In the dynamic world of international finance, staying abreast of exchange rates is crucial for informed decision-making. When dealing with the Ghanaian Cedi (GHS), navigating the complexities of the Forex bureau landscape is vital for individuals and businesses seeking to exchange currencies efficiently. This comprehensive guide delves into the intricacies of Ghana’s Forex bureau exchange rates, providing invaluable insights into their historical context, significant factors influencing them, and practical strategies for maximizing your currency transactions.

Image: robotforexzrv1gratis.blogspot.com

Ghana’s Forex bureau exchange rate represents the value of the GHS against a foreign currency on a given day. It is determined by the interplay of supply and demand in the Forex market, where individuals, businesses, and financial institutions exchange different currencies for various purposes, including trade, investment, and tourism. Understanding the dynamics of these exchange rates is essential for travelers, expats, traders, and anyone engaging in cross-border financial transactions involving the GHS.

Factors Influencing Ghana Forex Bureau Exchange Rates

- Economic Conditions: Ghana’s overall economic health significantly affects its currency value. Factors such as GDP growth, inflation, interest rates, and foreign investment levels play a role in determining the demand for GHS in the Forex market.

- Political Stability: Political stability and investor confidence contribute to a stable exchange rate. Political uncertainty, social unrest, or policy changes can lead to currency volatility.

- Interest Rates: Monetary policy decisions by the Bank of Ghana, particularly interest rate changes, influence the attractiveness of GHS for investment and speculative purposes.

- Supply and Demand: The fundamental principle of supply and demand applies to the Forex market. When the demand for GHS exceeds its supply, its value tends to appreciate; conversely, when supply exceeds demand, the GHS value may depreciate.

- Global Economic Conditions: The global economy, including the strength of the US dollar and other major currencies, can impact Ghana’s Forex bureau exchange rate.

- Forex Market Speculation: Speculators in the Forex market can influence exchange rates by buying or selling currencies based on anticipated future movements.

Using Forex Bureaus Wisely

Harnessing the power of Forex bureaus requires a strategic approach. Here are some tips to optimize your currency exchange experience:

Compare Rates:

It pays to compare exchange rates offered by different Forex bureaus. Utilize online comparison websites or visit multiple bureaus to secure the most favorable rate.

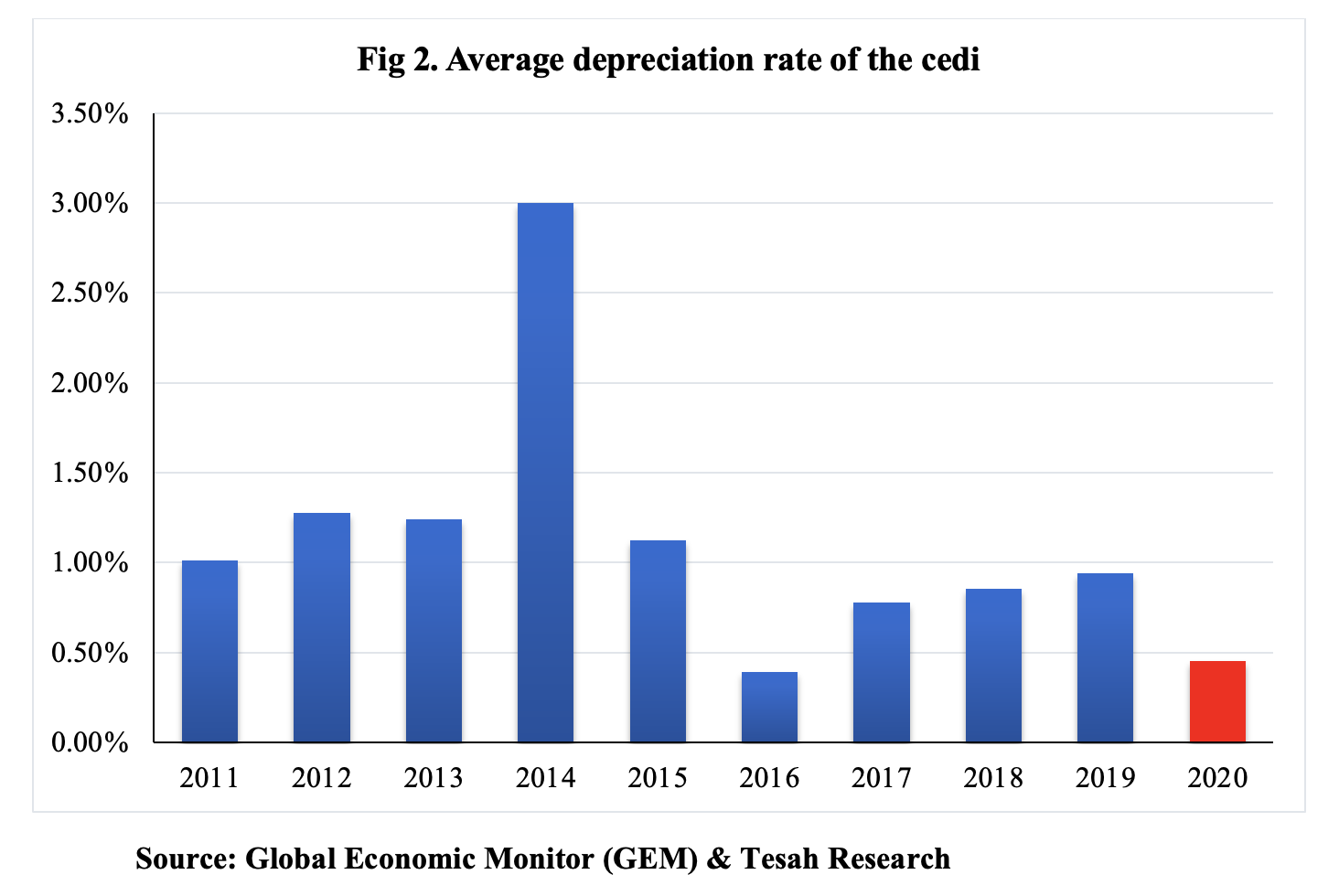

Image: tesahcapital.com

Look for Hidden Fees:

Beware of hidden fees that may inflate the transaction cost. Inquire about commissions, handling charges, and other associated expenses before converting currencies.

Negotiate Rates:

For substantial currency exchanges, don’t hesitate to negotiate a better rate with the Forex bureau. Politely inquire if they can offer improved terms based on your transaction volume.

Avoid Unfavorable Exchange Times:

Currency exchange rates fluctuate throughout the day. Monitor market conditions and exchange currencies during favorable periods to maximize your returns.

Beware of Scams:

Exercise caution when dealing with unauthorized Forex bureaus. Stick to reputable and licensed establishments to safeguard your funds.

Ghana Forex Bureau Exchange Rate

Conclusion

Ghana’s Forex bureau exchange rate is a dynamic indicator of the country’s economic health and its currency’s value in the global market. Understanding the factors influencing these rates and employing strategic currency exchange practices can help individuals and businesses navigate the Forex landscape effectively. By leveraging the information provided in this guide, you can make informed decisions about your currency transactions, maximize the value of your GHS exchanges, and stay ahead in the ever-evolving financial world.