Unlock the Secrets of Trend Lines: Your Essential Guide to Forex Success

Image: kulyfyyepi.web.fc2.com

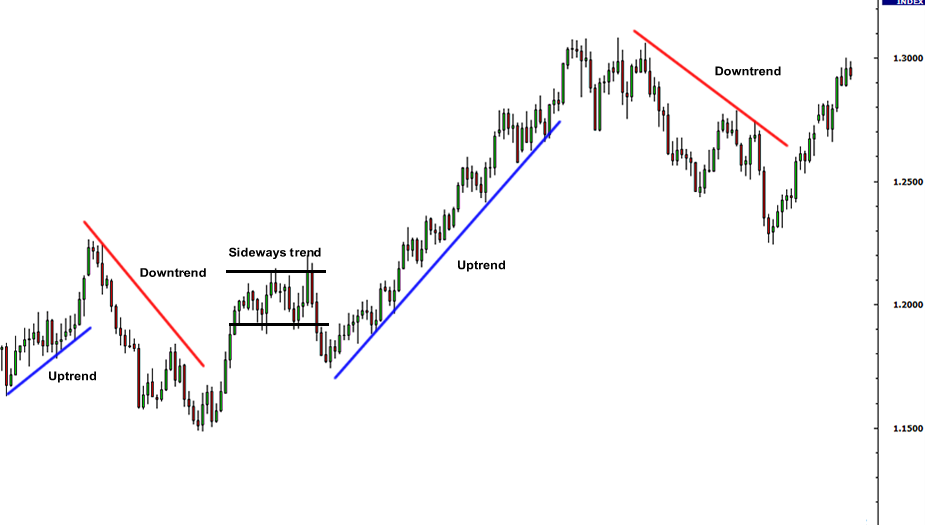

In the ever-evolving world of forex trading, navigating market trends is crucial for making informed decisions that can impact your financial success. Among the indispensable tools at your disposal are trend lines, powerful indicators that provide invaluable insights into market direction and potential opportunities.

Understanding Trend Lines: A Geometric Guide

Trend lines are essentially straight lines drawn along a series of highs (ascending lines) or lows (descending lines) in a price chart. They offer a visual representation of the prevailing market trend, highlighting the general direction in which prices are moving. By analyzing the angle of a trend line and its relation to price action, traders can gauge trend strength and identify potential trading opportunities.

Ascend to Success with Ascending Trend Lines

Ascending trend lines are drawn from a series of rising price lows, indicating an overarching upward trend. They act as support levels, often bouncing price action higher and creating opportunities for buying. When the price breaks above an ascending trend line, it signals a possible continuation of the uptrend.

Descend with Caution: Navigating Descending Trend Lines

Descending trend lines, on the other hand, connect falling price highs, portraying a downtrend. They serve as resistance levels, providing resistance and potentially pushing price action lower. A break below a descending trend line suggests the trend could persist downward, presenting potential selling opportunities.

Breaking the Trend: Identifying Trend Reversal Patterns

Identifying trend reversals is essential for successful forex trading. When the price breaks through a trend line in the opposite direction of the prevailing trend, it indicates a potential reversal. This is often accompanied by a change in the angle of the trend line and a divergence between the price action and the trend line.

Expert Insights: Unlocking Trend Line Mastery

Mastering the art of trend line analysis requires intuition and practice. Seek guidance from experienced traders who can provide valuable insights into market trends and help you refine your strategy. Here’s a critical nugget of wisdom from renowned forex trader Mark Douglas:

“The trend is your friend, but sometimes you have to let it go… Sometimes, the best trades are the ones you don’t make.”

Actionable Tips: Putting Trend Lines to Work

Leverage trend lines to enhance your forex trading strategy by implementing these practical tips:

- Identify multiple trend lines: Plot trend lines on different time frames to gain a comprehensive perspective of the market.

- Confirm your trend: Look for convergence between multiple trend lines, as it increases the likelihood of a valid trend.

- Set realistic targets: Don’t trade overly ambitious targets. Let the trend line itself guide your profit goals.

- Manage your risk: Use stop-loss orders to mitigate potential losses and protect your trading capital.

- Stay disciplined: Adhere to your trading plan, even when emotions run high.

Conclusion: Embracing the Power of Trend Lines

Trend lines are an indispensable tool in the forex trader’s arsenal, providing invaluable insights into market direction and potential trading opportunities. By mastering the art of trend line analysis, traders can position themselves for success in the ever-changing world of foreign exchange. Embrace the power of trend lines, unlock the secrets of price action, and embark on a profitable forex trading journey.

Image: forex-indicators.net

How To Use Trend Lines In Forex