Introduction

In the intricate tapestry of international finance, foreign exchange reserves serve as a crucial lifeblood, empowering nations to navigate economic uncertainties and maintain financial stability. These reserves, held by central banks and other monetary authorities, are stockpiles of foreign currencies, gold, Special Drawing Rights (SDRs), and other external assets. Their importance in shaping a nation’s economic well-being cannot be overstated.

Image: twitter.com

Safeguarding Economic Sovereignty

One of the primary roles of forex reserves is to protect a country against external financial shocks and preserve its economic sovereignty. By accumulating foreign currencies, a central bank can intervene in the foreign exchange market to stabilize the exchange rate and prevent excessive volatility. This stability is vital for international trade, investment, and economic growth.

Ensuring Import Capacity

In a globalized world, countries rely on imports for essential goods. Forex reserves provide a means to purchase these imports, ensuring a nation’s access to critical resources. Maintaining adequate reserves helps mitigate the risk of supply chain disruptions and protect against fluctuations in the prices of imported commodities.

Managing Capital Flows

Foreign exchange reserves act as a buffer against volatile capital flows. During periods of capital inflows, reserves can be used to reduce market pressure on the exchange rate and prevent excessive appreciation. Conversely, during capital outflows, reserves provide a source of foreign exchange to calm the market and stabilize the rate.

Image: www.business-standard.com

Safeguarding Financial Stability

Forex reserves contribute to financial stability by mitigating systemic risks. In the event of a financial crisis or external shock, central banks can tap into their reserves to provide liquidity to the banking system, support financial institutions, and maintain confidence in the financial sector.

Facilitating International Transactions

Foreign exchange reserves enable the smooth exchange of currencies, facilitating international trade and investment. Ample reserves reduce the need for foreign exchange controls, fostering economic integration and promoting globalization.

Ensuring External Debt Solvency

Countries with high levels of external debt rely on forex reserves to ensure debt servicing capacity. Reserves serve as collateral for borrowing and enhance a nation’s creditworthiness, allowing it to access foreign capital at favorable terms.

Promoting Economic Growth

Forex reserves contribute indirectly to economic growth by supporting macroeconomic stability and facilitating international trade. Stable exchange rates, adequate foreign exchange availability, and reduced financial risks foster a conducive environment for investment, economic activity, and employment creation.

Examples of Forex Reserves in Action

A notable example of forex reserves being used effectively is Singapore, known for its prudent management of its reserves. The country has consistently maintained substantial forex reserves, which have shielded it against economic crises and fueled its economic growth.

Conversely, countries that have experienced economic turmoil often attribute it to inadequate forex reserves. For instance, during the Asian financial crisis in 1997, Thailand had low forex reserves, making it more vulnerable to external shocks.

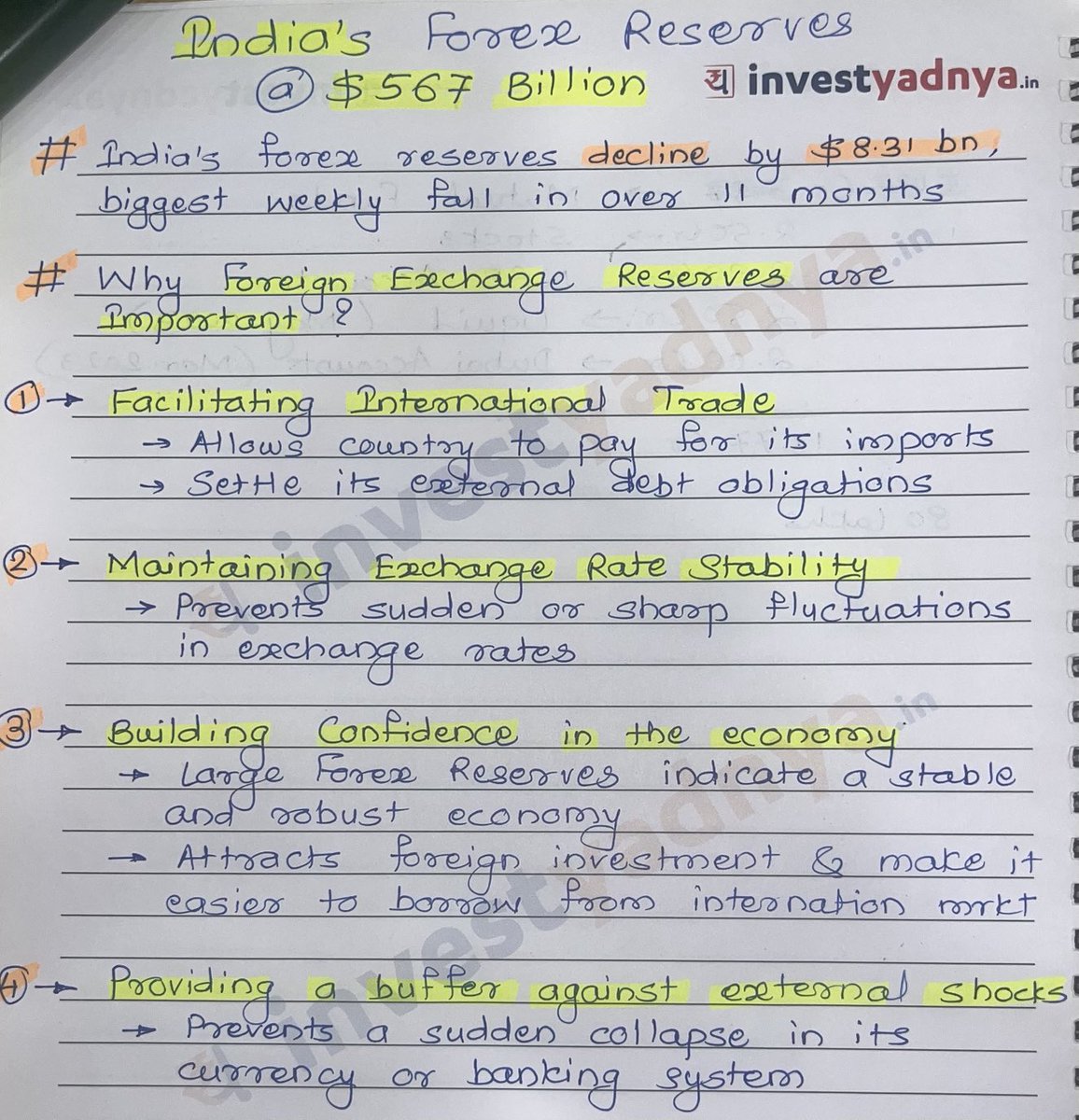

Why Forex Reserves Are Important

Conclusion

Foreign exchange reserves are an essential tool in the hands of central banks and governments, safeguarding economic sovereignty, ensuring import capacity, managing capital flows, maintaining financial stability, facilitating international transactions, and supporting debt solvency. Understanding their critical importance is paramount for nations seeking to enhance their economic well-being, navigate the intricacies of the global economy, and respond effectively to external challenges.