Introduction

In the realm of global finance, the ability to transfer funds effortlessly across borders has become increasingly crucial. For individuals and businesses in India, the necessity to manage international forex transfers is paramount. This article delves into the intricacies of maximizing such transfers into India, guiding readers through the process and highlighting key strategies to optimize results.

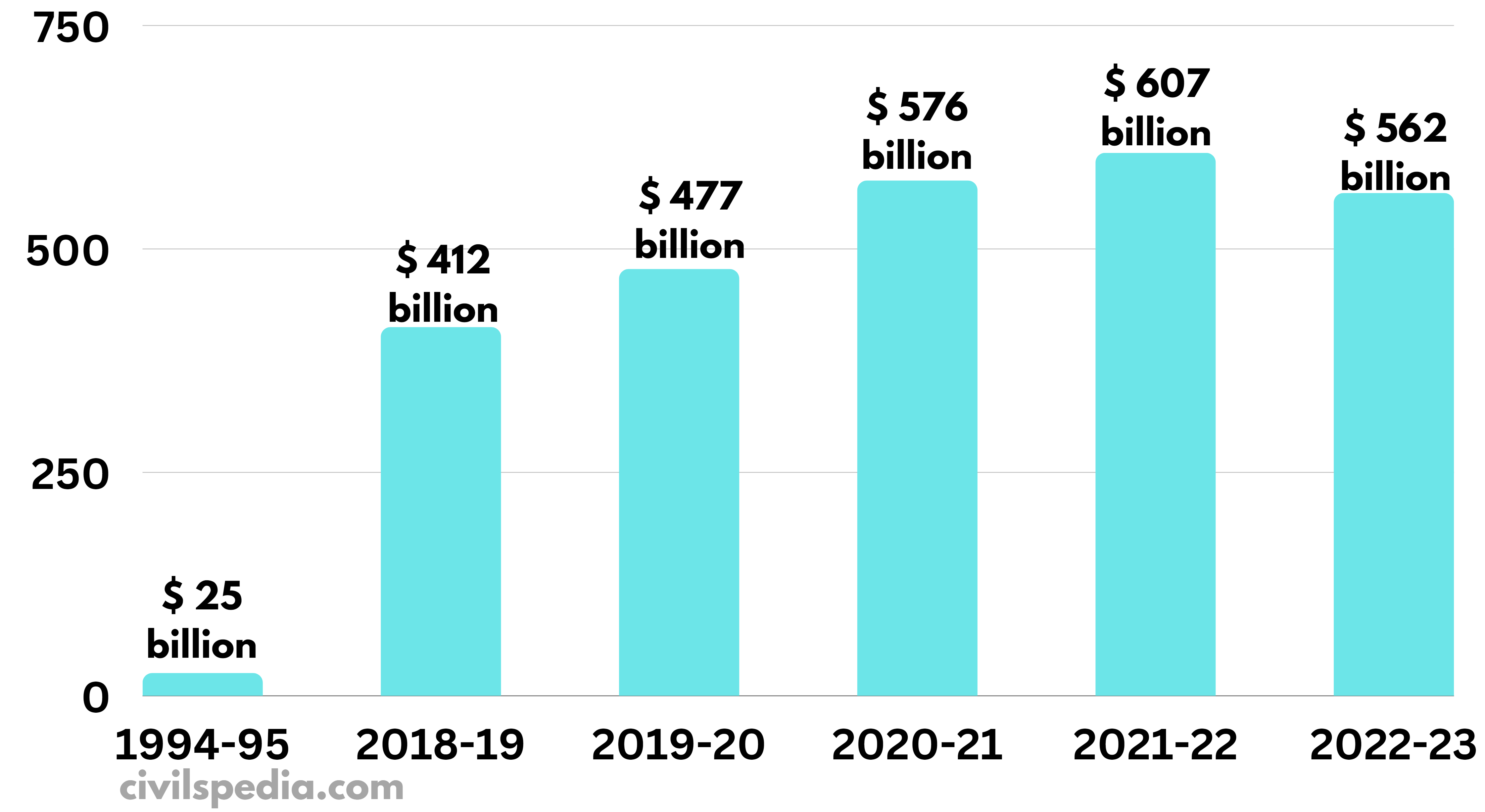

Image: civilspedia.com

International forex transfers involve converting one currency into another for remittance abroad. For Indian residents, receiving foreign exchange inflows is a common occurrence, ranging from overseas remittances to business transactions and investments. Navigating the complexities of international forex transfers requires a comprehensive understanding of the process, the prevailing regulations, and the factors that influence the exchange rate.

Understanding Maximum Forex Limits for Inward Remittances

The Reserve Bank of India (RBI) has instituted limits on the maximum amount of foreign currency that can be remitted into India. These limits vary depending on the purpose of the remittance and the source of funds. For instance, individuals can receive up to USD 250,000 per financial year under the Liberalized Remittance Scheme (LRS). This limit applies to remittances for personal use, such as education, medical expenses, and travel.

For businesses, the limits are generally higher, subject to compliance with specific regulations. Foreign direct investment (FDI) inflows are permitted within the sectoral caps and approval process established by the Foreign Exchange Management Act (FEMA). Companies may also utilize other channels, such as external commercial borrowings (ECBs), to raise foreign currency.

Maximizing Exchange Rates for Forex Transfers

When transferring foreign exchange into India, securing the most favorable exchange rate is essential. Several factors can influence the exchange rate, including the prevailing market conditions, demand and supply dynamics, and economic policies. Here are some strategies to maximize exchange rates:

- Monitor exchange rate trends: Keep track of the fluctuations in the exchange rate between the source and target currencies. Identify periods when the rate is beneficial for the transfer.

- Compare different providers: Various banks, money transfer services, and online platforms offer forex services. Compare the exchange rates, fees, and transfer time offered by different providers to find the most competitivoptions.

