Introduction

In the ever-evolving global economy, understanding currency exchange rates is crucial for businesses, travelers, and anyone engaged in cross-border transactions. As a central institution in managing Ghana’s financial ecosystem, the Bank of Ghana (BoG) plays a pivotal role in determining the exchange rates of the Ghanaian cedi against foreign currencies. This comprehensive guide delves into the intricacies of Bank of Ghana forex exchange rates, empowering you with the knowledge to navigate currency markets confidently and make informed financial decisions.

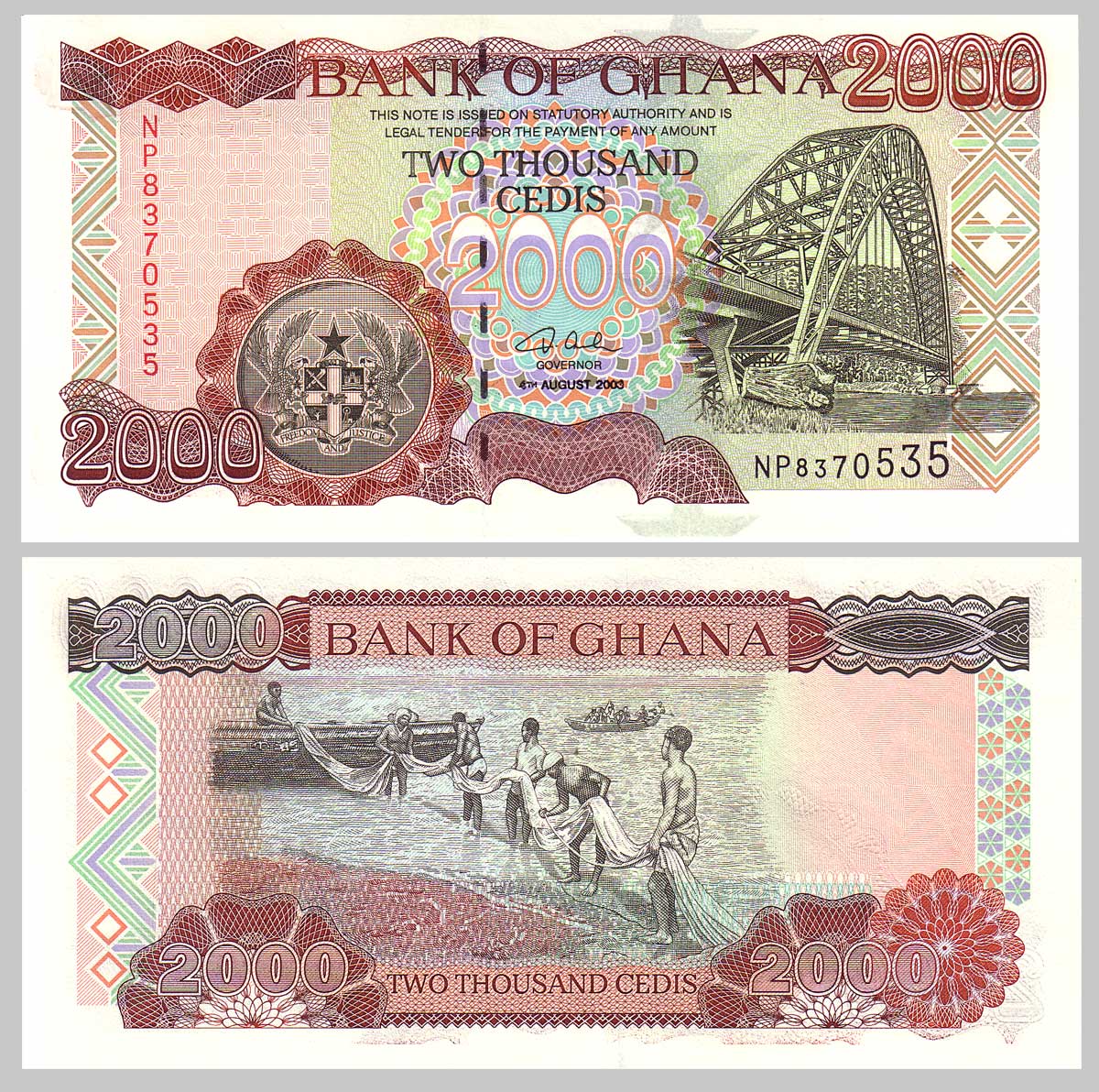

Image: ebidobyt.web.fc2.com

Understanding Bank of Ghana Exchange Rates

The Bank of Ghana sets the official exchange rates for the Ghanaian cedi against major currencies, including the US dollar, the British pound, and the euro. These rates are determined through a dynamic market mechanism that considers various factors, such as supply and demand, economic conditions, and monetary policy. The BoG’s role is to ensure stability and transparency in the foreign exchange market, facilitating efficient international trade and financial transactions.

Historical Perspective

The Ghanaian cedi has undergone significant fluctuations over the years, reflecting the country’s economic journey. In 1957, the cedi was introduced as a replacement for the British West African pound, with an initial exchange rate of £1 = 2.40 cedis. However, subsequent economic challenges and foreign exchange shortages led to gradual devaluation of the cedi, requiring periodic adjustments by the BoG.

Current Trends and Factors Influencing Exchange Rates

The Bank of Ghana forex exchange rates are subject to constant adjustments based on real-time market conditions. Factors that influence rate fluctuations include:

Interest Rates: Changes in Ghana’s interest rates relative to those in other economies can affect the demand for the cedi and its value.

Inflation Rates: Differences in inflation rates between Ghana and other countries impact the purchasing power of the cedi and its attractiveness in international markets.

Government Regulations: The BoG’s monetary policy and government policies related to foreign exchange affect the availability of foreign currency and influence exchange rates.

