Do you want to leverage the vast potential of the foreign exchange (forex) market, but find traditional day trading too demanding? Then, the 30-minute forex trading strategy is the perfect solution for you. This strategy strikes the ideal balance between short-term profit maximization and time efficiency, empowering you to capture substantial market movements within a manageable timeframe.

Image: www.forexstrategiesresources.com

Decoding the 30-Minute Strategy: A Primer

The 30-minute forex trading strategy revolves around analyzing price action and market trends on a 30-minute time frame. This timeframe provides a comprehensive view of market sentiment without being overwhelmed by excessive details as in shorter timeframes. Traders can identify potential trading opportunities by studying price patterns, indicators, and support and resistance levels. The strategy’s primary advantage lies in its ability to capitalize on short-term price swings while filtering out unnecessary market noise.

Step-by-Step Guide to Implementing the Strategy

-

Technical Analysis: Unlocking Market Insights

Technical analysis is the cornerstone of the 30-minute forex trading strategy. By studying historical price data and identifying patterns, traders can make informed predictions about future market movements. Common technical indicators used in this strategy include moving averages, Bollinger Bands, and relative strength index (RSI). These indicators help identify trend direction, market momentum, and overbought or oversold conditions.

-

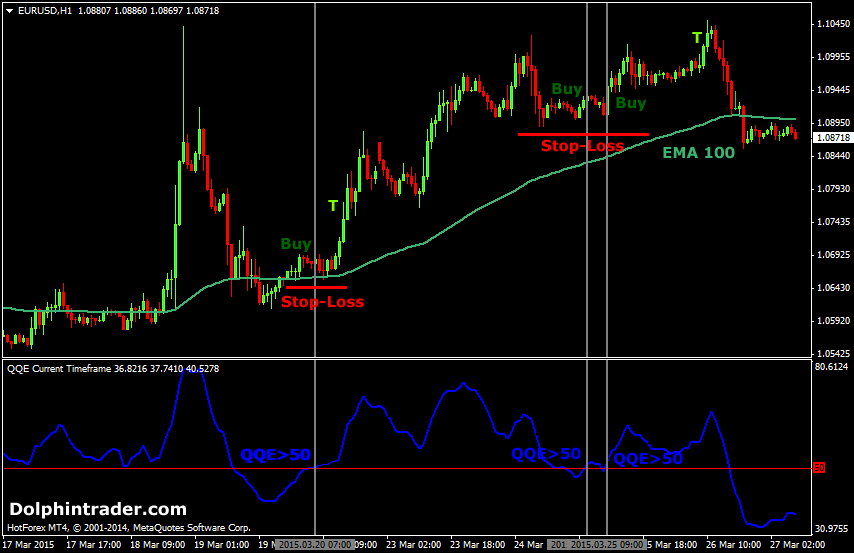

Image: www.dolphintrader.comDetermining Support and Resistance Levels

Support and resistance levels are crucial in this strategy, as they indicate areas where price action tends to pause or reverse. Support levels represent price points where demand is likely to outweigh supply, preventing further price declines. Conversely, resistance levels indicate areas where supply is likely to exceed demand, limiting price increases. Identifying these levels helps traders anticipate potential price reversals and enter or exit trades strategically.

-

Trend Confirmation: Riding the Market Momentum

Trend analysis is essential for success in the 30-minute forex trading strategy. By studying the direction and momentum of price movement, traders can determine whether to trade with or against the trend. Trading with the trend offers higher probability trades, as it aligns with the predominant market sentiment. Conversely, trading against the trend carries a higher risk and should be approached with caution and a solid risk management strategy.

Fine-Tuning Your Strategy: Optimization and Refinement

The 30-minute forex trading strategy, like any other trading strategy, is subject to continuous improvement and optimization. Here are some tips for refining your approach:

-

FBS Broker: A Reliable Trading Partner

Partnering with a reliable and reputable broker, such as FBS, can significantly enhance your trading experience. FBS offers competitive spreads, lightning-fast trade execution, and a vast array of financial instruments, empowering you to trade forex with confidence and ease. Their user-friendly trading platforms, educational resources, and 24/7 customer support ensure that you have the tools and support you need to succeed.

-

Customizing Timeframes: Tailoring to Your Trading Style

While the 30-minute timeframe is the foundation of this strategy, you can adjust it slightly to suit your trading style and market conditions. For instance, if you prefer a more active approach, you could consider a shorter timeframe, such as 15 minutes. Alternatively, if you favor more stability and less frequent trading, a longer timeframe, such as 60 minutes, may suit you better. Experiment with different timeframes to find the optimal setting that aligns with your risk tolerance and trading goals.

-

Hybrid Strategies: Enhancing Performance

Combining the 30-minute forex trading strategy with other trading strategies can enhance its effectiveness. For example, incorporating fundamental analysis into your trading decision-making process can provide valuable insights into macroeconomic factors that influence currency movements. Additionally, utilizing multiple technical indicators can help you confirm trading signals and reduce the risk of false breakouts.

30 Min Forex Trading Strategy

Conclusion

The 30-minute forex trading strategy empowers traders of all experience levels to profit from short-term currency price movements. By leveraging technical analysis, identifying support and resistance levels, and confirming market trends, traders can develop a solid foundation for successful execution. Remember to fine-tune your strategy through optimization and continuous learning, and partner with a reliable broker such as FBS for a seamless trading experience. As with any trading strategy, risk management remains paramount, and thorough research is essential for ongoing success in the forex market.