- Use limit orders: If the exchange rate is not favorable at the time of transfer, consider placing a limit order with your service provider. This allows you to specify the desired exchange rate and have the transfer executed automatically.

- Negotiate with banks: For large-value transactions, banks may be willing to negotiate a better exchange rate. Contact your bank and inquire about their flexibility for high-value inward remittances.

- Consider hedging strategies: For businesses and individuals expecting frequent forex inflows, consider hedging strategies to mitigate currency fluctuations. This involves using financial instruments, such as forward contracts, to lock in an exchange rate for future transactions.

Optimizing Inward Forex Remittances

In addition to maximizing exchange rates, there are several other strategies that can help optimize inward forex remittances into India:

- Choose the right channel: Depending on the amount, purpose, and frequency of the remittances, choose the most suitable channel. Banks, money transfer services, and online platforms offer various options with different fee structures and processing times.

- Submit required documentation: Ensure you have all the necessary documentation to support the purpose of the remittance. This may include invoices, contracts, or proof of identity.

- Be aware of taxes and charges: India has specific regulations regarding the taxation of inward remittances. Be aware of any applicable taxes or charges that may be levied on the transferred funds.

- Plan your remittances: Regular and planned remittance strategies can help you take advantage of favorable exchange rate fluctuations and minimize transfer costs.

- Explore alternative remittance solutions: In addition to traditional banking channels, consider alternative remittance solutions, such as peer-to-peer (P2P) platforms or cryptocurrency exchanges, which may offer lower fees and faster transfer times.

Image: www.reuters.com

Maximum International Forex Transfer Into Account India

Conclusion

Maximizing international forex transfers into India requires a well-informed approach that considers the interplay of exchange rate fluctuations, regulations, and available remittance channels. By understanding the limits, employing strategies to secure favorable exchange rates, and optimizing the remittance process, individuals and businesses can enhance the efficiency and effectiveness of their international forex transfers, ensuring a seamless inflow of foreign currency into India.