A Journey into the Heart of Forex: Understanding Lot Size

Stepping into the dynamic world of forex trading, it’s imperative to grasp the fundamental concept of lot size. This crucial aspect determines the amount of currency traded and directly impacts your potential profits and risks. Imagine you’re at a bustling farmers market, eager to savor the freshest produce. Just as you select the right quantity of fruits and vegetables for your needs, choosing the appropriate lot size in forex trading is equally important. Join us on an educational journey as we unravel the mysteries of forex calculator lot size and equip you with the knowledge to navigate this exciting market with confidence.

Image: yoyofabol.web.fc2.com

Deciphering Lot Size: The Cornerstone of Forex Trading

At the core of forex trading lies the concept of a lot, representing a standardized unit of currency. In the forex market, a standard lot is equivalent to 100,000 units of base currency. Intriguingly, some brokers also offer mini and micro lots, with values of 10,000 and 1,000 base currency units, respectively. Understanding these lot sizes is paramount to comprehending the scale of your trades and calculating potential returns accurately.

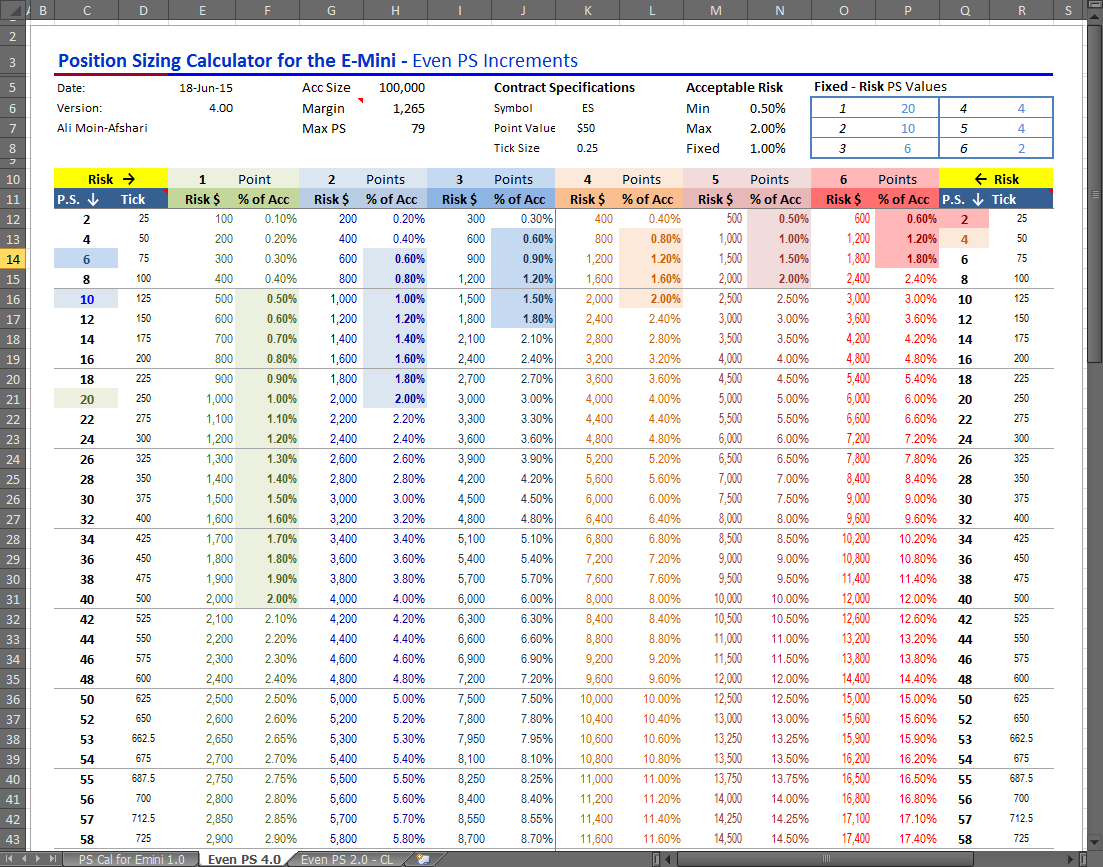

Forex Calculator Lot Size: A Tool to Master

Harnessing the power of forex calculator lot size is essential for successful trading. This indispensable tool provides a precise calculation of the number of units to trade based on your desired risk exposure and account balance. By inputting your desired risk percentage and account size, the calculator swiftly determines the appropriate lot size for your trade. Imagine standing before a complex mathematical equation, but with the forex calculator lot size as your ally, the solution unfolds effortlessly, empowering you to trade with precision and confidence.

Mastering Lot Size: A Journey to Trading Success

Choosing the optimal lot size is not a one-size-fits-all approach; it requires a careful assessment of your personal trading style, risk tolerance, and account size. For novice traders, starting with a smaller lot size is often prudent, minimizing potential losses while honing your trading skills. As you gain experience and confidence, you can gradually increase your lot size to amplify your profit potential. Remember, responsible trading involves prudently managing risk and choosing a lot size that aligns with your financial capabilities.

Image: forexscalpingwebinar.blogspot.com

Leverage: A Double-Edged Sword in Forex Trading

The concept of leverage deserves special attention in forex trading. It refers to the practice of borrowing funds from a broker to increase your trading power. While leverage can magnify potential profits, it also carries the inherent risk of amplifying losses. Using leverage wisely requires a thorough understanding of its implications and the ability to implement effective risk management strategies. Approach leverage with caution, ensuring that it aligns with your trading goals and risk appetite.

Piecing Together the Puzzle: Lot Size and Risk Management

Lot size plays a pivotal role in risk management, influencing the potential impact of market fluctuations on your trading account. The larger the lot size, the greater the potential gain or loss. Aligning your lot size with your financial capabilities and risk tolerance is vital. Consider your trading experience, account size, and the inherent volatility of the currency pair you’re trading. Prudent risk management ensures that potential losses do not outweigh your financial resilience.

Accuracy and Transparency: Cornerstones of Forex Calculator Lot Size

When utilizing a forex calculator lot size, precision is paramount. Ensure that the calculator you employ is reliable and provides accurate calculations. Seek out reputable sources and verify the accuracy of your calculations before executing trades. Transparency is equally important; thoroughly understand the underlying principles and algorithms used by the calculator to make informed decisions.

Forex Calculator Lot Size

Conclusion: The Path to Forex Trading Mastery

Navigating the forex market effectively hinges on a comprehensive understanding of lot size. By mastering the intricacies of forex calculator lot size, you gain the power to calculate the appropriate amount of currency to trade, accurately assess risk, and implement effective risk management strategies. Remember, responsible trading involves a measured approach, choosing a lot size that aligns with your financial capabilities, risk tolerance, and trading goals. Embrace the knowledge imparted in this article and embark on your forex trading journey with confidence and a clear understanding of lot size.