Introduction

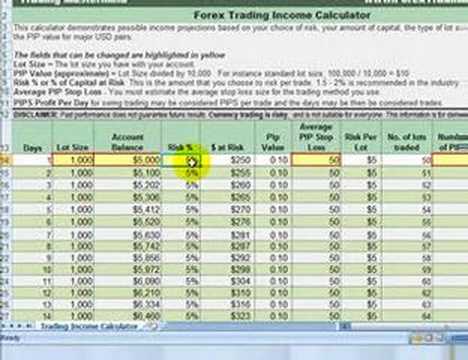

In the world of forex trading, determining the appropriate lot size for each trade is crucial for risk management and profit maximization. A lot size calculator excel is an invaluable tool that allows traders to calculate the exact number of currency units they wish to trade based on their account balance, risk tolerance, and desired leverage. Understanding how to use a forex lot size calculator excel will empower traders to optimize their trading strategies and enhance their chances of success.

Image: narekyfuhevaq.web.fc2.com

Understanding Lot Sizes and Units

A lot is a standardized unit of currency in the forex market. The most common lot size is the standard lot or 100,000 units of a currency. However, there are also mini lots (10,000 units), micro lots (1,000 units), and nano lots (100 units) available. The choice of lot size depends on the trader’s account size and risk appetite.

Using the Forex Lot Size Calculator Excel

The forex lot size calculator excel is a simple and straightforward tool that can be downloaded from various online sources. It typically requires the following inputs:

- Account Balance: The total amount of资金available in your trading account.

- Risk Percentage: The percentage of your account balance you are willing to risk on each trade.

- Leverage: The amount of leverage you are using, which is usually provided by your broker.

- Pip Value: The value of one pip (point in percentage) in the currency pair you are trading.

Once you have entered the required information, the calculator will automatically calculate the maximum number of lots you can trade while adhering to your specified risk parameters. It is essential to note that the calculator provides an estimate, and traders should always consider their individual circumstances and trading strategy when determining the appropriate lot size.

Benefits of Using a Forex Lot Size Calculator Excel

1. Improved Risk Management: By calculating the appropriate lot size, traders can effectively manage their risk exposure and prevent significant losses.

2. Enhanced Profitability: Optimizing lot size allows traders to maximize profits by entering trades that align with their account balance and risk tolerance.

3. Increased Confidence: Using a lot size calculator provides traders with confidence in their trading decisions, as they know they are operating within their preset risk parameters.

4. Avoidance of Overleveraging: The calculator helps traders avoid using excessive leverage, which can lead to substantial losses in adverse market conditions.

5. Time Saving: Lot size calculators save traders valuable time by automating the calculation process, allowing them to focus on other aspects of their trading.

Image: homecare24.id

Forex Lot Size Calculator Excel

Conclusion

A forex lot size calculator excel is an indispensable tool for forex traders seeking to determine the optimal lot size for each trade. By utilizing this tool, traders can mitigate risk, enhance profitability, and make informed trading decisions. Remember to approach lot size determination carefully, consider your account balance, risk tolerance, and the specific currency pair you are trading. With the knowledge and understanding provided in this guide, traders can effectively leverage the forex lot size calculator excel to optimize their trading experience and achieve their financial goals.