As an avid currency trader, I often found myself perplexed by the intricacies of bid and ask rates in the forex market. These rates play a crucial role in determining the profitability of my trades, yet understanding their nuances can be daunting.

Image: libertex.com

To clarify these concepts, I embarked on a journey to delve into the depths of bid and ask rates, their implications for forex trading, and the latest trends and expert advice. In this comprehensive guide, I aim to shed light on this essential aspect of forex trading, empowering you to navigate the forex market with confidence.

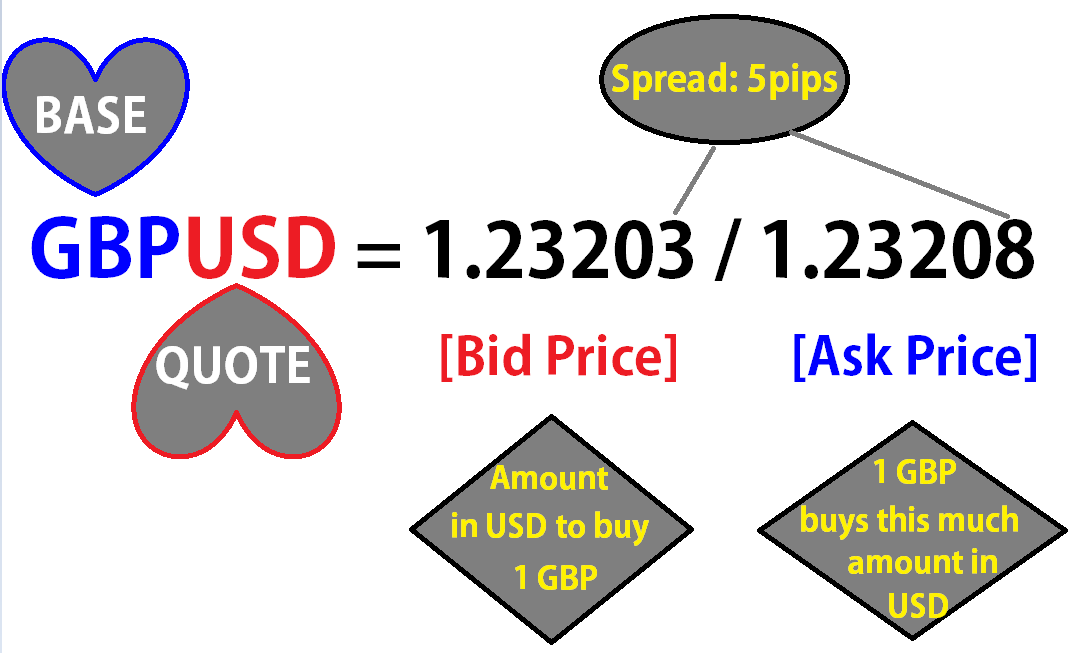

Bid Rate: Unveiling the Buyer’s Perspective

In the forex market, the bid rate represents the price at which a market maker is willing to buy a currency pair from a trader. This reflects the demand for a particular currency. A higher bid rate indicates that there are more buyers in the market, eager to purchase the currency at a higher price.

For instance, if the bid rate for the EUR/USD currency pair is 1.1000, it means that market makers are ready to purchase euros (EUR) at a rate of 1.1000 for every US dollar (USD) sold.

Ask Rate: The Seller’s Perspective Unveiled

In contrast, the ask rate is the price at which a market maker is willing to sell a currency pair to a trader. It represents the supply of a particular currency. A higher ask rate suggests that there are more sellers in the market, seeking to sell their currency at a higher price.

Continuing with the EUR/USD example, if the ask rate is 1.1010, it implies that market makers are prepared to sell euros (EUR) at a rate of 1.1010 for every US dollar (USD) bought.

The Relationship between Bid and Ask Rates

The difference between the bid and ask rates, known as the spread, serves as a source of revenue for market makers. Typically, the wider the spread, the more profit the market makers can generate. Hence, understanding the spread is crucial for optimizing profitability in forex trading.

It’s worth noting that the bid and ask rates are dynamic, constantly fluctuating in response to market sentiment, supply and demand, and geopolitical events. Traders must stay updated on these movements to make informed decisions.

Image: howtotradeonforex.github.io

Expert Tips to Enhance Your Forex Trading

Seasoned forex traders offer invaluable advice for maximizing returns while navigating the complexities of the market. Some of these expert tips include:

- Monitor Economic Indicators: Keep a close watch on economic indicators such as GDP, inflation, and unemployment rates, as these have a significant impact on currency values.

- Manage Risk Effectively: Employ sound risk management techniques like stop-loss orders and position sizing to mitigate potential losses.

- Choose a Reputable Broker: Trading with a reliable and regulated broker is essential for safeguarding your funds and ensuring fair trading practices.

- Stay Informed: Regularly monitor news and market updates to stay abreast of market trends and make informed trading decisions.

By implementing these expert recommendations, traders can augment their forex trading strategies, minimize risk exposure, and increase their chances of success.

FAQs: Addressing Common Forex Questions

To address the most common queries related to bid and ask rates, here are some insightful FAQs:

- Q: How can I determine the profit potential?

A: Calculate the profit potential by subtracting the bid rate from the ask rate. A positive value indicates potential profit.

- Q: What factors influence bid and ask rates?

A: Economic data, geopolitical events, and supply and demand dynamics all impact bid and ask rates.

- Q: How can I find the best bid and ask rates?

A: Compare rates from multiple market makers to secure the most favorable spread.

Bid Rate And Ask Rate In Forex

Conclusion

Bid and ask rates are pivotal concepts in the forex market, offering insights into currency demand and supply. By comprehending the nuances of these rates, forex traders can sharpen their strategies, make informed trading decisions, and enhance their profit-making potential. The tips and expert advice provided in this guide empower traders to navigate the complexities of forex trading with increased confidence and maximize their chances of success.

Are you ready to delve deeper into the world of bid and ask rates in forex trading? Your journey to becoming a seasoned forex trader begins now!