In the dynamic world of forex trading, the ability to identify and capitalize on market correlations can significantly enhance your profit potential. Among the most reliable and effective strategies is forex correlation, a technique that involves exploiting the inherent relationship between currency pairs. This article delves into the fascinating world of forex correlation, revealing its secrets and providing a fail-proof strategy to guide your trading decisions.

/forex-correlation-table-57a38be73df78cf4593c1c05.jpg)

Image: www.thebalance.com

The Alchemy of Forex Correlation: Connecting Currency Pairs

Forex correlation, a fundamental concept in currency trading, refers to the interdependency between different currency pairs. It measures the extent to which two currency pairs move in the same or opposite directions. Understanding this relationship is crucial for traders seeking to minimize risk, identify profitable opportunities, and ride the waves of market movements.

Consider the relationship between the EUR/USD and GBP/USD currency pairs. A positive correlation between these pairs indicates that they tend to move in the same direction, while a negative correlation suggests they move in opposite directions. The strength of the correlation is measured by a correlation coefficient, ranging from -1 to +1. A coefficient of -1 indicates a perfect negative correlation, while +1 indicates a perfect positive correlation.

Mastering the Art of Identifying Correlation

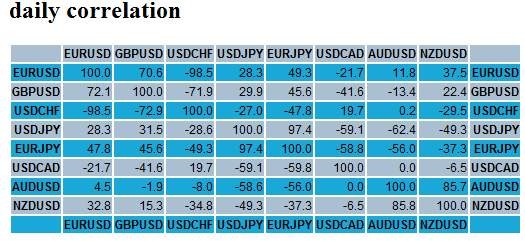

Identifying forex correlations requires meticulous analysis of historical data. Various technical tools and indicators can assist in this endeavor. One popular method is to use a correlation matrix, which displays the correlation coefficients between multiple currency pairs. Traders can also employ correlation charts to visualize the correlation patterns over time.

Exploiting Correlation for Profitable Decisions

The knowledge of forex correlation empowers traders to craft sophisticated trading strategies that leverage these relationships. By understanding the direction of the correlation between two currency pairs, traders can make informed decisions about whether to enter or exit trades.

For instance, if the EUR/USD and GBP/USD currency pairs exhibit a positive correlation, a trader might consider opening a long position in both pairs. Alternatively, if the correlation is negative, they might open a long position in one pair and a short position in the other.

Image: investpost.org

Navigating Common Pitfalls and Maximizing Success

While forex correlation can be a potent tool, it’s essential to navigate its nuances and potential pitfalls. One crucial factor to consider is the time frame of the correlation. Correlations can vary significantly depending on the time frame analyzed. It’s advisable to conduct analysis on multiple time frames to gain a comprehensive understanding of the correlations.

Furthermore, it’s important to remember that forex correlation is not a perfect predictor of future price movements. Market conditions can change rapidly, and unforeseen factors may disrupt established correlations. Traders should always consider other fundamental and technical factors when making trading decisions.

Forex Correlation Never Fail Strategy

Embrace the Power of Forex Correlation

Harnessing the power of forex correlation can transform your trading endeavors. By identifying and exploiting the interdependency between currency pairs, traders can make more informed decisions, minimize risk, and increase their profit potential. Remember, the key to successful forex correlation trading lies in diligent analysis, an understanding of market dynamics, and a steadfast adherence to risk management principles.

Embrace the secrets of forex correlation, unlock the mysteries of the currency markets, and embark on a journey of trading mastery.