In the labyrinth of financial markets, where fortunes are made and lost, the foreign exchange (Forex) market beckons traders with its allure of substantial profits. Yet, discerning the best days to trade Forex holds the key to unlocking its true potential.

Image: www.forex.com

Factors Shaping the Trading Landscape

The bustling Forex market operates relentlessly, but not all days are created equal for traders. A myriad of factors dance in concert to shape the trading landscape, dictating the ebbs and flows of currency prices.

One pivotal influence is the release of key economic data and events, such as employment figures, inflation rates, and central bank announcements. These can trigger substantial market volatility as traders scramble to adjust their positions based on the latest information.

- Positive economic news may bolster a currency, while negative news can send it spiraling downward.

- Traders eagerly anticipate these releases, seeking to capitalize on sudden price movements.

Another crucial factor is the day of the week. Certain days tend to exhibit higher volatility and trading volume compared to others. For instance, Mondays often present opportunities due to the carryover effect from weekend news and the return of major players to the market.

- Fridays, on the other hand, may offer reduced liquidity toward the end of the trading week, leading to narrower price spreads.

- Understanding these weekly patterns can help traders plan their trading strategies accordingly.

A Time-Sensitive Advantage: Choosing the Right Hours

In addition to the day of the week, the time of day also plays a significant role in FX trading. During the London and New York market sessions, liquidity tends to surge, resulting in tighter spreads and increased trading activity.

- The overlap between these sessions, known as the “New York Close” or “London Fix”, often witnesses a convergence of major market participants, amplifying volatility and creating potential trading opportunities.

- Traders can align their trading schedules with these key session times to maximize their chances of success.

However, it’s important to note that the best trading days and hours can vary depending on the specific currency pairs or trading strategies employed by traders. Adapting to evolving market conditions and monitoring economic indicators in real-time are essential for maximizing trading results.

Expert Tips for Trading Success

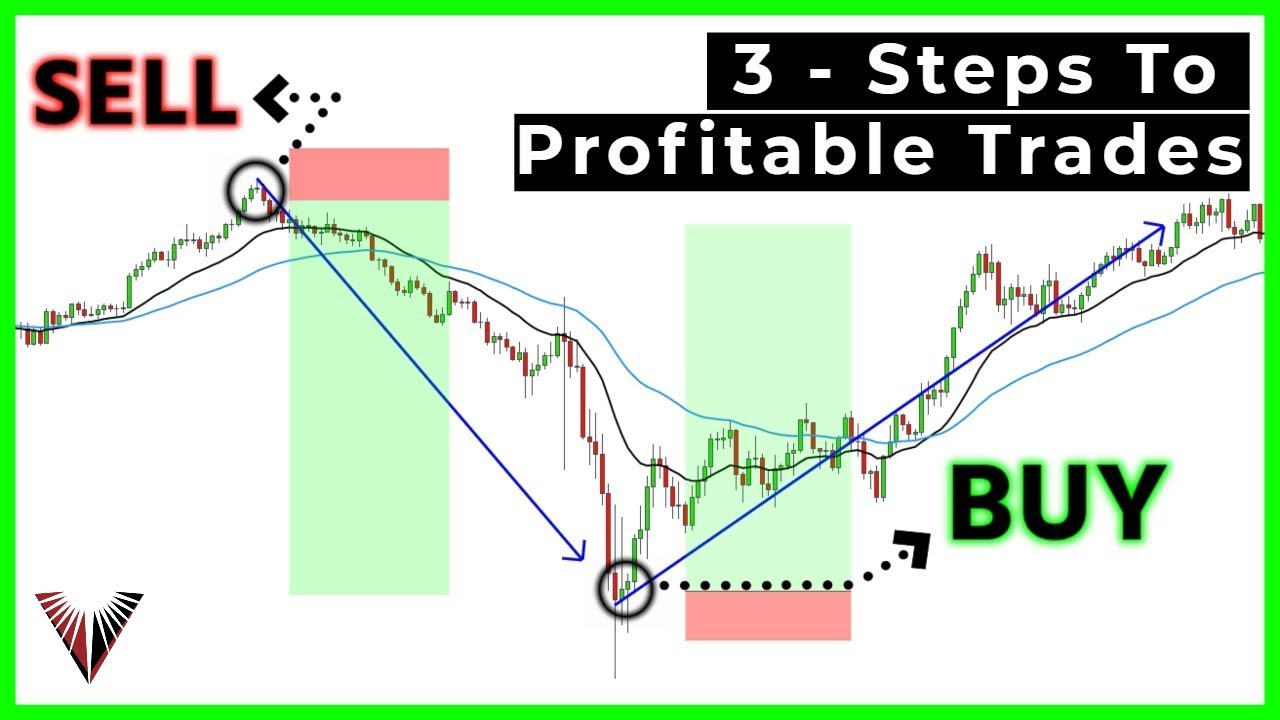

Unlocking the full potential of FX trading extends beyond merely identifying the best days to trade. Incorporating proven trading strategies and expert advice can further enhance a trader’s ability to navigate the market with confidence and reap consistent profits.

- Choose a Reliable Broker: Establishing a partnership with a reputable and trustworthy Forex broker is paramount to ensure fair execution, competitive spreads, and prompt customer support.

- Manage Risk Prudently: Forex trading carries inherent risks, and managing them effectively is essential for long-term success. Implementing stop-loss orders, prudent position sizing, and proper risk-reward ratios can mitigate potential losses.

- Develop a Trading Plan: Success in FX trading often hinges on having a well-defined trading plan. It should outline specific entry and exit points, risk parameters, and trading strategies, providing a clear roadmap for decision-making.

- Monitor Market News: Staying abreast of breaking news and economic data releases is crucial for identifying potential trading opportunities and avoiding abrupt market shifts. Utilizing economic calendars and subscribing to reputable news sources can keep traders informed and alert to market-moving events.

- Practice with a Demo Account: Before venturing into live trading, consider practicing and honing your skills on a demo account. This risk-free environment allows traders to experiment with strategies, test new trading ideas, and gain confidence in their abilities before putting real capital at stake.

Image: panasonicdvdvcrcombofreeshippingg.blogspot.com

FAQs to Empower Your Trading Journey

Q: Which specific days of the week are generally considered the best for Forex trading?

A: Mondays often present opportunities due to the carryover effect from weekend news and the return of major players to the market. Fridays, on the other hand, may offer reduced liquidity and lower volatility.

Q: Are there specific time zones or trading sessions during which volatility tends to be higher?

A: Liquidity tends to surge during the London and New York market sessions. The overlap between these sessions, known as the “New York Close” or “London Fix”, often exhibits increased volatility and trading activity, offering potential trading opportunities.

Q: How can a trader manage risk effectively in Forex trading?

A: Implementing stop-loss orders, prudent position sizing, and proper risk-reward ratios can mitigate potential losses. Additionally, diversifying trading strategies across different currency pairs and utilizing risk management tools can further enhance risk mitigation.

Best Days To Trade Forex

Conclusion: Unlocking the Secrets to Forex Trading Success

Identifying the best days to trade Forex is a crucial component in the quest for consistent profits in the fast-paced world of currency trading. By considering economic data releases, day-of-the-week patterns, and optimal trading hours, traders can optimize their trading strategies and position themselves for success.