In the dynamic world of forex trading, understanding gaps can be the key to unlocking lucrative opportunities. Gaps, which occur when the market opens at a price significantly different from the previous close, create unique trading scenarios that can yield substantial profits if navigated strategically. This comprehensive guide will delve into the intricacies of trading gaps in forex, empowering you with the knowledge and tactics to maximize your returns and minimize risks.

Image: hulkgreeneyes.blogspot.com

What are Forex Gaps and Why They Matter

Forex gaps represent market inconsistencies that arise when the opening price differs substantially from the prior closing price. These gaps can result from significant news events, economic data releases, natural disasters, or geopolitical tensions that occur during market closures, leaving a void of trading activity.

Gaps provide valuable insights into market sentiment and future price movements. They can signal a change in trend, the emergence of new support or resistance levels, or indicate the market’s reaction to important events. Traders who can accurately identify and interpret gaps can gain an edge in predicting future price direction and capitalizing on market opportunities.

Types of Forex Gaps and Their Significance

Forex gaps can be classified into three primary types:

-

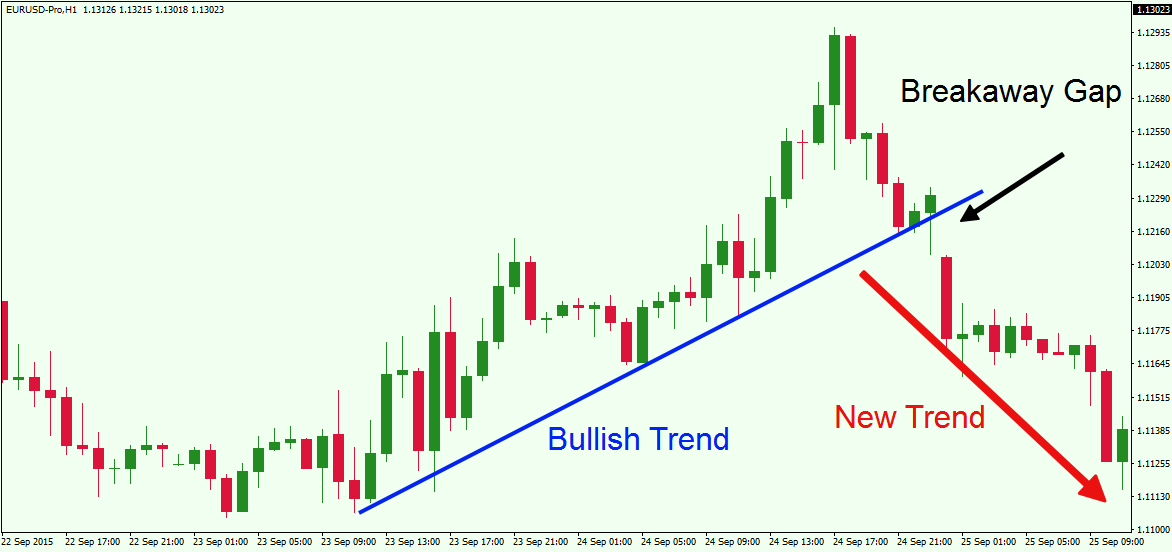

Breakaway Gaps: These gaps occur when the market opens significantly higher or lower than the previous close, indicating a potential breakout or reversal in price trend.

-

Continuation Gaps: These gaps occur within an established trend, extending the previous price movement in the same direction.

-

Exhaustion Gaps: These gaps form at the end of a strong price move and signal a potential reversal or consolidation.

Understanding the different types of gaps and their implications is crucial for making informed trading decisions.

Identifying Forex Gaps: A Step-by-Step Guide

-

Monitor News and Events: Stay updated with economic data releases, political announcements, and global events that have the potential to impact the market.

-

Check Forex Calendars: Forex calendars provide a schedule of upcoming news events and data releases that can trigger gaps.

-

Analyze Price Charts: Examine historical price charts to identify areas where gaps have occurred in the past. These patterns can provide clues for future gap formations.

-

Use Gap Detection Tools: Utilize technical indicators and trading platforms that offer gap detection capabilities to automate the process.

Image: forextraininggroup.com

Trading Strategies for Forex Gaps

-

Gap Fill Strategy: This strategy involves trading in the expectation that a gap will eventually fill, meaning the price will move back to the previous close. Traders can place orders near the gap level to capitalize on this reversion.

-

Gap Breakout Strategy: This strategy identifies gaps that signal a breakout of an existing trend. Traders can enter trades in the direction of the breakout, targeting potential profit levels.

-

Gap Consolidation Strategy: This strategy involves identifying gaps that form during consolidation periods. Traders can enter trades within the gap range, anticipating a breakout in either direction.

-

Gap Fade Strategy: This strategy involves trading against the direction of a gap, anticipating a reversal. Traders can enter short or long positions depending on whether the gap is up or down.

Risk Management for Gap Trading

Trading gaps involves inherent risks that require prudent risk management strategies:

-

Establish Clear Stop Loss Levels: Determine appropriate stop loss levels to limit potential losses if the trade moves against you.

-

Control Leverage: Exercise caution when using leverage, as it can magnify both profits and losses.

-

Limit Trade Size: Manage your risk by trading with a small fraction of your account balance, allowing for multiple trades without risking excessive capital.

Master the Art of Gap Trading: Expert Tips

-

Understand Market Dynamics: Gain a deep understanding of forex fundamentals, economic indicators, and global events that influence price movements.

-

Use Multiple Time Frames: Analyze price charts on various time frames to identify gaps in different market contexts.

-

Test Trading Strategies: Before implementing gap trading strategies in live markets, test them thoroughly on historical data or demo accounts.

-

Stay Informed and Adapt: Market conditions are constantly evolving. Stay updated with the latest news and research to adjust your gap trading strategies accordingly.

-

Seek Guidance from Professionals: Consider consulting with experienced traders or financial advisors to enhance your knowledge and trading skills.

How To Trade Gap In Forex

Conclusion

Trading gaps in forex can be a rewarding pursuit for those who possess the knowledge, skills, and risk management discipline. By understanding the different types of gaps, recognizing their implications, and implementing sound trading strategies, you can turn market openings into profitable opportunities. Embrace the power of gaps to enhance your forex trading prowess and achieve consistent success. Remember, continuous learning, market analysis, and prudent risk management are the keys to unlocking the full potential of gap trading in forex.