Global Economic Conditions: Economic crises or geopolitical events can trigger volatility in currency markets, including the Ghanaian cedi.

Image: ywivihyxa.web.fc2.com

Implications for Businesses

Fluctuations in Bank of Ghana forex exchange rates can have significant implications for businesses engaged in international trade:

Exporting: Depreciation of the cedi makes Ghanaian exports more competitive in the global market, as they become cheaper for foreign buyers.

Importing: On the other hand, a depreciating cedi increases the cost of imported goods and services for Ghanaian businesses.

Foreign Direct Investment: Changes in exchange rates can influence the attractiveness of Ghana as a destination for foreign direct investment.

Impact on Travelers

The Bank of Ghana forex exchange rates also affect individuals traveling to or from Ghana:

Tourists: If the cedi depreciates, foreign tourists may find it relatively cheaper to visit Ghana, as their currency can purchase more cedis.

Travelers Abroad: Conversely, a depreciated cedi means Ghanaians traveling abroad will need to exchange more cedis to obtain the same amount of foreign currency.

Expert Insights and Actionable Tips

Understanding the dynamics of Bank of Ghana forex exchange rates is essential for making informed financial decisions. Here are some tips from experts:

Monitor Currency Fluctuations: Stay informed about global economic news and market trends that may impact exchange rates.

Use Currency Conversion Tools: Utilize online currency conversion tools to track the current exchange rate of the cedi against major currencies.

Consider Hedging Options: Businesses dealing with foreign exchange risk can employ hedging strategies to mitigate potential losses.

Bank Of Ghana Forex Exchange Rates

Conclusion

The Bank of Ghana forex exchange rates are a vital aspect of Ghana’s financial system, facilitating international trade, foreign direct investment, and travel. Understanding the factors that influence these rates is crucial for businesses and individuals to navigate currency markets effectively. The Bank of Ghana’s commitment to transparency and stability ensures a fair and predictable environment for financial transactions. By staying informed and using the insights provided in this guide, you can harness the power of Bank of Ghana forex exchange rates to your advantage and achieve financial success in a globally interconnected world.