Introduction:

In today’s interconnected world, seamless global financial transactions are imperative. Axis Bank, a leading Indian financial institution, empowers travelers with its Forex Card, a convenient and secure solution for accessing funds abroad. However, it’s crucial to understand the withdrawal limits associated with this card to avoid any financial surprises during your travels.

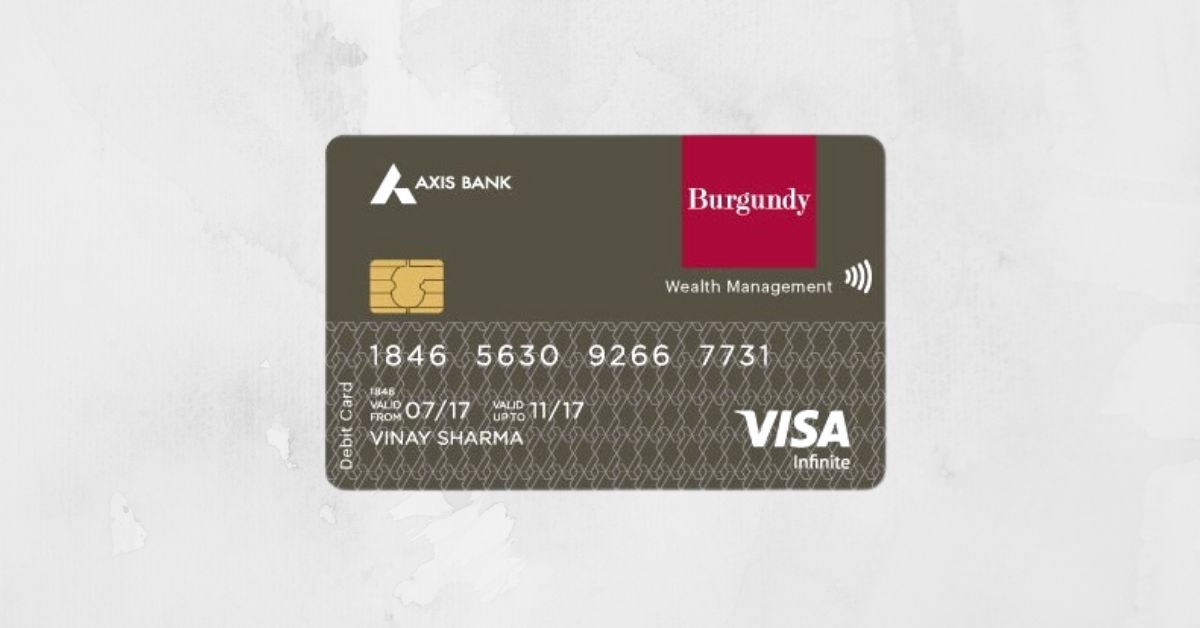

Image: fincards.in

Navigating ATM Withdrawal Limits:

Axis Bank’s Forex Card comes with daily and cumulative ATM withdrawal limits, ensuring responsible spending and preventing excessive cash withdrawals. The daily withdrawal limit varies depending on the card variant and your account’s risk profile. Typically, it ranges from INR 100,000 to INR 500,000 per day. The cumulative withdrawal limit, which accumulates over a 28-day period, is generally set to a higher amount, allowing for greater flexibility in fund access.

Daily Withdrawal Limit: A Balancing Act

The daily withdrawal limit is designed to safeguard against unauthorized usage and protect cardholders from potential financial losses. It’s important to note that these limits apply to each individual ATM, regardless of their location. Therefore, if you withdraw the maximum amount from one ATM, you won’t be able to withdraw any further funds from another ATM on the same day.

Cumulative Withdrawal Limit: Flexibility for Extended Stays

The cumulative withdrawal limit provides greater flexibility, especially for individuals traveling for extended periods. It resets every 28 days, allowing you to withdraw a higher total amount over a period of time. However, it’s essential to track your withdrawals carefully to avoid exceeding the limit and facing potential restrictions or penalty fees.

Image: www.forex.academy

Additional Factors to Consider:

Apart from the fixed withdrawal limits, there are a few additional factors that can influence the availability of funds from your Forex Card:

- Issuing Bank: The issuing bank of your Forex Card may impose additional limits or restrictions.

- ATM Operator: Different ATM operators may have varying withdrawal limits, regardless of the card issuer.

- Currency Conversion: When withdrawing funds in a foreign currency, the exchange rates and transaction charges may impact the actual amount you receive.

Axis Bank Forex Card Atm Withdrawal Limit

Conclusion:

Understanding the Axis Bank Forex Card ATM withdrawal limits is crucial for responsible financial planning and seamless travel experiences. By carefully managing your withdrawals within the prescribed limits, you can ensure access to the funds you need while safeguarding against potential risks. Remember to check with your issuing bank and ATM operator for any additional limitations or charges, and plan accordingly to enjoy convenient and secure access to your finances abroad.