Navigating the tumultuous waters of the forex market can be a daunting task, especially when faced with unpredictable currency fluctuations. Hedging, a risk management strategy, provides a way to protect your investments and mitigate potential losses. This article will delve into the world of forex hedging, focusing specifically on the benefits and techniques of using two accounts.

Image: www.tradingheroes.com

**Why Hedge Forex with 2 Accounts?**

Employing two forex accounts for hedging offers several distinct advantages:

- Increased Flexibility: Separate accounts allow traders to customize hedging strategies based on varying risk profiles and investment goals.

- Enhanced Control: Managing trades in two accounts enables precise adjustments and real-time monitoring, ensuring optimal risk management.

- Reduced Spread Costs: Spreading trades across two accounts can potentially reduce overall spread costs, resulting in improved profitability.

**Understanding Forex Hedging**

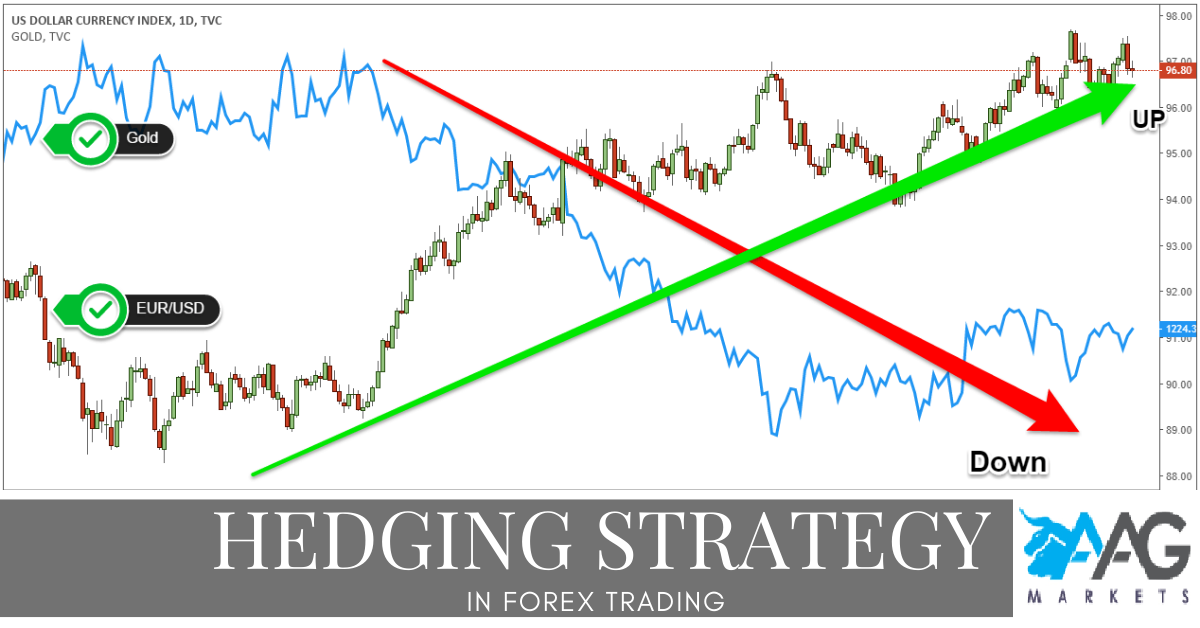

Forex hedging involves opening opposing positions in different currency pairs that exhibit negative correlation. By doing so, traders seek to offset potential losses incurred on one position with potential gains on the other. This strategy aims to minimize overall market exposure and enhance portfolio stability.

**Implementing Forex Hedging with 2 Accounts**

To effectively hedge forex with two accounts, follow these steps:

- Open Two Accounts: Create separate accounts with two different forex brokers. This separation allows for independent trading and risk management.

- Identify Correlated Currency Pairs: Research and select currency pairs that exhibit inverse or negatively correlated price movements. This ensures effective hedging by minimizing market exposure.

- Determine the Hedge Ratio: Calculate the appropriate size of the hedge orders. The ratio should be carefully calculated based on the desired level of risk reduction and potential return.

- Monitor and Adjust: Regularly monitor the performance of both accounts and make necessary adjustments to the hedge ratio as market conditions change.

For example, a trader with a speculative position in EUR/USD can offset risk by opening an opposing hedge position in USD/CHF. As EUR and USD exhibit positive correlation and USD and CHF tend to move in opposite directions, this hedging strategy aims to balance any losses incurred on the EUR/USD trade with potential gains on USD/CHF.

Image: www.allperfectstories.com

**Tips and Expert Advice**

Consider the following tips from seasoned forex traders:

- Define Clear Trading Rules: Establish precise entry and exit points for both the hedging and speculative positions.

- Manage Risk Effectively: Determine the maximum drawdown you are willing to tolerate on each account.

- Avoid Emotional Trading: Stay disciplined and avoid making trades based on emotions.

- Seek Professional Assistance: Consult with a qualified financial advisor for personalized guidance and support.

Remember, forex hedging is a risk management tool, not a guarantee of profit. It should be implemented within a comprehensive trading plan and only after careful consideration.

**FAQ**

Q: How can I determine the correlation between different currency pairs?

A: Utilize online correlation calculators or historical data to assess the historical relationship between currency pairs.

Q: How often should I monitor my hedging positions?

A: Regular monitoring, at least daily, is recommended to ensure positions are appropriately aligned with market conditions.

Q: Is forex hedging suitable for all traders?

A: Hedging is most appropriate for experienced traders with a clear understanding of risk management. Beginners should exercise caution and seek professional advice before implementing hedging strategies.

Forex Hedging With 2 Accounts

**Conclusion**

Forex hedging with two accounts offers a robust approach to managing risk and mitigating potential losses. By leveraging separate accounts, traders gain increased flexibility, enhanced control, and potentially lower spread costs. While providing value to forex investors, it’s crucial to remember that hedging is not without its challenges and should be approached strategically as part of a comprehensive trading plan.

Are you ready to embark on the journey of forex hedging with two accounts? Share your insights and questions below!