In the volatile world of forex trading, where fortunes are made and lost with lightning speed, every edge counts. And understanding the bid-ask spread – the difference between the price a trader is willing to buy and sell a currency pair – is a crucial skill that can significantly improve your chances of success.

Image: forexuseful.com

But what exactly is the bid-ask spread, and how does it impact your trading? Let’s dive into this fascinating world and provide you with insights that will empower you to execute savvy trading decisions.

The Anatomy of Bid-Ask Spread

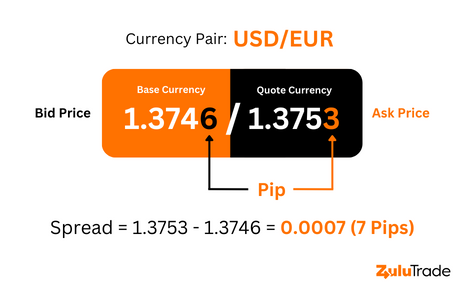

Think of the bid-ask spread as the heartbeat of the forex market, constantly in flux as traders from around the globe compete to set the best prices. The bid price represents the maximum amount a buyer is willing to pay for a currency pair, while the ask price is the minimum amount a seller is ready to accept. The spread, also known as the ‘pip’ or price increment paid by the trader, is the difference between these two prices.

The bid-ask spread is not static and varies depending on market volatility, liquidity, and currency pair. Major currency pairs, like EUR/USD, typically have tighter spreads, while exotic currencies or less traded pairs may have wider ones. For instance, during periods of market uncertainty or economic turmoil, the spread might expand as liquidity dries up and participants become reluctant to execute large trades. Conversely, during calmer markets with ample liquidity, the spread may narrow due to increased competition among liquidity providers.

Bid-Ask Spread: Impact on Your Trading

Now, let’s explore the profound impact the bid-ask spread can have on your trading strategies:

-

Hidden Costs: The spread acts as a hidden transaction cost that impacts trading profitability. Scalpers or day traders aiming for small, frequent profits are particularly affected, as the spread can eat into their narrow margins.

-

Trading Tactics: Depending on your trading style, a wider spread might call for different strategies. For instance, scalpers often seek out currency pairs with tighter spreads to maximize gains, while longer-term traders may be less affected by the spread’s impact.

-

Market Information: The bid-ask spread provides a glimpse into the current market sentiment. A wider spread may indicate lower liquidity and increased uncertainty, while a narrow spread suggests the presence of ample liquidity and less market volatility.

Minimizing the Impact of Bid-Ask Spread

While the bid-ask spread is an unavoidable aspect of forex trading, there are ways to minimize its impact:

-

Choose Pairs with Tight Spreads: Focus on trading major currency pairs that typically have lower spreads, such as EUR/USD or GBP/USD.

-

Monitor Market Conditions: Optimize your trading by observing the market during peak liquidity hours, such as the London or New York trading sessions. Liquidity is a key driver of bid-ask spreads, so trading during these periods can help you secure tighter spreads.

-

Compare Brokers: Different brokers offer varying spreads. Take the time to research and compare offerings before selecting the broker that best aligns with your trading needs.

-

Offer and Take Quotes: Advanced traders can consider placing limit orders above the ask price or below the bid price, known as offering or taking quotes. This can potentially result in a favorable execution price.

Image: blog.zulutrade.com

Bid Ask Rate In Forex

Expanding Your Forex Trading Horizons

Understanding the bid-ask spread is an essential step toward becoming a successful forex trader. By incorporating this valuable knowledge into your trading strategy, you gain an advantage in navigating the ever-changing market landscape. Embrace these insights, hone your trading skills, and embark on a profitable forex trading journey.