As a seasoned trader, I recall being bewildered by the myriad of acronyms in the forex market. One such acronym that initially perplexed me was CTM. Amidst the hustle and bustle of the trading floor, I felt a daunting sense of being out of my depth. Determined to bridge the knowledge gap, I meticulously delved into the world of foreign exchange, unearthing the significance and implications of CTM.

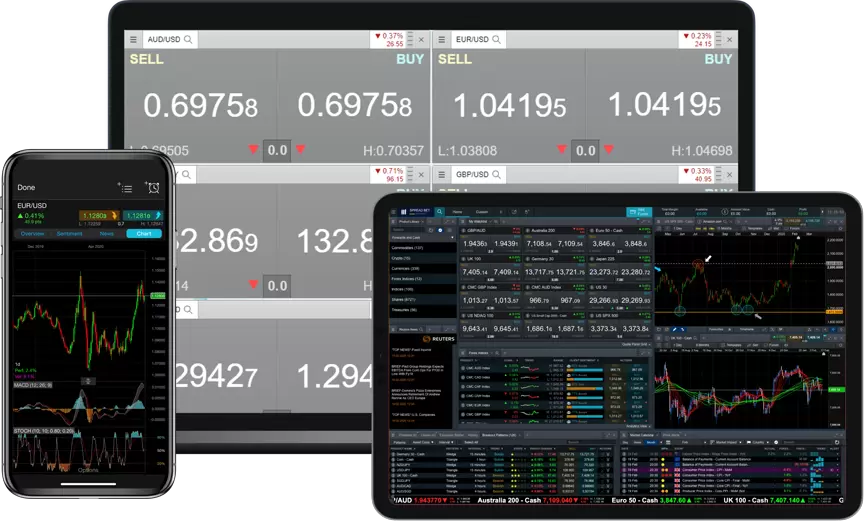

Image: www.cmcmarkets.com

In the following comprehensive guide, I will embark on a journey to unravel the intricate details surrounding CTM’s role in forex. Whether you are a seasoned trader or just starting to navigate the complexities of the global currency markets, this article will serve as your beacon, illuminating the path towards a deeper understanding.

Continuous Time Model: The Foundation of CTM

To fully grasp the concept of CTM, we must first venture into the realm of stochastic processes. Forex price movements, like many other phenomena in nature, exhibit a stochastic nature, meaning they evolve randomly over time. CTM, short for Continuous Time Model, plays a pivotal role in modeling these stochastic processes, providing a framework to analyze and forecast the intricate dynamics of the forex market.

Unlike traditional discrete-time models, which capture price changes at specific intervals, CTM operates in continuous time. This allows for a more precise representation of market behavior, especially over shorter time frames where minute price fluctuations can exert a significant impact on trading decisions. CTM’s continuous nature enables traders to capture the nuances of price movements, unlocking opportunities for more accurate trading strategies.

CTM in Practice: Unraveling its Applications

CTM’s versatility extends to a wide range of applications within the forex market. Here are a few key examples:

1. Price Forecasting: CTM serves as a powerful tool for forecasting future price movements. By simulating stochastic processes, traders can gain insights into the potential trajectories of currency pairs, empowering them to make informed trading decisions.

2. Risk Management: CTM empowers traders with the ability to assess and quantify risk. Sophisticated CTM-based models can simulate various market scenarios, evaluating the impact of different trading strategies on potential losses.

3. Strategy Optimization: CTM facilitates the optimization of trading strategies by enabling traders to test and refine their approaches. Through simulations, traders can identify strengths and weaknesses in their strategies, ultimately enhancing their trading performance.

4. Market Analysis: CTM provides a robust framework for analyzing market trends and patterns. Traders can leverage CTM-based models to identify correlations between currency pairs, market inefficiencies, and potential trading opportunities.

Current Trends and Developments: Shaping the Future of CTM

The world of CTM is constantly evolving, driven by advancements in technology and a deeper understanding of market dynamics. Here are a few noteworthy trends shaping the future of CTM in forex:

1. Machine Learning Integration: Machine learning algorithms are increasingly being incorporated into CTM models, enhancing their predictive capabilities. By leveraging vast historical data, machine learning algorithms can identify complex patterns and relationships, leading to more accurate forecasts.

2. Cloud Computing: Cloud computing platforms are becoming indispensable for running complex CTM simulations. The scalability and on-demand availability of cloud computing resources enable traders to perform extensive simulations without the constraints of local computing power.

3. Real-Time Data Analysis: Access to real-time market data is becoming increasingly crucial for CTM applications. Real-time data feeds allow traders to incorporate the latest market information into their models, ensuring that their strategies remain adaptive and responsive.

Image: www.dxbprint.com

Expert Tips and Advice: Enhancing Your CTM Proficiency

As you venture into the realm of CTM, consider these expert tips to maximize your understanding and utilization:

1. Seek Education and Training: Invest in education and training to acquire a solid foundation in stochastic processes, mathematical finance, and CTM modeling techniques. This knowledge will empower you to harness the full potential of CTM.

2. Practice and Experiment: Apply your theoretical knowledge in practice by experimenting with different CTM models and parameters. Hands-on experience is invaluable for developing your intuition and refining your trading strategies.

3. Leverage Technology: Utilize available technology, such as CTM software and cloud computing platforms, to enhance the efficiency and accuracy of your analysis. These tools can automate complex calculations and simulations, freeing up your time for decision-making.

4. Stay Informed: Keep abreast of the latest developments and trends in CTM and forex market analysis. Attend webinars, read research papers, and engage with the trading community to stay at the forefront of knowledge.

FAQ: Addressing Common Queries

1. What is the difference between CTM and discrete-time models?

CTM operates in continuous time, allowing for more precise modeling of market behavior over shorter time frames, while discrete-time models capture price changes at specific intervals.

2. How can CTM help me improve my trading performance?

CTM enables you to forecast price movements, assess risk, optimize strategies, and analyze market trends, empowering you to make more informed trading decisions.

3. Is prior knowledge in mathematics required to understand CTM?

While a basic understanding of mathematics is beneficial, CTM can be made accessible through simplified explanations and practical applications.

Ctm Stands For In Forex

Conclusion

CTM stands as a cornerstone of modern forex analysis, providing a powerful toolset for understanding and navigating the intricacies of the market. By embracing CTM’s capabilities, you can unlock a deeper level of market comprehension, ultimately enhancing your trading prowess. Whether you are an experienced trader seeking to refine your strategies or a novice embarking on your forex journey, CTM holds the key to unlocking your trading potential.

Let me know if you have any further questions or if there is a specific aspect of CTM you would like to explore further. As an experienced trader and financial analyst, I am dedicated to empowering traders with the knowledge and tools they need to succeed in the dynamic world of forex.