Unveiling the Secrets to Successful Forex Trading

The world of Forex (Foreign Exchange) trading can be a lucrative but volatile venture. Effective money management strategies are paramount for navigating market fluctuations and maximizing profit potential. This article delves into the realm of Forex money management, offering valuable insights, tips, and a downloadable PDF guide.

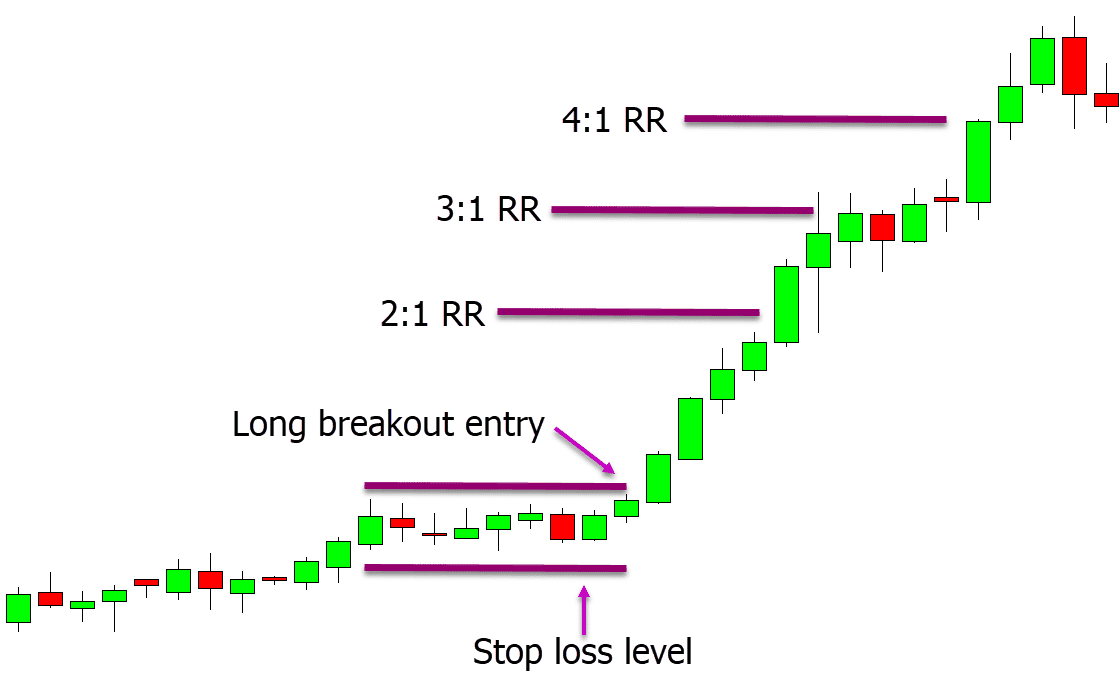

Image: learnpriceaction.com

Understanding Forex Money Management

At its core, money management involves allocating and safeguarding funds within Forex trading. It entails defining risk tolerance, setting stop-loss levels, determining trade size, and strategizing around position sizing. Prudent money management empowers traders to manage drawdowns, protect profits, and make informed trading decisions.

Comprehensive PDF Guide: A Trading Edge

To further enhance your mastery of Forex money management, we present a downloadable PDF guide. This comprehensive resource encompasses fundamental strategies, advanced techniques, and a wealth of knowledge essential for maximizing your trading potential.

Key Forex Money Management Strategies

- Define Risk Tolerance: Determine the amount of capital you can afford to potentially lose, ensuring that potential losses will not jeopardize your financial stability.

- Harness Stop-Loss Orders: Place stop-loss orders to automatically exit trades when prices reach predefined levels, limiting potential losses and enabling you to preserve your equity.

- Calculate Correct Trade Size: Determine the optimal trade size based on your risk tolerance, available capital, and anticipated market volatility.

- Strategize Position Sizing: Allocate funds across multiple trades to diversify risk and potentially enhance overall returns.

- Leverage Risk-Reward Ratio: Evaluate the potential profit against the potential loss for each trade, aiming to maintain a positive risk-reward ratio.

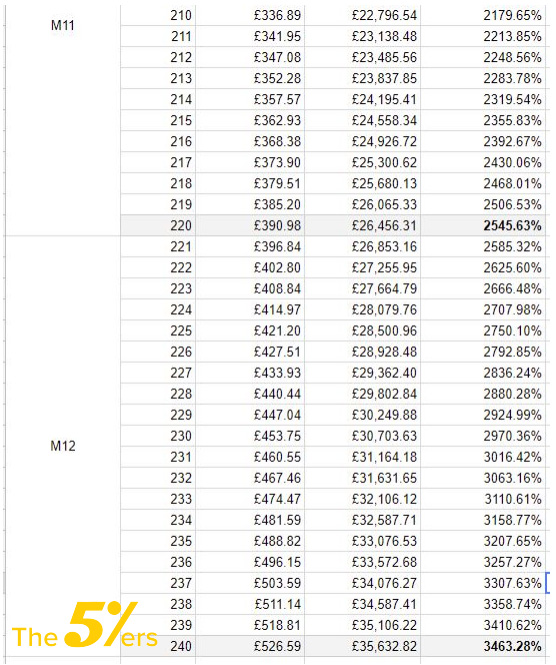

Image: the5ers.com

Tips and Expert Insights

- Maintain Discipline: Adhere to your predefined money management rules, avoiding emotional decision-making and ensuring objectivity.

- Evaluate Historical Data: Analyze previous market performance to ascertain risk and volatility patterns, aiding in informed trading decisions.

- Consider Spread Betting: Explore alternative trading options such as spread betting, which offers potential tax advantages in certain jurisdictions.

- Stay Updated: Monitor global economic events, news, and market analysis to make informed trading decisions based on current conditions.

- Utilize Technology: Leverage trading platforms and software that provide risk management and position sizing tools.

- Engage with Professionals: Seek guidance from experienced traders or financial advisors to gain valuable insights and optimize your trading strategy.

FAQs

- Q: What are the key principles of Forex money management?

A: Defining risk tolerance, setting stop-loss orders, calculating trade size, and strategizing around position sizing. - Q: How can I calculate my risk tolerance?

A: Assess your financial situation, investment horizon, and emotional resilience to potential losses. - Q: What are the benefits of using stop-loss orders?

A: Automatically exiting trades when predefined loss levels are reached, limiting potential losses and protecting profits. - Q: How do I determine the optimal trade size?

A: Consider your risk tolerance, available capital, and estimated market volatility. - Q: Why is it important to diversify risk?

A: Diversifying across multiple trades reduces the impact of losses on any single trade, enhancing potential returns.

Forex Money Management Strategies Pdf

Conclusion

Effective Forex money management strategies are indispensable for long-term trading success. By incorporating the principles and tips outlined in this article, you can gain a competitive edge, mitigate risk, and maximize your profit potential.

To further enhance your understanding and embark on a journey toward financial empowerment, download our comprehensive Forex money management strategies PDF guide today. Embark on the path to informed decision-making and prosperity in the dynamic world of Forex trading.

Is Forex Trading Interesting to You?