In today’s fast-paced financial landscape, foreign exchange (forex) trading has emerged as an attractive avenue for investors seeking financial success. The allure of lucrative profits and the ability to trade around the clock have drawn countless individuals to this dynamic market. However, embarking on a forex trading journey requires a comprehensive understanding of the underlying strategies and techniques that can significantly impact your chances of success.

Image: teletype.in

This article aims to provide an in-depth guide to forex trading, empowering you with the essential knowledge and strategies to navigate this multifaceted market effectively. Whether you’re a seasoned trader or just starting out, grasp the intricacies of technical analysis, fundamental analysis, risk management, and more, equipping yourself with the tools necessary to make informed decisions and maximize your potential returns.

What is Forex Trading?

Forex trading involves the buying and selling of currencies from different countries, speculating on their relative value and exchange rates. As the largest and most liquid financial market in the world, the forex market offers an unprecedented opportunity to profit from currency fluctuations, regardless of market conditions.

Understanding the fundamental principles of exchange rates is crucial for successful forex trading. A currency’s value is influenced by various economic factors, such as inflation, interest rates, political stability, and economic growth. Monitoring economic news, analyzing market sentiment, and staying informed about global events are fundamental to making accurate predictions about currency movements.

Technical Analysis for Forex Trading

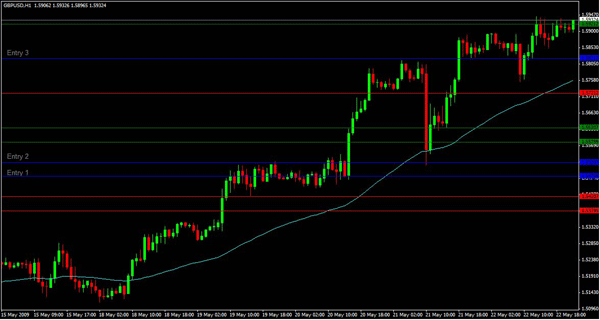

Technical analysis is a widely used trading technique that involves studying historical price data to identify patterns and trends that can predict future price movements. Technical analysts believe that by examining past behavior, traders can gain valuable insights into market sentiment and potential price movements.

There are numerous technical indicators and charting techniques employed by traders. Some popular indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). Traders analyze these indicators alongside price action to make informed trading decisions. While technical analysis can be a powerful tool, it’s essential to recognize its limitations and use it in conjunction with other analysis methods.

Fundamental Analysis for Forex Trading

Fundamental analysis focuses on examining economic factors that influence currency value. This type of analysis involves assessing the overall health of a country’s economy, including macroeconomic indicators such as GDP, employment rates, and trade balances. Political stability, interest rate decisions, and geopolitical events also play a significant role in shaping currency movements.

By conducting fundamental analysis, traders can gain insights into the long-term outlook of a currency. However, it’s important to note that fundamental analysis is less effective in predicting short-term price movements, as economic data can take time to be reflected in currency values.

