Introduction: Embarking on a Global Financial Journey

In the ever-evolving world of finance, cross-border transactions have become indispensable for businesses and individuals alike. Whether it’s sending money to family and friends abroad, making overseas investments, or paying for international education, the ability to seamlessly transfer funds across borders is crucial. In this landscape, the State Bank of India (SBI) offers a robust solution through its SBI Forex Outward Remittance Form. This guide will provide a comprehensive overview of this form and guide you through its intricacies, ensuring your international financial transactions are effortless and secure.

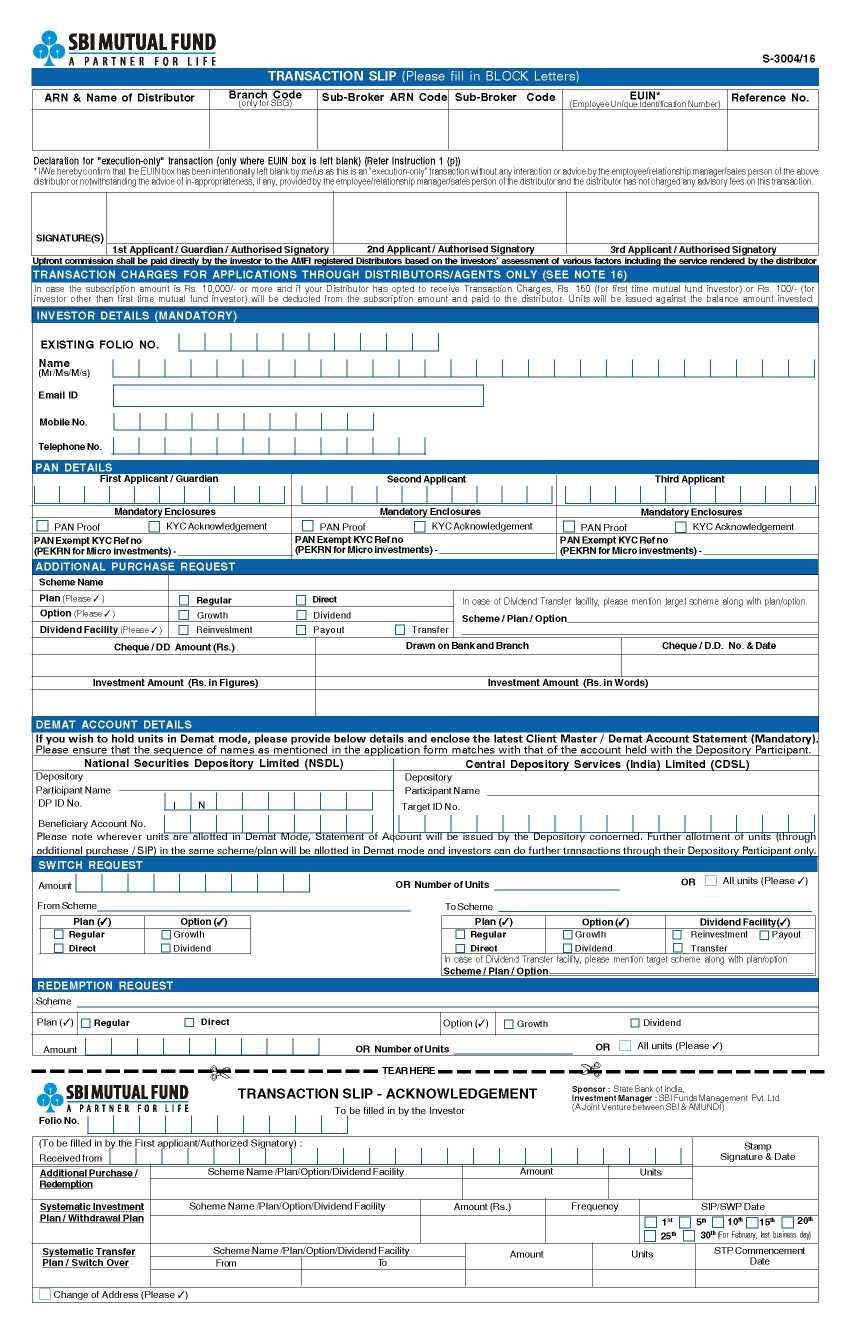

Image: management.ind.in

Understanding the SBI Forex Outward Remittance Form

SBI’s Forex Outward Remittance Form is an essential document that serves as a request to transfer funds from India to a beneficiary outside the country. This form is meticulously designed to capture vital details about the transaction, including the sender’s and beneficiary’s information, the amount to be transferred, the purpose of remittance, and other relevant particulars. By completing the form accurately and comprehensively, you can ensure that your remittance request is processed swiftly and without any hindrances.

Purpose and Types of Remittance

Outward remittances can be classified into two primary categories: personal and business. Personal remittances typically include funds sent to family and friends abroad, travel expenses, education fees, and donations. Business remittances, on the other hand, encompass international trade transactions, investments, and payments for services rendered across borders.

Completing the SBI Forex Outward Remittance Form

To initiate an outward remittance, you must first obtain the SBI Forex Outward Remittance Form from your nearest SBI branch or download it from the bank’s website. The form consists of several sections that require specific information. Here’s a step-by-step guide to filling out the form:

-

Personal Information: Provide your complete name, address, phone number, email address, and occupation.

-

Beneficiary Information: Enter the name of the individual or entity who will receive the funds, along with their complete address, phone number, and bank account details.

-

Remittance Details: Specify the amount you wish to transfer, along with the currency of the transaction.

-

Purpose of Remittance: Select the appropriate option from the provided list that best describes the reason for your remittance.

-

Other Details: Provide details related to the mode of payment, such as cash, demand draft, or online transfer.

-

Declaration: Sign and date the declaration at the bottom of the form, certifying the accuracy of the information provided.

Image: thegadgetlite.com

Tips for Seamless Remittance

To ensure a hassle-free remittance experience, consider the following tips:

-

Scrutinize the form carefully before submitting it, ensuring that all the details are exact and complete.

-

Make photocopies of the completed form and relevant documents for your records.

-

Submit the form to your SBI branch along with the necessary supporting documents.

-

Preserve the transaction receipt for future reference.

FAQs on SBI Forex Outward Remittance Form

Q: What documents are required to support my remittance request?

A: Depending on the nature of the remittance, you may need to provide supporting documents such as invoices, bills of exchange, or a declaration of purpose.

Q: What are the charges and fees associated with outward remittances?

A: SBI charges a service fee for outward remittances, which varies depending on the amount and currency of the transaction. You can inquire at your nearest branch for specific details.

Q: How can I track the status of my remittance?

A: You can track the status of your remittance by visiting your SBI branch or online banking portal, providing your transaction reference number.

Sbi Forex Outward Remittance Form

Conclusion

The SBI Forex Outward Remittance Form is a crucial tool for facilitating international fund transfers. By understanding its purpose and completing it accurately, you can ensure that your remittances are processed swiftly and securely. Should you require further clarification, do not hesitate to seek assistance from your local SBI branch. We would appreciate it if you could share your thoughts on whether this article was beneficial in understanding the topic of SBI Forex Outward Remittance Form. Your insights will help us improve our content and serve you better.