Saudi Arabia’s foreign exchange (forex) reserves are a critical component of the nation’s financial stability and a key indicator of its economic strength. These reserves represent the value of foreign currencies and gold held by the Saudi Arabian Monetary Agency (SAMA) and serve various essential functions for the Saudi economy.

Image: blogs.ubc.ca

In this article, we will delve into the importance of forex reserves for Saudi Arabia, exploring their uses, the factors influencing their fluctuation, and the challenges and opportunities associated with managing these reserves. By understanding the significance of forex reserves, we gain insights into the overall health of the Saudi economy and its resilience in the face of global economic headwinds.

The Importance of Forex Reserves for Saudi Arabia

Forex reserves play a crucial role in Saudi Arabia’s economic stability and growth, fulfilling several key functions:

- Currency Stability: Forex reserves help maintain the stability of the Saudi riyal by preventing sharp fluctuations in its value against other currencies. This is essential for promoting trade and investment, as businesses and investors need a stable currency environment to make informed decisions.

- Balance of Payments Support: Saudi Arabia often imports more goods and services than it exports, resulting in a trade deficit. Forex reserves can be used to finance this deficit by intervening in the currency market to prevent the riyal from depreciating excessively.

- Debt Repayment: The government can use forex reserves to repay foreign currency-denominated debt obligations, such as sovereign bonds and loans from international financial institutions.

- Foreign Aid and Investment: Saudi Arabia has a history of providing financial assistance to other countries and making strategic investments abroad. Forex reserves provide the financial resources for these initiatives, strengthening the nation’s diplomatic and economic ties.

Factors Influencing Forex Reserve Fluctuations

Several factors influence the size and volatility of Saudi Arabia’s forex reserves:

- Oil Prices: Oil is the backbone of the Saudi economy, and its price fluctuations directly impact forex reserves. Higher oil prices typically lead to higher reserves due to increased foreign currency earnings from oil exports.

- Government Spending: Excessive government spending can lead to a decline in forex reserves, especially if it exceeds the country’s revenue. Careful management of public finances helps maintain reserve stability.

- Capital Flows: Inflows of foreign capital into Saudi Arabia, such as portfolio investments and foreign direct investment, contribute to the growth of forex reserves. Outflows, on the other hand, can lead to reserve depletion.

- Currency Speculation: Speculators who anticipate a depreciation of the Saudi riyal may sell their riyals for foreign currencies, putting downward pressure on reserves. Central bank interventions and effective monetary policy can mitigate this effect.

Challenges and Opportunities

Managing forex reserves presents both challenges and opportunities for Saudi Arabia:

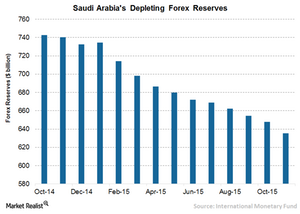

- Depletion of Reserves: Prolonged periods of low oil prices or excessive government spending can deplete forex reserves. Careful planning and prudent economic management are essential for avoiding such situations.

- Investment Opportunities: Forex reserves can be used to generate additional income for the Saudi economy by investing in foreign assets. Diversifying these investments across multiple asset classes and geographies can enhance returns and reduce risks.

- Volatility Control: Central banks use various monetary policy tools to control excessive volatility in forex reserves. This includes managing interest rates, intervening in currency markets, and adjusting reserve requirements.

Image: marketrealist.com

Forex Reserves Of Saudi Arabia

Conclusion

Saudi Arabia’s forex reserves are a vital component of the nation’s economic stability and growth. By maintaining adequate reserves, the government can ensure the stability of the riyal, support the balance of payments, repay foreign debt, provide foreign aid, and make strategic investments abroad. Understanding the factors that influence forex reserves and the challenges and opportunities associated with their management is crucial for policymakers and investors alike.

As Saudi Arabia embarks on its economic transformation, the prudent management of forex reserves will remain a key factor in maintaining the nation’s financial stability and fostering sustainable economic growth.