Image: yukabolypohe.web.fc2.com

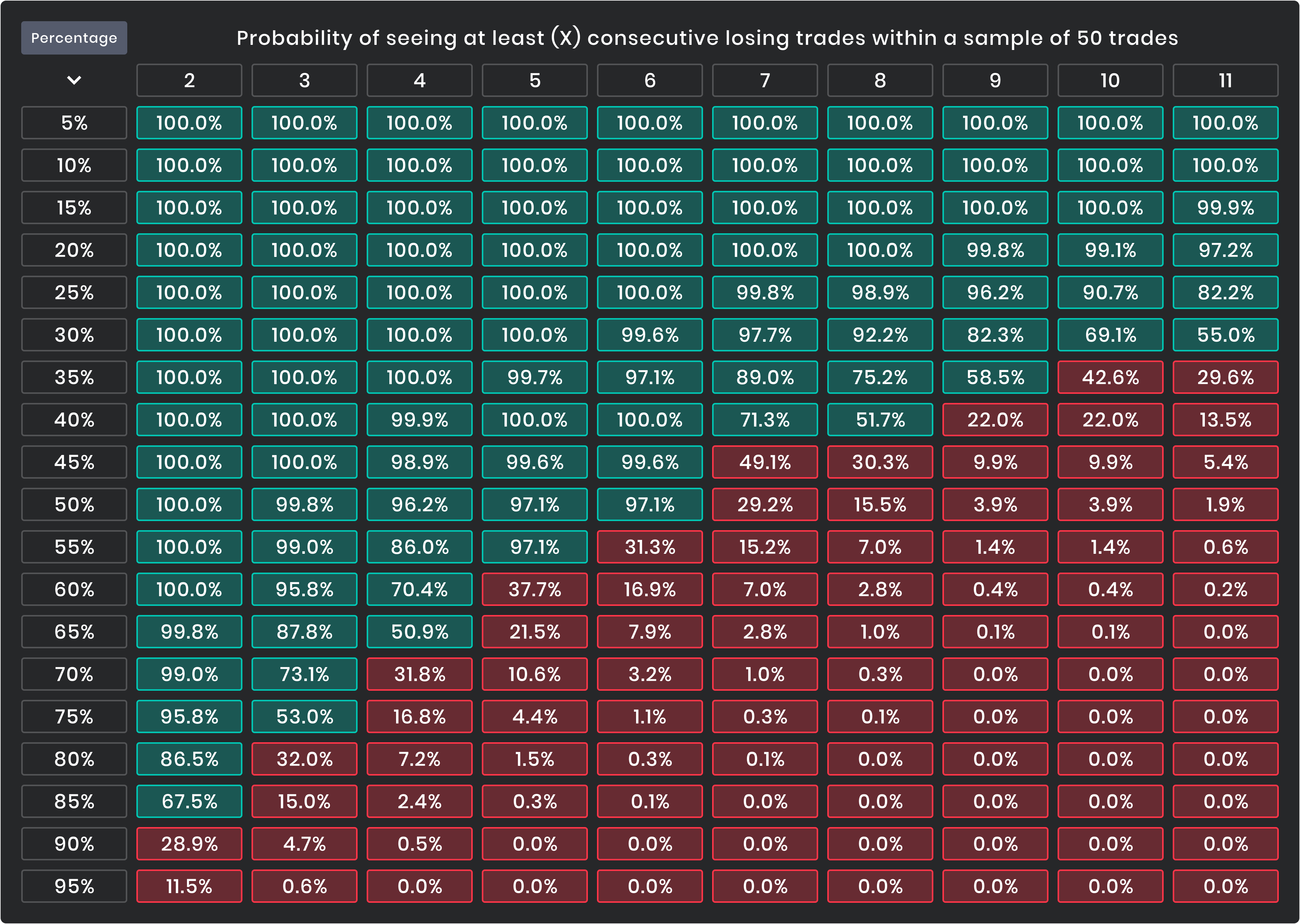

Risk Management in Forex Trading

Risk management is paramount in forex trading. Given the inherent volatility of the market, effective risk management strategies are essential for protecting your capital and preserving your profits. Setting stop-loss orders, determining appropriate position sizes, and utilizing leverage prudently are all key aspects of risk management.

Traders must also be aware of psychological factors that can influence their trading behavior, such as fear, greed, and overconfidence. Proper risk management practices help traders maintain discipline and mitigate the impact of emotional decision-making, enabling them to navigate market fluctuations with greater confidence.

100 Percent Winning Forex Strategy

Conclusion

Forex trading offers an exciting opportunity to generate profits by speculating on currency movements. However, achieving success in this dynamic market requires a thorough understanding of trading strategies, technical and fundamental analysis, and risk management. By embracing the principles outlined in this comprehensive guide, traders can equip themselves with the knowledge and techniques necessary to make informed decisions, manage risk effectively, and maximize their chances of success in the world of forex trading.