Introduction

In the realm of Forex trading, timing is everything. With global markets constantly fluctuating, identifying the best time frame to trade can significantly impact your profitability. This comprehensive guide delves into the intricate intricacies of time frames, providing you with the knowledge and insights to optimize your trading strategies and maximize your returns.

Image: unbrick.id

Understanding Time Frames: The Anatomy of Trading

Time frames refer to the intervals at which price charts are analyzed. From ultra-short-term scalping to long-term position trading, each time frame offers unique advantages and challenges. Understanding these time frames is essential for aligning your trading style with the market’s rhythm.

Deciphering the Daily Time Frame: A Balanced Approach

For daily Forex traders, the daily time frame strikes a harmonious balance between short-term volatility and long-term stability. This time frame offers ample opportunities for trend identification while minimizing the impact of intraday noise. The daily time frame provides a clear picture of the market’s underlying direction, allowing traders to make informed decisions based on trend analysis.

The Psychological Impact: Trading with Confidence and Conviction

The daily time frame instils confidence and conviction in traders. The extended period covered by each candle provides ample time for trends to develop and consolidations to occur. This allows traders to identify high-probability trading opportunities with reduced uncertainty. The psychological benefits of trading on the daily time frame cannot be underestimated, as it fosters discipline and patience, key elements for long-term success in the Forex market.

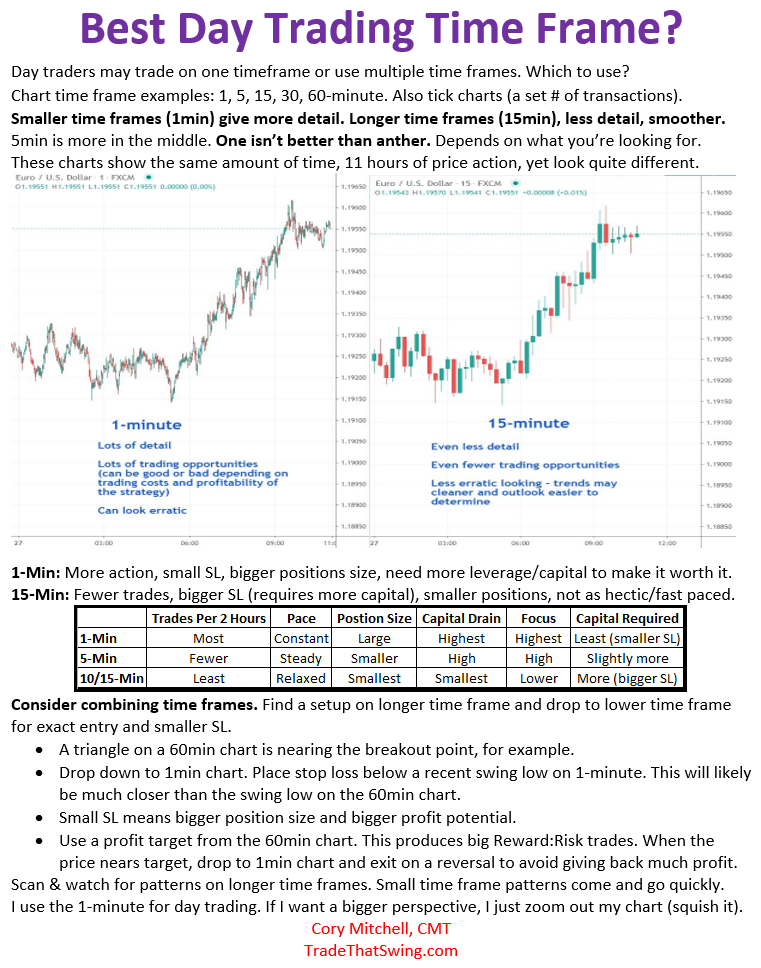

Image: tradethatswing.com

Expert Insights: Harnessing the Wisdom of Seasoned Traders

Forex veterans universally acknowledge the effectiveness of the daily time frame. Renowned currency expert, George Soros, emphasizes the importance of viewing the market from a medium-term perspective to capture major trends. Likewise, Marc Faber, a respected investment advisor, highlights the significance of focusing on long-term macroeconomics rather than short-term market noise. These expert insights underscore the value of the daily time frame for discerning traders seeking sustained profitability.

Actionable Tips for Mastering the Daily Time Frame

To make the most of the daily time frame, incorporate these actionable tips into your trading strategy:

- Focus on Trend Analysis: Identify prevailing trends and trade in their direction. The daily time frame provides a clear perspective of trend development, allowing you to ride market momentum.

- Use Technical Indicators Prudently: Leverage technical indicators to confirm trends and identify potential reversal points. However, avoid excessive reliance on indicators, as they can introduce biases.

- Manage Risk Effectively: Determine appropriate risk-to-reward ratios and implement stop-loss orders to protect your capital. The daily time frame allows for ample risk management strategies.

- Control Your Emotions: Avoid impulsive trades driven by fear or greed. The extended time frame provides ample opportunities to assess market conditions and make rational decisions.

Best Time Frame For Daily Forex Trading

Conclusion

Mastering the best time frame for daily Forex trading is a journey of knowledge, experience, and emotional control. By understanding the dynamics of time frames, incorporating expert insights, and implementing actionable tips, you can unlock the potential of the daily time frame and consistently achieve your trading objectives. Remember, the Forex market is a perpetual dance of time and price, and the daily time frame offers a harmonious rhythm for profitable navigation. Embark on this journey today, and you will be well-positioned to seize the opportunities that await in the ever-evolving Forex market.