Introduction

In the realm of currency trading, the concept of “pips” plays a pivotal role. Understanding the value and significance of pips is crucial for forex traders to navigate the market effectively. In this article, we delve into the intricacies of pips, shedding light on their definition, calculation, and implications for trading strategies.

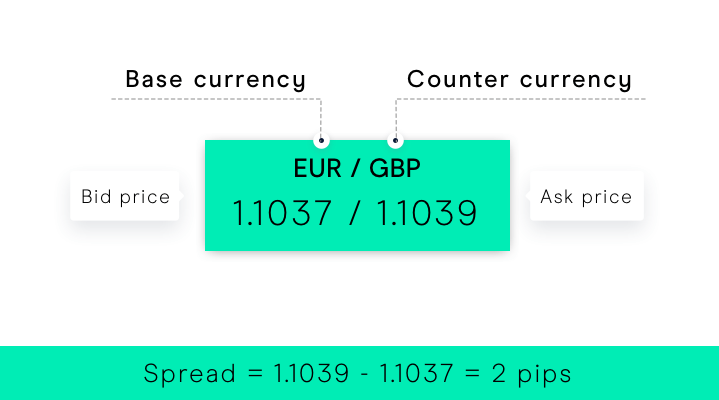

Image: www.cmcmarkets.com

What is a Pip?

A pip, short for “point in percentage,” represents the smallest fractional movement in the exchange rate between two currencies. The pip value varies depending on the currency pair being traded. For most major currency pairs, such as EUR/USD, one pip is equivalent to a change of 0.0001 in the quoted price. In other words, if EUR/USD moves from 1.1234 to 1.1235, that would be considered a gain or loss of one pip.

Calculating Pip Value

The pip value for a given currency pair can be calculated using the following formula:

Pip Value = 1 / Pip Size

Where:

- Pip Size is the number of decimal places in the currency pair’s quoted price.

For instance, if EUR/USD is quoted to four decimal places (1.1234), the pip size is 0.0001. Therefore, the pip value would be:

Pip Value = 1 / 0.0001 = 10,000

This means that for every pip movement in EUR/USD, the trader’s profit or loss will be equivalent to 10,000 units of the quoted currency (in this case, USD).

Significance of Pips

Pips are not only used to measure currency price movements but also play a vital role in several aspects of forex trading:

-

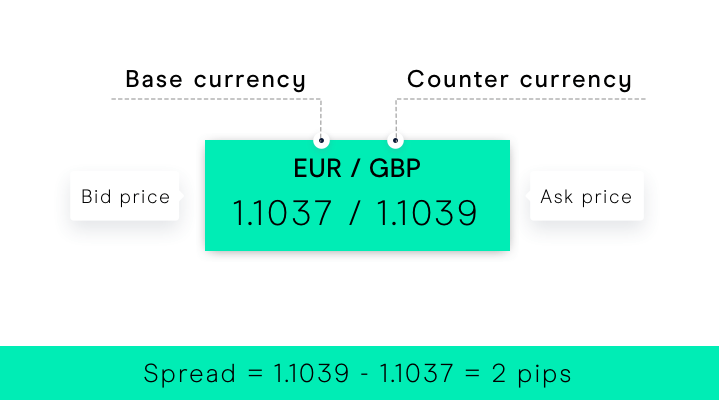

Image: www.cmcmarkets.comProfit and Loss Calculations:

Pips serve as the basis for calculating profits and losses in forex trades. By tracking pip movements, traders can determine the profitability of their positions.

-

Risk Management:

Pips help traders manage their risk exposure effectively. By setting stop-loss and take-profit orders at a specified number of pips away from the entry price, traders can limit potential losses and secure profits.

-

Technical Analysis:

Pips are used in technical analysis to identify trading opportunities and predict price movements. By studying historical pip fluctuations, traders can develop trading strategies that exploit predictable patterns in the market.

Latest Trends and Developments

The concept of pips has remained fundamental in forex trading over the years. However, advancements in technology and changes in market dynamics have brought about some notable developments:

-

Fractional Pips:

Nowadays, some brokers offer the ability to trade in fractional pips. This allows for more precise positioning of orders and potentially smaller profit targets.

-

Pip-Based Indicators:

Traders can utilize technical indicators that specifically measure pip movements, such as the Average True Range (ATR) and the Pip Size indicator. These tools help traders gauge market volatility and adjust their trading strategies accordingly.

-

Algorithmic Trading:

Algorithmic trading systems rely on pip movements to execute trading decisions automatically. These systems are programmed with predefined criteria based on pip fluctuations, enabling traders to respond quickly to market conditions.

Tips and Expert Advice

Understanding pips and their implications can help traders make informed decisions:

-

Choose Currency Pairs with Low Pip Volatility:

Currency pairs with lower pip volatility tend to be less susceptible to erratic price movements, making them suitable for beginner traders.

-

Use Pip Calculators:

Online pip calculators can assist traders in quickly determining pip values for different currency pairs and account sizes.

-

Practice Risk Management:

Conservative risk management practices are essential. Setting realistic stop-loss and take-profit levels based on pips helps mitigate potential losses.

-

Stay Informed:

Keeping up with forex news and market updates can provide valuable insights into factors that influence pip movements.

Frequently Asked Questions

-

Q: What is the pip size for all currency pairs?

A: Not all currency pairs have the same pip size. The pip size varies depending on the currency pair’s quoted price. -

Q: Can pips be used to trade cryptocurrencies?

A: Pips are primarily used in forex trading, but some cryptocurrency exchanges offer the ability to trade cryptocurrencies in fractional units that can be similar to pips. -

Q: How many pips are in a dollar?

A: This varies depending on the currency pair and the exchange rate. The pip value is a relative measurement that represents the smallest possible change in the exchange rate.

How Much Is 1 Pip In Forex

Conclusion

Pips are fundamental to the intricate world of forex trading, serving as a measure of currency price fluctuations and providing a basis for trading decisions. Understanding the value, calculation, and significance of pips empowers traders with the knowledge and tools to navigate the market with greater confidence and precision. Whether you are a seasoned trader or just starting your forex journey, familiarizing yourself with the concept of pips is an essential step toward success.

Are you interested in learning more about the significance of pips in forex trading? Share your thoughts and questions in the comments below!