As novice traders embark on their financial journey, mastering effective trading strategies becomes paramount. Among the plethora of available strategies, trendline trading stands out as a powerful technique that can yield substantial returns when executed with precision. This comprehensive guide will delve into the intricacies of trendline trading, empowering you with the knowledge and skills to harness its profit-generating potential in the dynamic forex market.

Image: www.tradingsetupsreview.com

Unveiling Trendlines: A Beacon of Market Direction

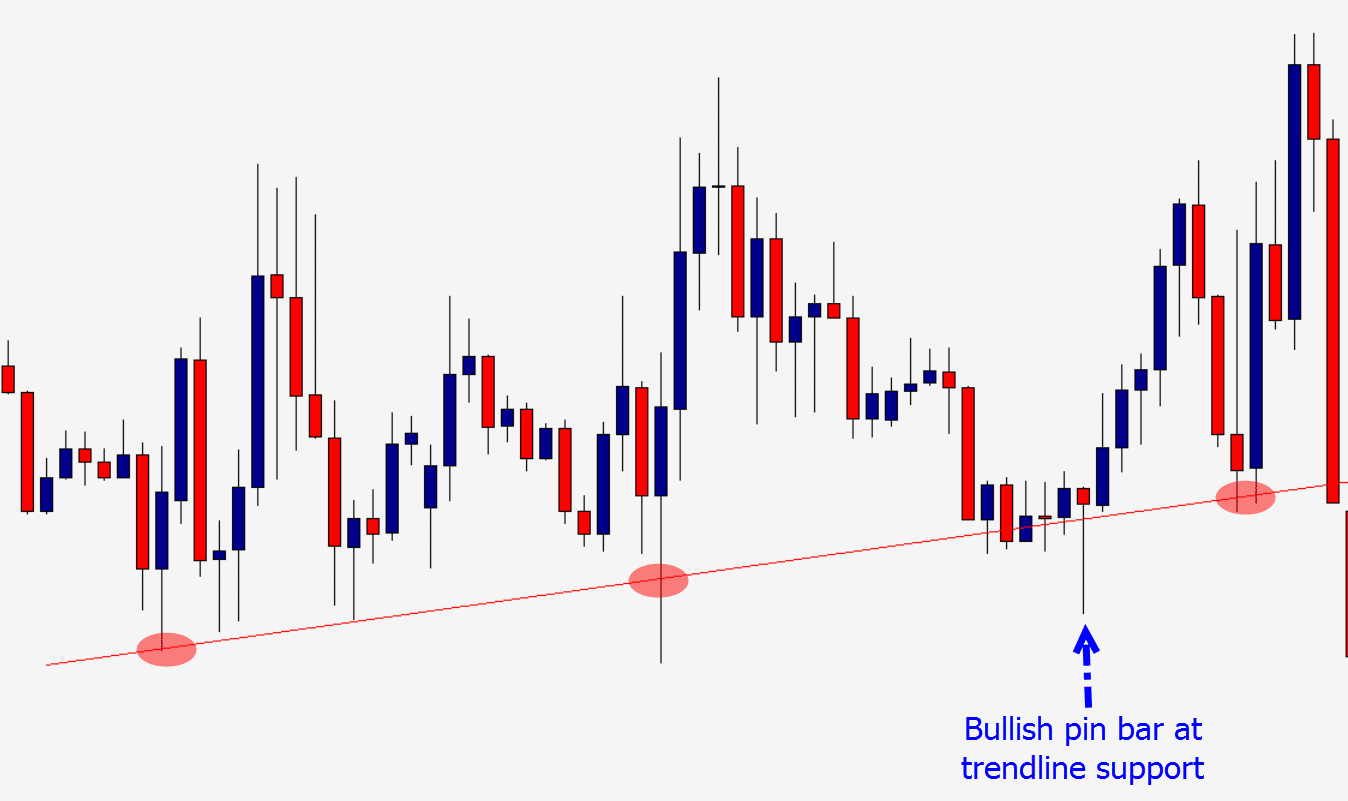

Trendlines, a cornerstone of technical analysis, are simply lines drawn along a series of price highs or lows, revealing the underlying trend of a financial instrument. These lines serve as visual representations of market momentum, indicating whether prices are moving upwards (uptrend) or downwards (downtrend). Identifying trendlines requires a keen eye for patterns and an understanding of market dynamics.

Harnessing the Power of Trendlines: Riding the Market’s Wave

Once you have identified a well-defined trendline, you can harness its power to make informed trading decisions. The strategy revolves around the principle that prices tend to respect trendlines, bouncing off them like a ball against a wall. By identifying these boundaries, traders can anticipate potential reversals or continuations and position themselves accordingly.

Trendline Trading in Practice: Translating Theory into Profit

To successfully implement trendline trading, meticulous attention to detail is crucial. Here’s a step-by-step guide to help you navigate the market with confidence:

-

Identify the Trend: The first step is to determine the prevailing trend. Draw trendlines along price highs for uptrends and price lows for downtrends.

-

Locate Support and Resistance Levels: Trendlines act as dynamic support and resistance levels. Breakouts above an uptrend line signal potential buying opportunities, while breakouts below a downtrend line indicate potential selling opportunities.

-

Time Your Entries and Exits: Use technical indicators such as moving averages or oscillators to refine your entry and exit points within the trend.

-

Manage Risk: Risk management is paramount in any trading strategy. Establish clear stop-loss and take-profit levels to mitigate potential losses.

Image: learnpriceaction.com

Why Trendline Trading? Unlocking its Advantages

Trendline trading offers a wealth of benefits that make it an attractive choice for traders of all levels:

-

Simplicity: The concept of trendlines is straightforward, making it accessible to both beginners and experienced traders.

-

Visual Appeal: Trendlines provide a clear visual representation of market trends, facilitating quick and informed decision-making.

-

Versatility: Trendline trading can be applied to any financial instrument, from forex pairs to stocks and commodities.

-

Profitability: By skillfully identifying and trading along trendlines, traders can capture significant profits while minimizing risks.

Forex Trendline Trading Strategy Pdf

Conclusion: Embracing Trendline Trading for Forex Mastery

Trendline trading is an invaluable weapon in the arsenal of any forex trader. Its simplicity, visual appeal, and profitability make it an ideal strategy for navigating the complexities of the financial markets. By mastering the art of trendline analysis, you can unlock the potential for consistent profits and establish a solid foundation for your trading journey. Remember, the key to success lies in meticulous execution, risk management, and a deep understanding of market dynamics. Embrace the power of trendline trading today and embark on the path to forex mastery!