Introduction

In the dynamic and often unpredictable world of currency trading, volatility and risk are ever-present challenges. As traders navigate the complex landscape of currency pairs, understanding the correlation between different currencies can provide a valuable advantage in mitigating risk and enhancing profitability. One powerful tool in this regard is a forex correlation hedging strategy, a technique that utilizes the correlation between currency pairs to create a risk-averse portfolio. In this comprehensive article, we will delve into the intricacies of forex correlation hedging, exploring its benefits, concepts, and practical implementation to empower traders with a robust risk management solution.

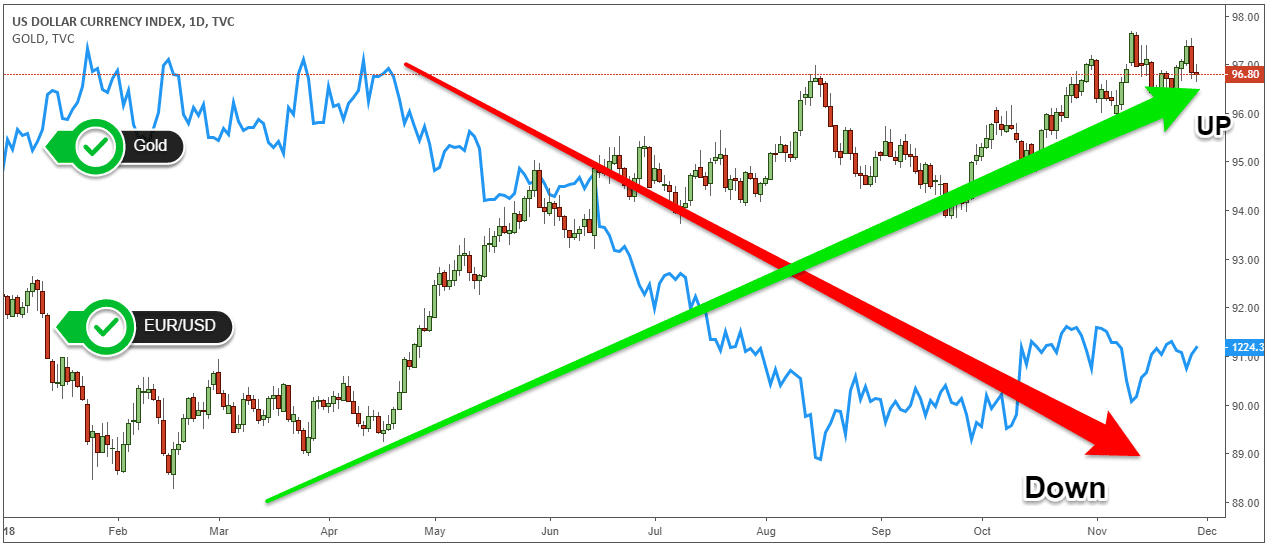

Image: tradingstrategyguides.com

The Concept of Currency Correlation

Currency correlation measures the degree of simultaneous price movements between two different currency pairs. Positive correlation indicates that the price movements of the two pairs tend to move in the same direction, while negative correlation suggests that they tend to move in opposite directions. Understanding currency correlation is crucial because it allows traders to identify pairs that exhibit similar price behaviors and exploit these relationships to create strategies that minimize risk.

Benefits of Forex Correlation Hedging

Incorporating a forex correlation hedging strategy offers a multitude of benefits to traders:

- Risk Reduction: By hedging opposing currency pairs with similar price movements, traders can effectively offset potential losses. When one currency pair experiences a downturn, the correlated pair is likely to rise, compensating for the loss.

- Portfolio Diversification: Hedging with correlated pairs introduces diversification into a trader’s portfolio, reducing overall volatility and exposure to single currency risks.

- Increased Profitability: Hedging can capture profits from currency pairs that move in tandem, allowing traders to enhance their returns consistently.

Types of Forex Correlation Hedges

Traders can employ various types of correlation hedges depending on their risk appetite and trading objectives:

- Direct Hedge: Involves holding two opposing currency pairs with a high positive correlation. The profit from one pair is expected to offset the loss from the other.

- Indirect Hedge: Utilizes two currency pairs with high negative correlation. A gain in one pair potentially compensates for a loss in the other.

- Cross Hedge: Hedging between two currency pairs with differing positive correlations. This strategy requires precise calculation to balance the risk and reward.

Image: indicatorchart.com

Implementing a Correlation Hedging Strategy

Implementing a successful forex correlation hedging strategy involves the following steps:

- Identify Correlated Pairs: Use correlation charts or correlation coefficients to identify currency pairs with strong positive or negative correlations.

- Calculate Position Sizing: Determine the appropriate position sizes for each currency pair based on risk tolerance and account size. Consider using a position size calculator for accuracy.

- Monitor the Hedge: Closely monitor the performance of the hedged pairs and adjust positions as needed. Monitor correlation levels to ensure that the hedge remains effective.

Forex Correlation Hedging Strategy Pdf

Conclusion

Harnessing the power of forex correlation hedging strategies empowers traders with a valuable risk management tool. By understanding currency correlation and implementing appropriate hedging techniques, traders can significantly reduce portfolio volatility, enhance profitability, and navigate the complexities of the forex market with greater confidence. Whether you are a seasoned professional or a novice trader, incorporating correlation hedging into your trading strategy can provide a substantial advantage in the pursuit of consistent trading success.