Navigating the Limits for Seamless Forex Transactions

Forex cards have become indispensable tools for travelers, providing convenient access to foreign currencies without the hassles of exchanging cash. But when it comes to withdrawing funds from ATMs, a crucial question arises: what are the current withdrawal limits? In this comprehensive guide, we’ll delve into the ins and outs of ATM withdrawal limits for forex cards, empowering you with essential knowledge for well-informed withdrawals.

Image: www.gotradingasia.com

The Definition of Forex Cards

Forex cards, also known as multicurrency cards, are designed to simplify international financial transactions. They are prepaid cards that can be loaded with multiple foreign currencies, eliminating the need for carrying large sums of cash or exchanging currency at unfavorable rates. Forex cards offer the convenience of ATM withdrawals, point-of-sale purchases, and online transactions, catering specifically to the needs of travelers and global citizens.

The Evolution of ATM Withdrawal Limits

ATM withdrawal limits on forex cards have evolved over time, influenced by factors such as financial regulations, security measures, and customer preferences. Initially, withdrawal limits were significantly lower due to concerns about fraud and unauthorized access. However, as technology advanced and security protocols improved, these limits have been cautiously raised to meet the growing demand for convenient cash access while abroad.

Factors Influencing Withdrawal Limits

Several factors can influence the ATM withdrawal limit on your forex card, including:

- Card issuer: Different card issuers have their own policies regarding withdrawal limits.

- Type of card: Premium forex cards often come with higher withdrawal limits compared to standard cards.

- Country regulations: The country where you are withdrawing funds may impose specific limits on cash withdrawals.

- Security measures: To protect against fraud, card issuers may implement daily or per-transaction limits.

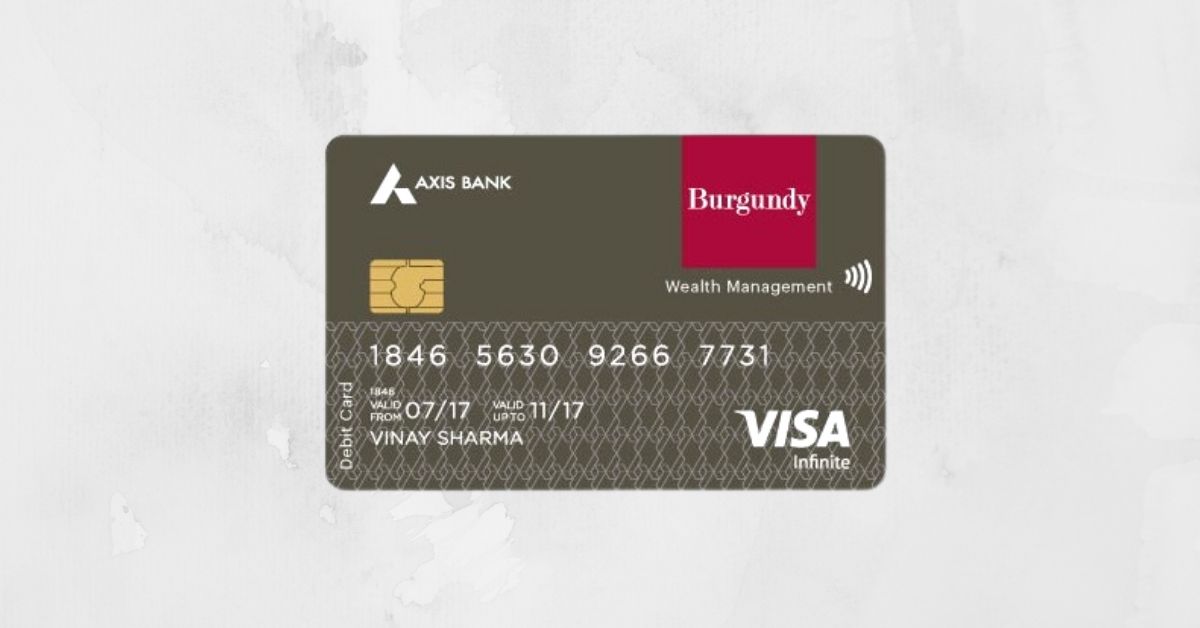

Image: fincards.in

Tips for Maximizing Withdrawals

To maximize your ATM withdrawals from forex cards, consider the following tips:

- Choose a card with a high withdrawal limit: Research and select a forex card that meets your specific cash withdrawal needs.

- Notify your card issuer: Inform your card issuer about your travel plans, including the countries you’ll visit and the approximate amount you plan to withdraw.

- Set up a daily withdrawal limit: This can help prevent unauthorized access and protect your funds in case of a lost or stolen card.

- Withdraw funds during daylight hours: For safety reasons, it’s advisable to withdraw funds from ATMs in well-lit, public areas.

FAQs:

Q: How do I find out my ATM withdrawal limit?

A: Contact your card issuer or check your account statement.

Q: Can I increase my withdrawal limit?

A: Some card issuers may allow you to request an increase in your withdrawal limit. Contact your card issuer for more information.

Q: What happens if I exceed my withdrawal limit?

A: Exceeding your withdrawal limit may result in declined transactions or additional fees.

Q: Are there any fees associated with ATM withdrawals?

A: Yes, some ATM operators and card issuers may charge fees for withdrawals.

Q: What should I do if my forex card is lost or stolen?

A: Report the loss or theft immediately to your card issuer.

What Is The Current Atm Withdrawal Limit On Forex Cards

Conclusion

Understanding the current ATM withdrawal limit on forex cards is crucial for planning and executing successful financial transactions while traveling. By carefully selecting your forex card, setting up appropriate withdrawal limits, and following expert advice, you can maximize your cash withdrawals, minimize hassles, and enjoy peace of mind during your international adventures.

After reading this article, we hope you have a clearer understanding of ATM withdrawal limits on forex cards. If you have any further questions or would like to explore other topics related to responsible financial management and global travel, feel free to reach out to us. Your feedback and suggestions are always welcome.