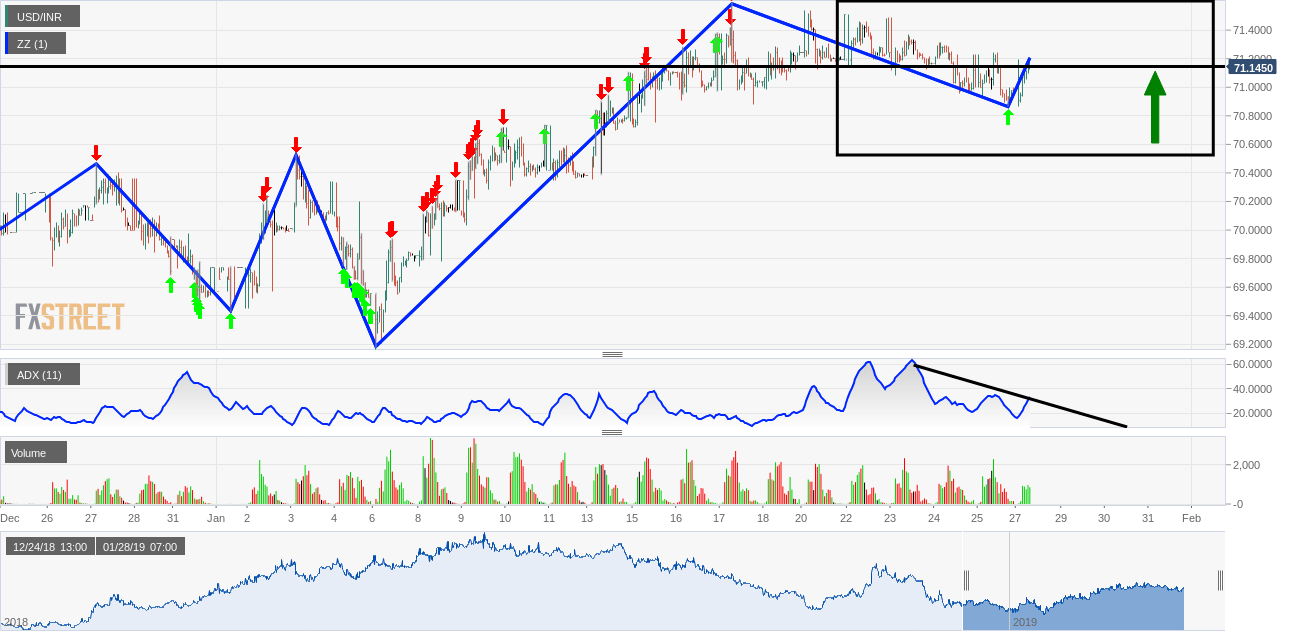

Image: quantinaintelligenceforexnewstrade1.blogspot.com

Understanding the Basics of Forex Trading

Foreign exchange (forex) trading involves the buying and selling of currencies from different countries. The exchange rate between two currencies represents the value of one currency against another. In the case of USD to INR, the exchange rate indicates how many Indian Rupees are needed to purchase one US Dollar.

Factors Influencing the USD to INR Forecast

A multitude of factors influence the USD to INR forecast, including:

-

Economic Growth: The economic growth rates of India and the United States play a pivotal role. A strong Indian economy typically leads to a stronger INR against the USD.

-

Inflation: Inflation, or the rate of price increases, can impact currency valuations. If inflation rises in India faster than in the US, the INR may weaken against the USD.

-

Interest Rates: Central bank interest rate decisions affect currency demand. When the Reserve Bank of India (RBI) raises interest rates, the INR tends to strengthen.

-

Political Stability: Political stability and economic policies can impact investor confidence. Political turmoil in India can weaken the INR.

-

Global Factors: Global economic conditions, such as recessions or geopolitical events, can influence currency markets.

Expert Insights and Forecast Trends

Based on expert insights and market analysis, the USD to INR forecast for 2023 is expected to witness a gradual appreciation of the INR. This is primarily driven by India’s strong economic growth prospects, coupled with the RBI’s proactive monetary policy.

However, it’s important to note that currency markets are inherently volatile, and forecasts can change rapidly. Staying up-to-date with market news and analysis is crucial for making informed decisions.

Image: indzara.com

Actionable Tips for Navigating the Forex Market

For individuals and businesses involved in forex trading, consider these practical tips:

-

Monitor Economic Data: Keep abreast of economic data releases from India and the US, as they can provide valuable insights into currency trends.

-

Leverage Historical Trends: Study historical USD to INR exchange rates to identify potential patterns and seasonality.

-

Use Stop-Loss Orders: Protect your investments by setting stop-loss orders to limit potential losses if the currency moves against your expectations.

-

Consider Hedging Strategies: Explore hedging strategies, such as options or forward contracts, to mitigate currency risk.

-

Consult with a Financial Advisor: Seek professional advice from a qualified financial advisor before making significant forex investments.

Forex Usd To Inr Forecast

Conclusion

Understanding the forex USD to INR forecast is essential for navigating the currency market and making informed financial decisions. The factors influencing currency valuations are complex and ever-changing, but by staying up-to-date with market analysis and following expert insights, you can enhance your understanding and make smarter choices. Remember, currency markets are volatile, and forecasts should be treated as valuable guidance rather than absolute predictions. With careful consideration and a proactive approach, you can leverage the opportunities presented by the ever-changing forex landscape.